Crescent Steel and Allied Products Limited

Crescent Steel and Allied Products Limited (PSX: CSAP) was established in 1983 as a public limited company under the Companies Act, 1913 (now Companies Act, 2017). The company operates in five divisions: steel, cotton, investment and infrastructure development (IID), energy and hadeed (billet) segments.

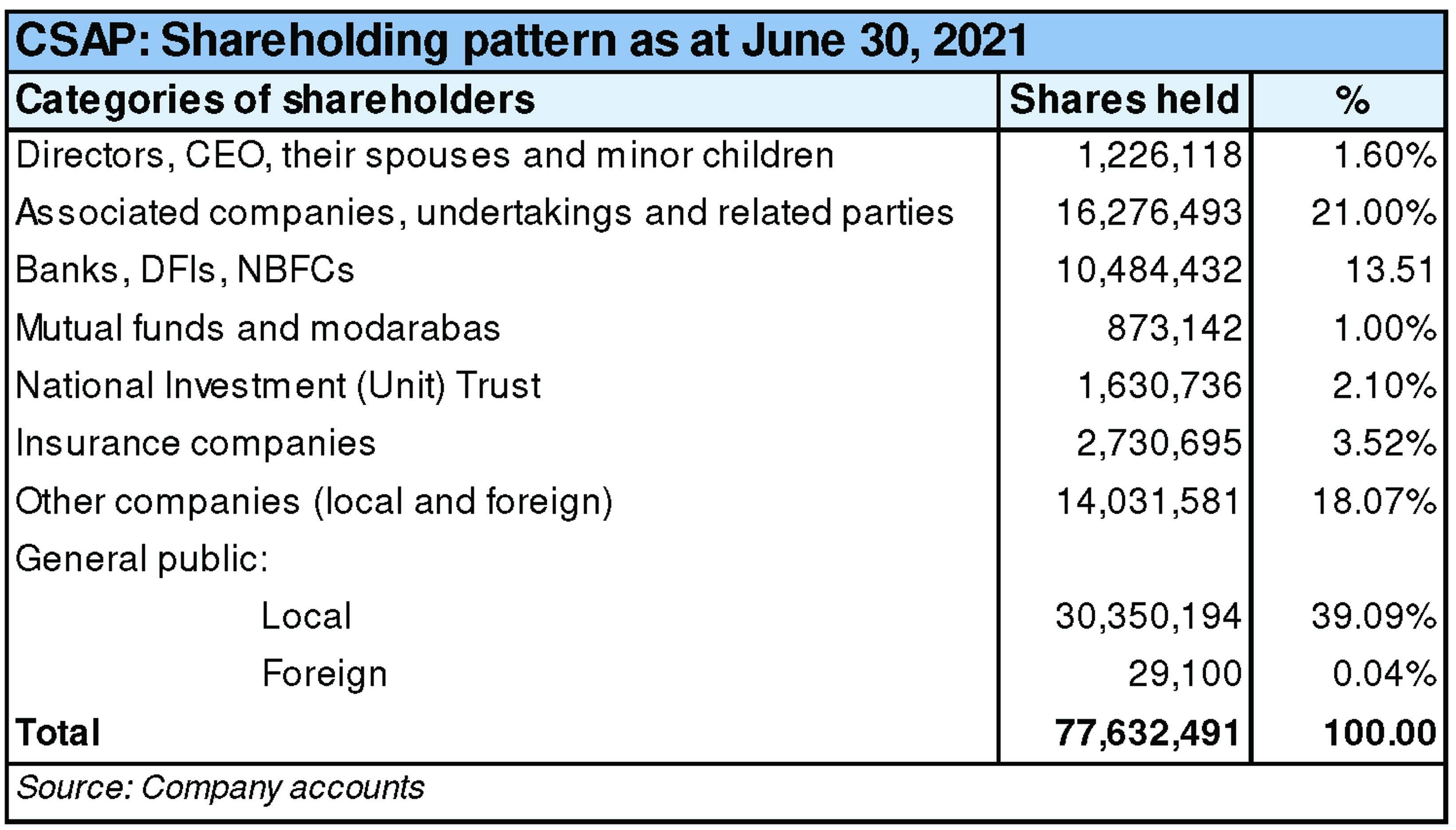

Shareholding pattern

As at June 30, 2021, around 21 percent shares are held in associated companies, undertakings and related parties. Within this category, The Crescent Textile Mills Limited is major shareholder holding 11 percent shares. The local general public owns 39 percent shares, followed by 18 percent shares held in other companies (local and foreign). The directors, CEO, their spouses and minor children own close to 2 percent shares, while 13.5 percent shares are held in banks, DFIs, and NBFCs. The remaining roughly 7 percent shares are with the rest of the shareholder categories.

