Petroleum consumption by the power sector has been primarily due to furnace oil demand by the independent power producers. The share of the oil in power generation has been on an upward trajectory after a short gap when furnace oil based power production was discouraged and planned to be phased out and replaced by coal. However, the rise in demand, fuel shortages, seasonal shortage in hydel, rising commodity prices including coal, gas shortage at home and local refinery dynamics brought oil back into power generation. Share of thermal sources in power generation that include both oil and gas/RLNG continues to remain high and stood at 61 percent for the first 10 months of fiscal year 2022.

The energy sector is dependent mostly on imported fuel be it oil or LNG, which the latest Economic Survey (FY22) shows that became more expensive in FY22 due to higher oil prices in the global market and massive depreciation of the Pakistani rupee. The latest figures in the survey shows that total oil import increased massively both in terms of value and quantity where the petroleum imports were up by 121 percent in value and 24.2 percent in quantity during 10MFY22. Similarly, the import of LNG increased by 39.86 percent during July-April FY22.

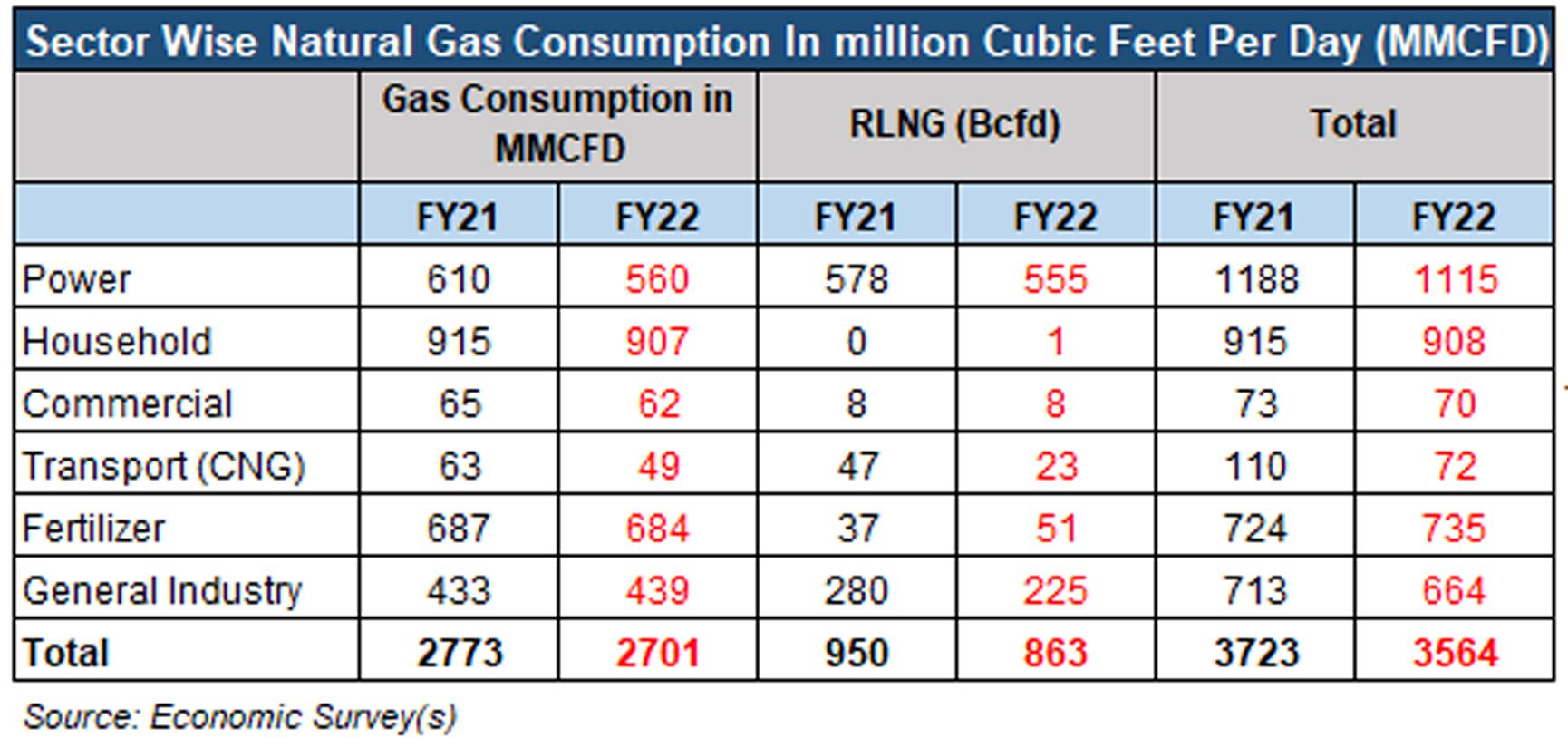

The decline in share of natural gas has been due to falling supply of indigenous gas witnessed, which went down by around 5 percent in 10MFY22. This is partially offset by the import of RLNG from two 1200 MMCFD capacity Floating Re-gasification Storage Units (FRSU). The consumption of natural gas in power sector reduced from 610 MMCFD to 560 MMCFD in 9MFY22.

Comments

Comments are closed.