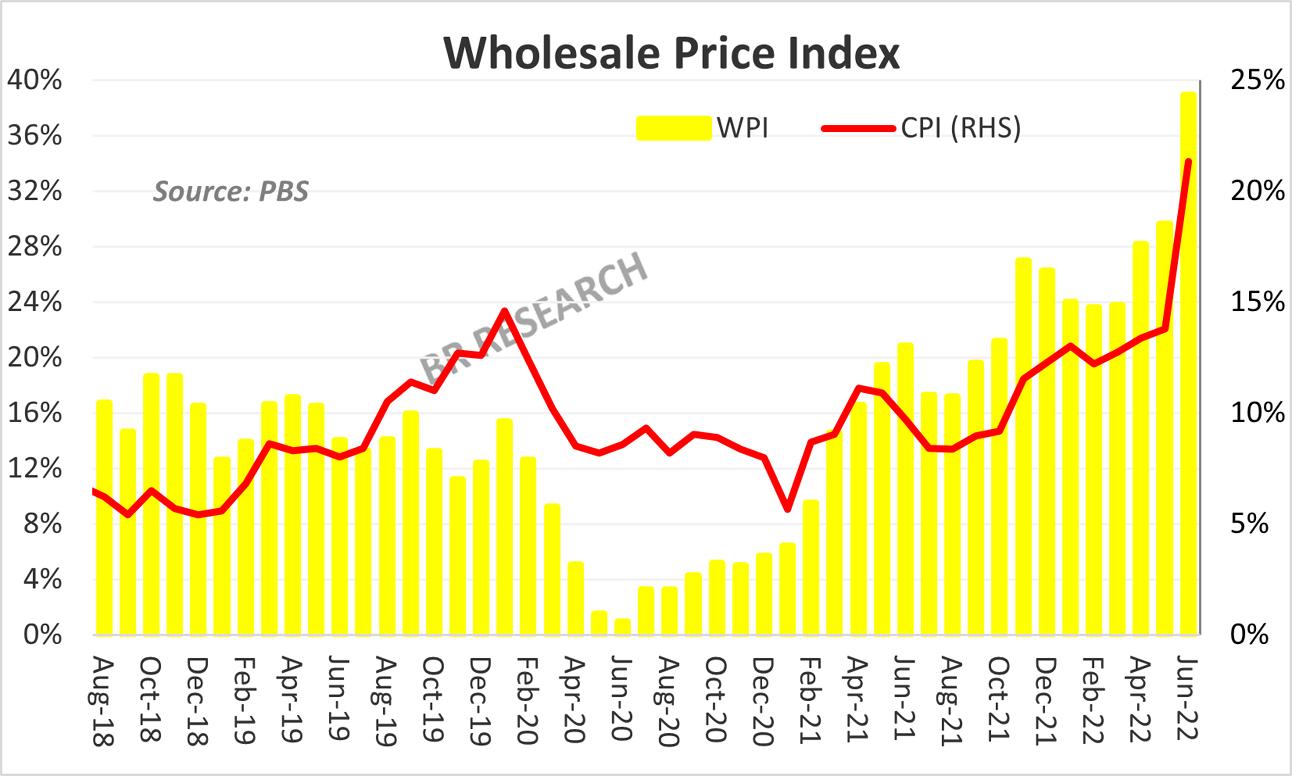

It is promising to be a repeat of 2009, in an optimistic scenario. It could all get worse seeing how things are shaping. As expected, the Wholesale Price Index (WPI) at 39 percent for June 2022 was the highest in well over two decades, if not more. For the fiscal year FY22, WPI at 25 percent is so rare, that you have to go back 48 years to see a higher WPI incidence.

And remember that the 39 percent is not coming off a low base either. The WPI had started to creep up around the same time last year, having reached 21 percent for June 2021 – a then high for over a decade. To put it into better context, WPI for FY21 was 9.4 percent. And it may well just be the beginning of what appears to be a painful four to six months in terms of wholesale prices, that is sure to feed into retail prices, with varying degree of lags.