Historical operational performance

The company’s revenue in FY18 fell substantially by 31 percent, from Rs 10.2 billion in FY17 to 7 billion in FY18. Of this Rs 7 billion, steel segment contributed Rs 6 billion. However, the steelsegment itself also witnessed a drop in sales by 31 percent due to a slowdown in projects. In addition, prices have also remained volatile for HRC. They increased by 7 percent during the year. For the steel division, gross margin reduced to almost 13 percent, while cumulatively too, gross margin was lower at 11.5 percent, compared to over 18 percent in FY17, as cost of production increased to 88.5 percent (FY17: 81.79%). On the contrary, net margin was higher at 10.7 percent as income from investments grew to Rs 496 million for the year.

Revenue declined again in FY19 by over 42 percent to reach Rs 4 billion in value terms. Steel segment, that is the largest contributor to revenue, witnessed a decrease of 61 percent. Prices continued to be volatile as they registered an increase of 12.5 percent. Despite this, gross margin for the division fell to almost 5 percent, while cumulatively for the company; gross margin was again lower at 5.4 percent. With cost of production consuming nearly 95 percent of revenue, and a decrease in other income as well as income from investments, net margin shrunk to 3.5 percent- the lowest seen since FY10.

Topline declined for the third consecutive year in FY20, by 6 percent. Revenue from the steel division was again decreased by 46 percent while cost of production consumed nearly all of the revenue, low order intakes caused steel division gross margin to fall to 2.6 percent, while overall for the company it was lower at 1.3 percent. Moreover, administrative and finance expense together accounted for more than 14 percent of revenue due to increase in salaries expense and higher interest expense on non-shariah arrangement for running finances. Despite the fairly significant support from income from investments at Rs 389 million, the company posted a net loss of Rs 17 million.

After declining for three years straight, topline grew in FY21 by nearly 90 percent to cross Rs 7 billion. This was attributed to an improvement in demand for steel pipe and billet that almost doubled. Energy infrastructure development projects have been a major contributor to the company’s growth for the year. Moreover, with cost of production reducing to 93 percent of revenue, gross margin improved considerably to 6.8 percent. Additionally, other income grew to Rs 196 million, compared to Rs 35 million in FY20, providing further support to the bottomline that stood at Rs 352 million for the year, with a net margin of 4.8 percent. The higher other income came largely from unrealized gain on FVTPL investments.

Quarterly results and future outlook

Revenue in the first quarter of FY22 was lower by 37 percent year on year. Steel division incurred a loss for the quarter while cotton division saw a significant improvement in profitability at net profit of Rs 97 million versus 14.5 million in the corresponding period last year. Overall, the company incurred a loss for the quarter of Rs 49 million as cost of production escalated to nearly 96 percent of revenue compared to 85.6 percent in 1QFY21. This was due to an increase in cost ofraw materials.

Revenue decreased year on year in the second quarter as well, by almost 22 percent. Steel division continued to incur loss while profit from the cotton division increased to Rs 168.2 million for 1HFY22 compared to Rs 75 million in 1HFY21. The loss in steel division was attributed to increase in steel prices as well as supply chain disturbances. Moreover, the plant also remained idle that resulted in fixed cost being unabsorbed. Overall, the company posted a net profit of Rs 932 million that was primarily supported by income from investments (Rs 1.1 billion), the absence of which would have resulted in a loss for the quarter.

The third quarter saw an increase in revenue by nearly 29 percent year on year. Similar trend followed as cotton division contributed towards better margins, while steel division witnessed lower turnover, as well as loss before tax. Cumulatively, the company incurred a loss for the quarter as production cost consumed 98 percent of revenue. Overall, 9MFY22 saw improved net margin on the back of income from investments. In the steel division, the company foresees pent up demand that will emerge, while cotton division benefits from supportive packages. However, the escalation in raw material prices will hurt profitability.

Comments

Comments are closed.