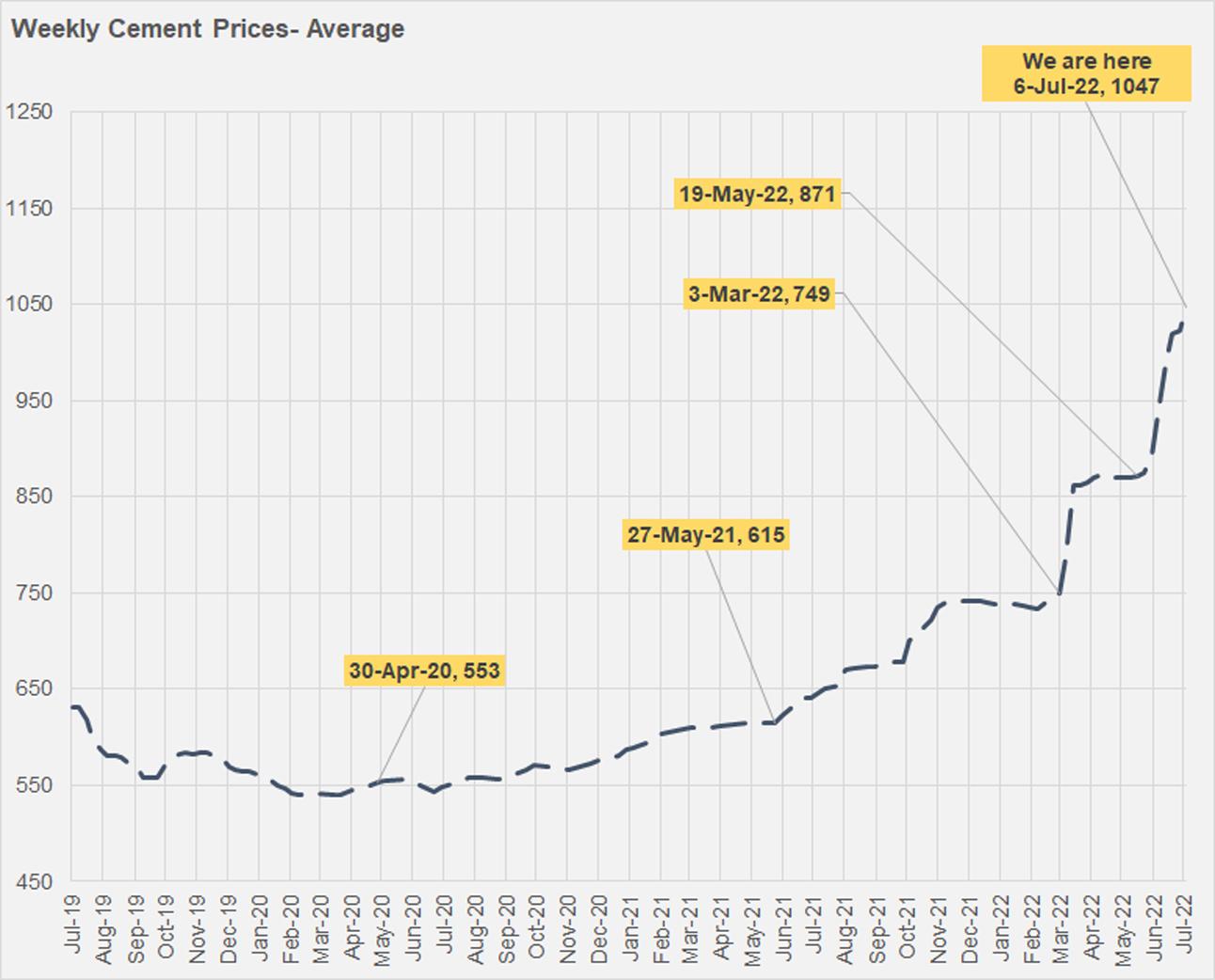

There is no stopping cement prices. Last month, the average price of a bag carrying 50-kg of cement crossed Rs1000 in Pakistan—landing at much higher in certain markets up north. Weekly data captured by the Pakistan Bureau of Statistics (PBS) shows that this is now getting closer to Rs1100 per bag within two weeks making this hike a 68 percent increase from the average prevailing prices last year. Cement price hikes are not uncommon except, this particular cycle is unfolding at a time of dampening demand where price shooting up cannot be helping matters.

In FY22, cement recorded a negative overall growth of 8 percent—for the first time in many years—as thus far boom or bust, cement continued to grow positively year after year. Granted the main reason for the decline is plunging exports that were 16 percent of dispatches last year but fell to 10 percent in FY22. In volumetric terms, cement exports fell 42 percent where domestic offtake grew 1 percent in tons. This dramatically decline came because of nearly all important exporting markets drying up—from Afghanistan to Sri Lanka to markets overseas. Seaborne exports fell because freight rates became exorbitant making cement coming from Pakistan very expensive. Meanwhile, Afghanistan undergoing the political change of guard and ensuing upheavel while Sri Lanka going through tremendous economic and financial distress both became less accessible markets for Pakistani cement. Construction demand in these countries became scarce.

Domesticall, there was virtually no growth in cement sales this year despite the early few months spent in an excited bubble where the government’s construction amnesty scheme and the Naya Pakistan Housing Program were supposed to give a substantial impetus for growth in the sector. Which it did, but for a while. It was not sustainable as the amnesty scheme did not translate to much construction on the ground and the NPHP could not deliver on housing as it hoped to do.

The situation now is even worse. The country is facing unbridled inflation and construction materials like cement are getting more expensive than ever which will only push demand further south. According to the monthly price index of the PBS, cement price index grew 49 percent in Jun-22 compared to this time last year, higher than the wholesale price index of 39 percent year on year. Steel—another major construction material—also became 49 percent more expensive, as per the index. WPI of 39 percent itself is at historic highs which will reflect soon in retail prices and therefore CPI. The purchasing power for households is diminishing with cost of living becoming prohibitive, at a time when fiscal pressures have forced the government to raise taxes for the tax compliant.

The SBP has hit pause on the Mera Pakistan Mera Ghar mark-up scheme which effectively hits pause to the NPHP dream while the government has also made cuts into PSDP spending. If there is cement demand, it will come from existing, ongoing projects with earmarked funding in both the public and private sector.

Comments

Comments are closed.