After the record high LNG import cost of $760 million in May 2022 – June 2022 was not too far with 12 cargoes costing no less than $726 million. For context, the 12-month leading average to May 2022 was $300 million. That is how bad it is out there in the energy market in general, and LNG in particular. And nothing suggests the Bull Run is coming to an end anytime soon, as Europe gasps for more gas, in the wake of Ukraine-Russia war.

It is only summers, mind you. The US natural gas prices may have tanked temporarily, but the LNG market remains tight, and traders continue to pay cancellation penalties in order to find more attractive buyers in the West.

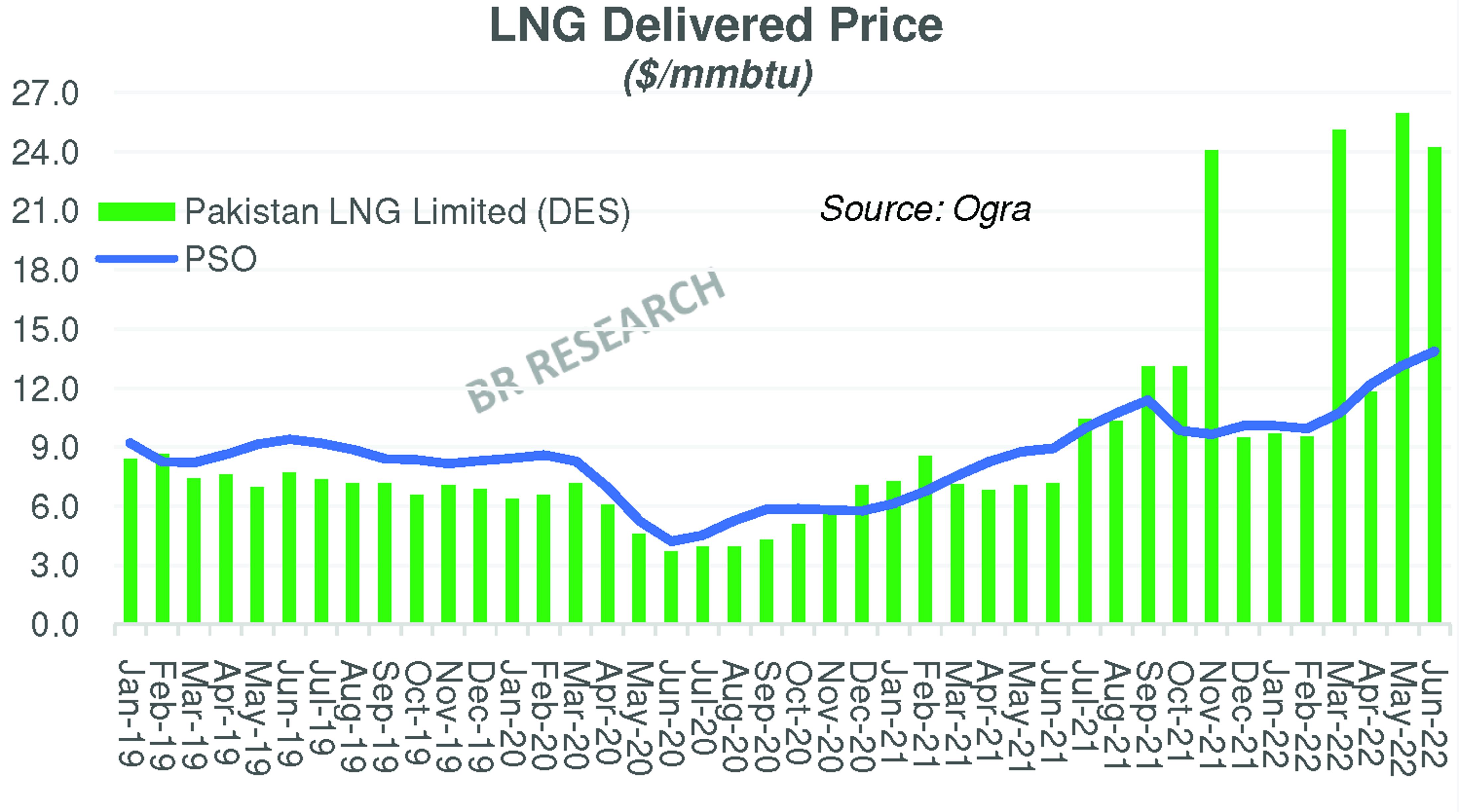

The LNG cost for June 2022 averages around $21/mmbtu for SNGPL and $23/mmbtu for SSGC consumers, excluding standard rates of GST, at distribution stage. It was $10/mmbtu a year ago, and the import bill half for 12 cargoes. Eight of the 12 cargoes have been secured the long-term contract arrangements with Qatar, of which six are priced at a slope of 13.3 percent of Brent, and two at 10.2 percent.

Brent averaged $110/bbl for the reference period for June 2022 slope calculation – which is based on average Brent prices of three preceding months. Needless to say, this was the highest Brent average since Pakistan started to import LNG from Qatar under the long-term agreement with Slope at 13.37 percent. The Delivered-Ex-Shipp (DES) import cost at $13.89/mmbtu is easily the highest, beating $13.15/mmbtu for May 2022.

The spot cargoes were priced at an average DES rate of $22/mmbtu – costing $316 in import bill for four cargoes. The consumer price at distribution stage shot up to $27/mmbtu and $30/mmbtu for SNGPL and SSGC consumers, respectively, excluding GST. On a weighted average basis, the maximum distribution stage price stood at $22.6/mmbtu without GST. The average price stayed lower month-on-month, largely because of one cargo arranged by the PLL on 10.12 percent of Brent – bringing the overall cost slightly in control.

Come July, the import bill for RLNG may be substantially reduced. But only because Pakistan seems to be struggling to get hold of any LNG cargoes from the spot market. Two consecutive tenders were scrapped as no bidder qualified for July delivery. There is still time to arrange a cargo or two – but it seems unlikely that four cargoes could be fetched from spot market for July.

Pakistan has resorted to increased power load shedding as it struggles to arrange fuel. Given the dollar reserve position, not importing LNG at hefty rates may well be a more suited outcome in the larger scheme, even if it means subjecting masses and industries to prolonged hours of electricity load shedding.Bring LNG or not – either way – things do not look rosy.

Comments

Comments are closed.