Remittances for April 2022 touched the highest ever monthly level of $3 billion. While remittances have continued to grow unabated, the trend in 2022 has seen two consecutive months of record inflows. Growth year-on-year too has been impressive. However, it seems that the anticipated dent in remittances has been witnessed as May 2022 remittance stood at $2.3 billion as per central bank’s latest data. The monthly remittances for May 2022 were down by around 7 percent year-on-year and 24.7 percent month-on-month.

Remittances have been growing phenomenally over the last two years primarily since the beginning of the global pandemic due to the incentives to formalize the payment channels as well as the global and country dynamics in terms of travel restrictions, money transfer, FATF efforts, layoffs and lockdowns, currency depreciation, and fiscal stimuli in the host and countries. Moreover, the spillover of accelerate remote working culture since the pandemic and the boom in the real estate sector also contributed to the rise in remittances.

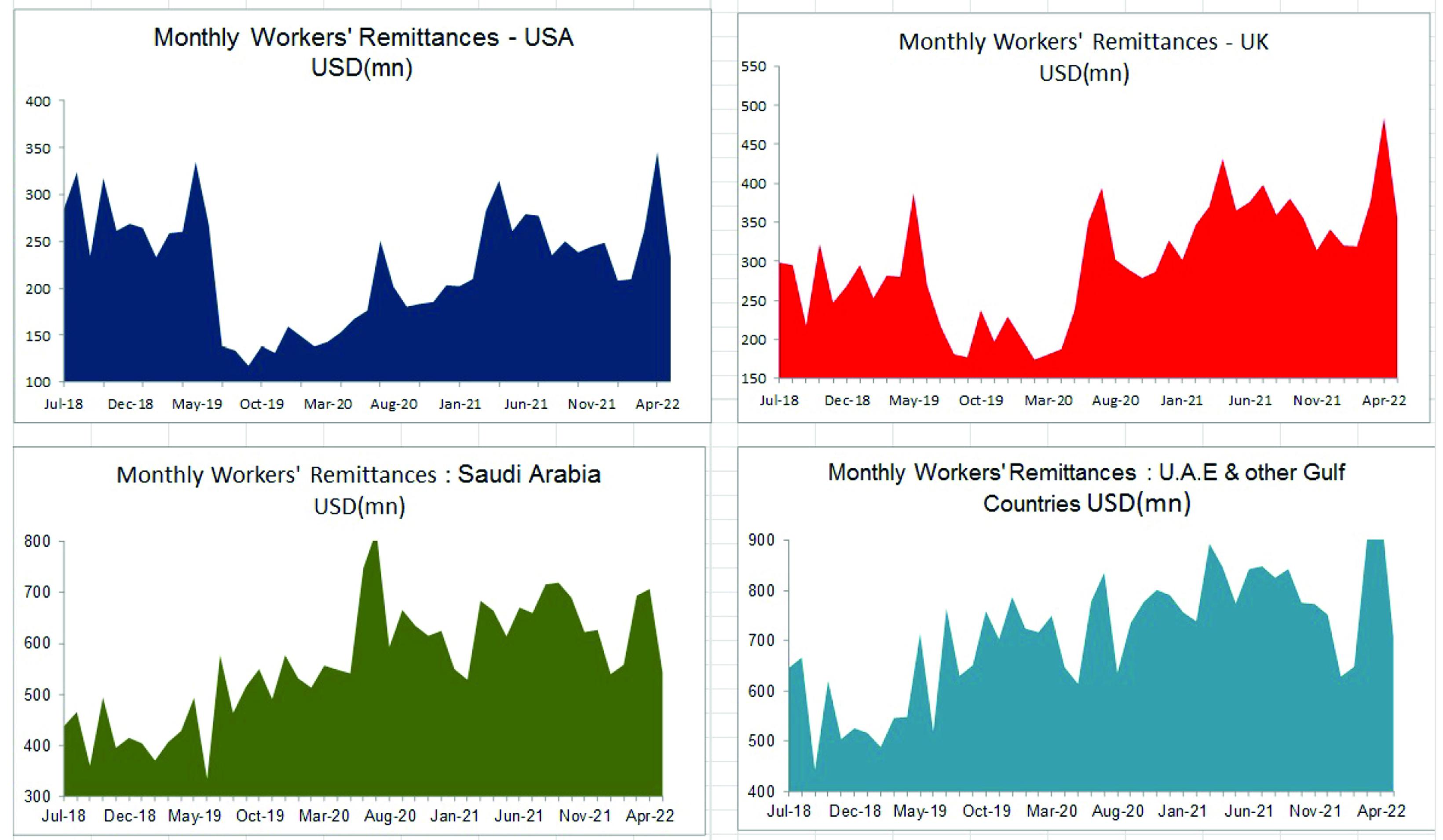

While some believe that remittances in May have fallen due to the ouster of IK government earlier this year, experts and annual trend shows that a slowdown in remittances in the month after Ramzan and Eid take a seasonal hit. In 11MFY22, remittances stood at $28.4 billion, up by 6.3 percent year-on-year. Inflow from US has the highest growth in top sending countries – up by 18 percent to $2.6 billion. This is followed by UK with 805 percent growth to $4 billion. Flows from the top sender, Saudi Arabia remained flat at 0.3 percent to $7 billion. Then there is a decline of 5 percent to $5.33 billion from UAE. The growth from EU countries is better than the US – up by 25 percent to $3 billion.

The growth month-on-month at least can again pick up in June inflows due to Eid-ul-Azha fall in the first 10 days of July 2022 as people send money back home for sacrificial animals. However, this could be impacted by the high inflation at home and currency depreciation. While overall remittances will easily cross $30 billion this year, it can be seen that remittances in May 2022 declined from all the top host countries year-on-year and month-on-month.

Comments

Comments are closed.