Global crude oil demand bounced back from the pandemic, which meant increase in crude oilproduction in 2021. While the year-on-year growth in global crude oil production was only 0.8 percent overall, the rebound in production was seen as a recovery in demand, which is still continuing despite the rising prices. OPEC crude oil production rose by 2.7 percent year-on-year in 2021, while crude production by non-OPEC countries fell slightly by 0.4 percent year-on-year.

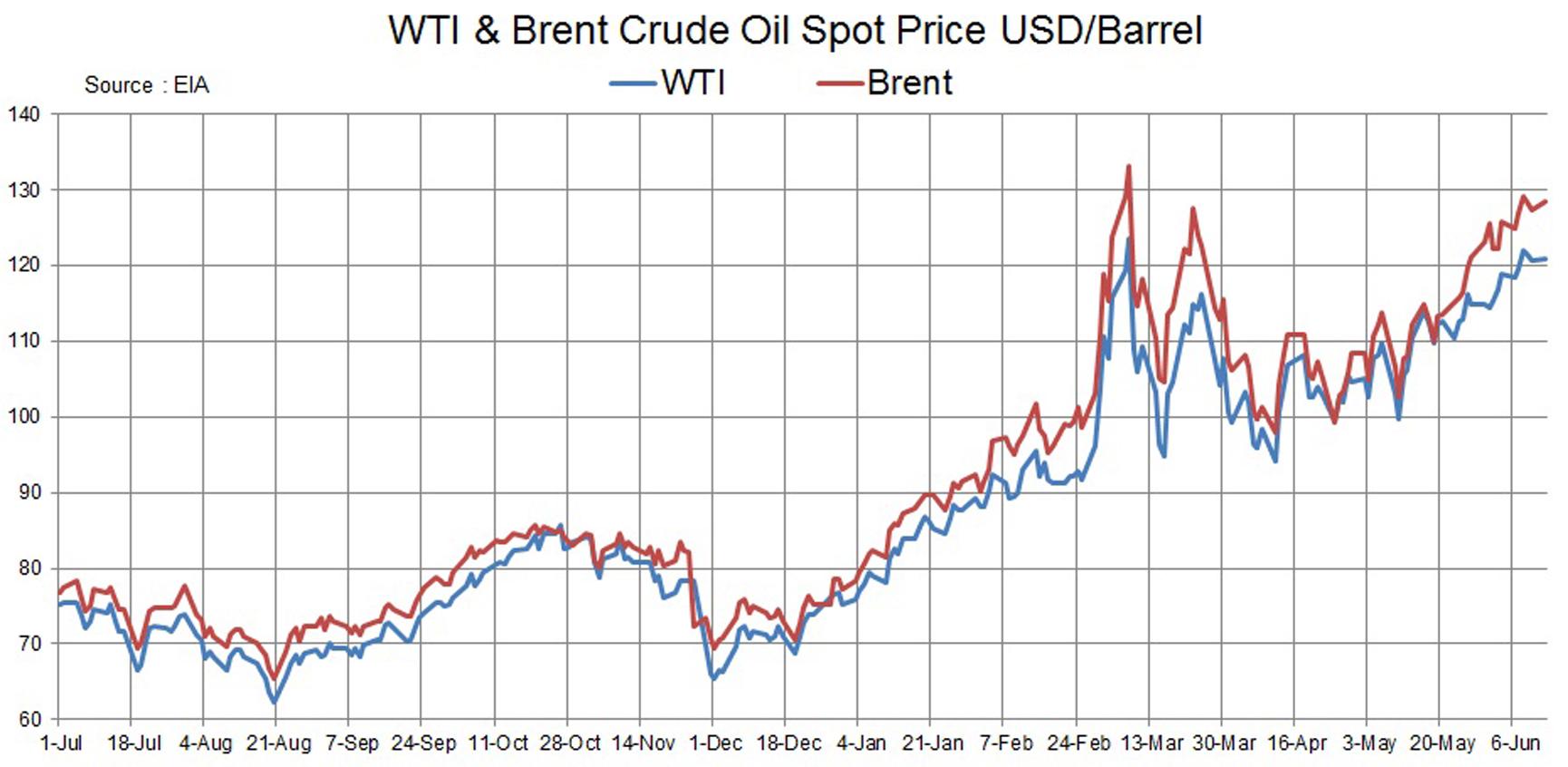

Forecast for demand in 2022 however has not been simple. The world is juggling to find a balance amid excessive supply constraints and demand dilemmas. The current global economic crisis with high inflation and interest rates should push demand for crude oil downwards to release the pressure on oil prices. However, this hasn’t happened till now and demand for oil is still increasing despite skyrocketing prices of petroleum products. The persistent supply issues are outweighingthe growing concerns on a potential economic slump and a global recession. This is keep oil exporters and investors at the edge. Also, the prospects of Chinese economy reopening and increased demand for oil in the summer season across the globe along shortages in natural gas supply are also likely to keep crude oil prices up.

What has recently increased prices after a three day falling streak was the news of new sanction on Russian oil by the G7. Then there are also fears of increased internal turmoil in Libya, Iraq, and Ecuador, which could push prices further up. Members of the OPEC+ in their meeting being held today will likely stick to the plan of output increases in August to stabilize prices. However, the lacuna here too is the idle capacity available. Recently UAE Energy Minister has reportedly said that UAE is already producing near the maximum capacity under on the agreement with OPEC+. At the same time, the largest OPEC producer, Saudi Arabia also has only additional 150,000 bpd to stabilize.

Comments

Comments are closed.