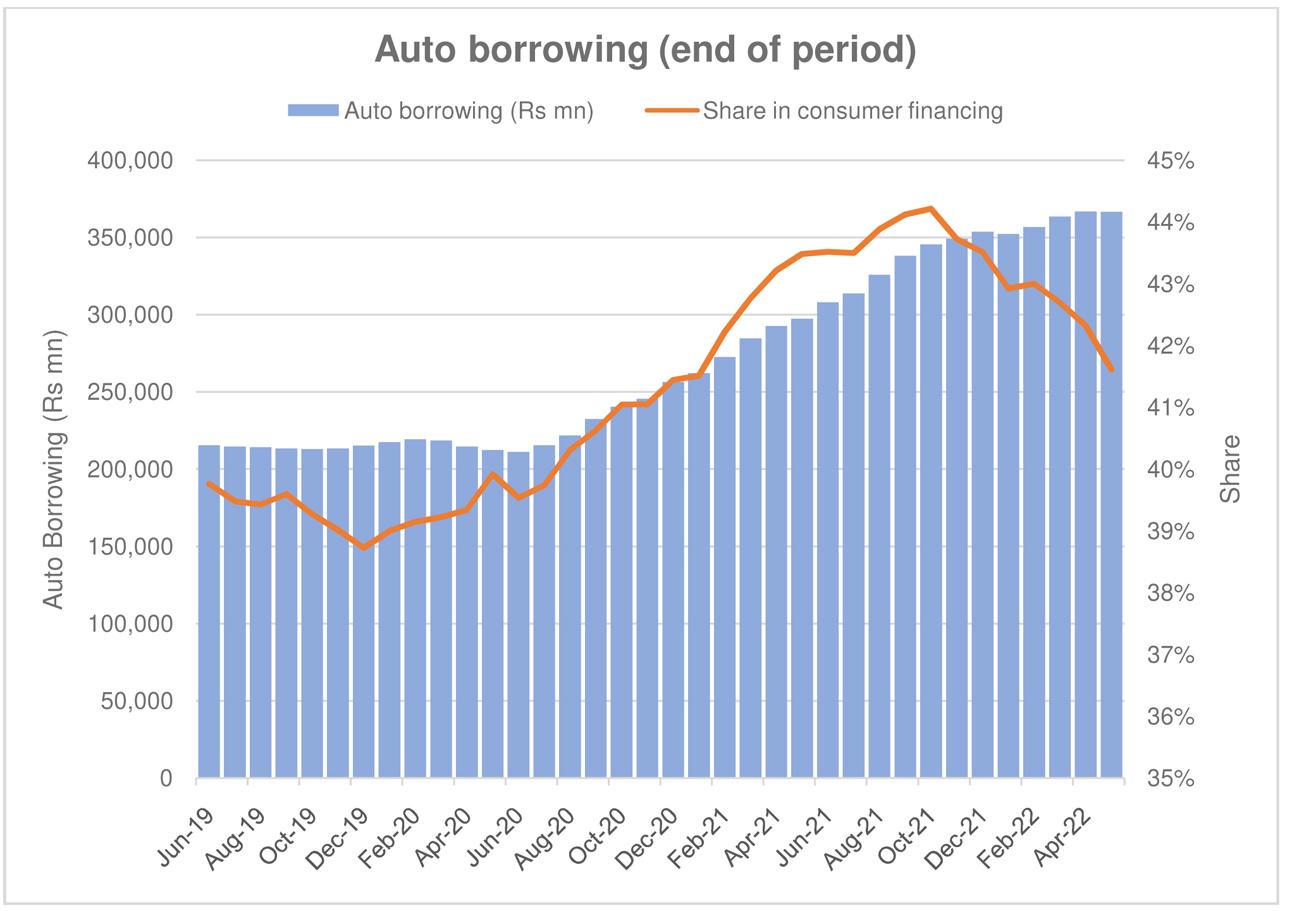

Car buyers are seemingly no longer knocking on bank doors for auto loans given the upward trajectory of interest rates. Automotive borrowing started displaying signs of weakness very soon after kibor began its ascent in Nov-21. In the last recorded month of May-22, SBP’s published data for outstanding credit shows net borrowing under the car financing dropping to a negative number, the first time since Jun-20, implying banks may not be furnishing fresh loans against the vehicle buyers.Not only that, auto financing as a share of consumer financing is also dropping coming down from 44 percent to 42 percent late last year. The reduced interest rates earlier during 2021 had played a prominent role in pushing auto financing; and demand for automobiles forward. The natural shift in demand and borrowing is visible with rates going up.

In fact, it seems that demand within the automobile industry is a lot more responsive to interest rates than it is to rising car prices. Despite surging prices for vehicles, FY22 will end with the market growing to nearly 270,000 units in volumetric sales, more than 50 percent higher than last year. This number should be higher including sales for companies like Kia and Changan that have been fairly successful new entrants into the now growing local assembler list. Demand within the industry has just started to wane, after months of persevering. Car buyers came back with exuberance in the after math of covid and bought more cars across the variety available—not just luxury sedans and SUVs, but also small compact car offerings by Suzuki. In fact, Suzuki’s rebound growth this year was higher than other Japanese car assemblers with Alto, Cultus and Wagon-R performing fairly well.

It was a combination of need, and the fear that cars will become even more expensive in coming months given the depreciating rupee. And what is evident now is that car buyers were perhaps right. The dollar is becoming more expensive which will cause unit production dependent on imported content to increase, compelling car makers to raise prices even further. This has always been the modus operandi of local assemblers. The government meanwhile, has not only imposed several restrictions on car financing for high-end vehicles but also slapped additional taxes on cars to curb demand while trying to meet its own revenue shortfalls. There is nothing unexpected in what data is displaying at present. Demand is weak and will weaken further in months to come.Given prevailing rates, cash will (have to) remain king.

Comments

Comments are closed.