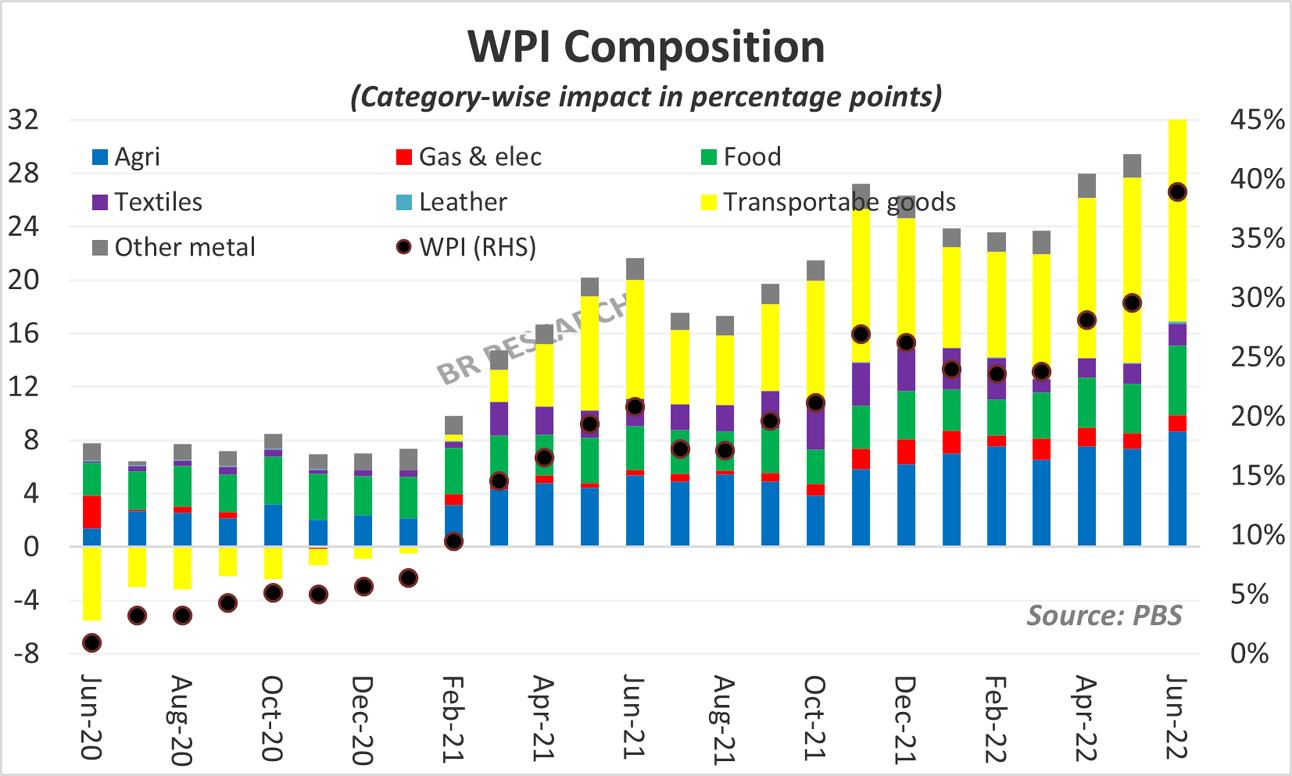

The transportable goods expectedly carry the bulk of increase in wholesale prices, as petrol, HSD, and furnace oil have increased appreciably over the last month and a half. Chemicals and fertilizer prices have risen by over 50 percent year-on-year, with a considerable combined weightage. These prices are often found to translate into retail prices with a lag but even if the international food price spiral dies down, the next round of food price inflation could well be carried by uptick in fertilizer prices, and the obvious impact of transporting the same.

Electricity and gas tariffs are going to go up in phases for 1QFY23 – with an increase of nearly 45 percent year-on-year. A combined 11 percent weight can sure enough carry WPI increase to double digits singlehandedly, as it did for much of the previous such rally. The CPI at 21 percent for June 2022 is only the start of what is coming. And it would not be a pretty sight, from the looks of WPI.

Comments

Comments are closed.