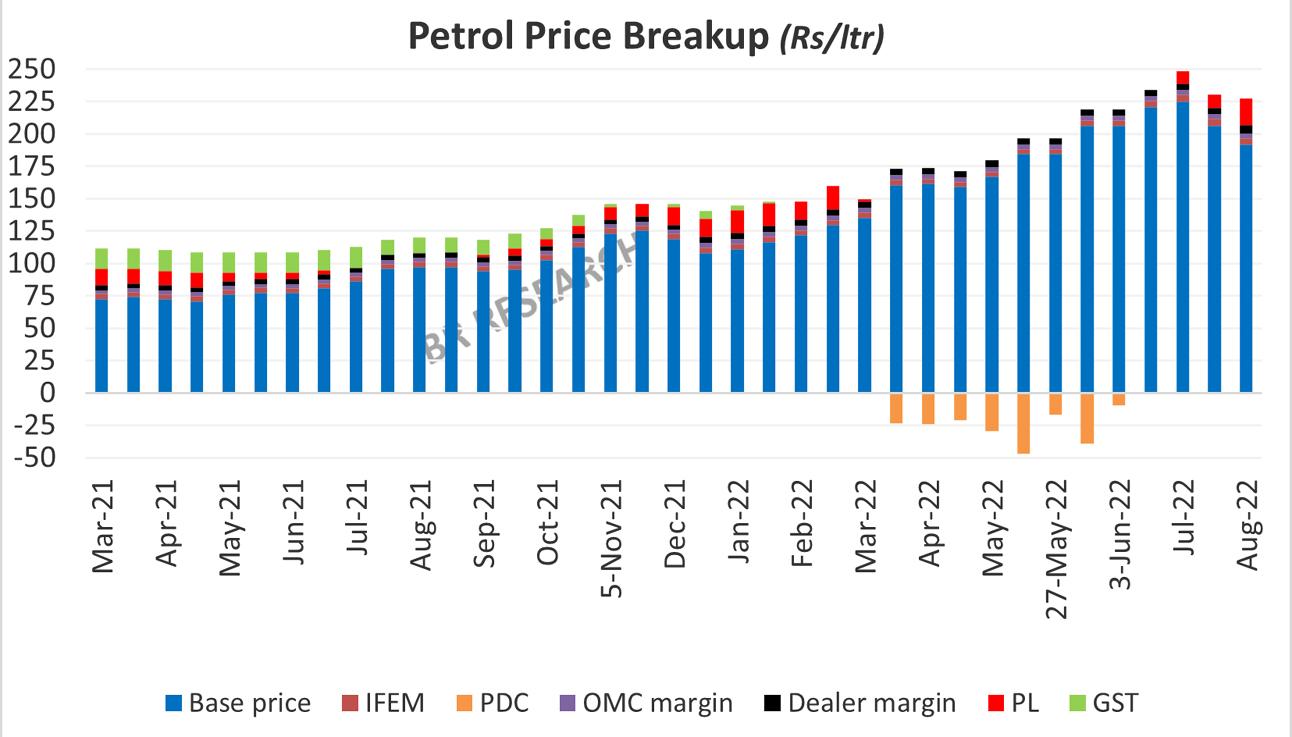

A sharp decline in benchmark gasoline prices allowed the government to cut domestic retail petrol prices by 1.3 percent over previous fortnight. Some observers wanted more. Only that the price breakup is in complete conformity with the IMF conditions, as the Petroleum Levy (PL) was doubled from Rs10/ltr to Rs20/ltr. There is still no GST, mind you, as base prices are still on the higher side year-on-year.

Recall that the Petroleum Levy target for FY23 has been set at Rs750 billion, which will continue to remain elusive, unless of course, international prices nosedive considerably from present rates. Either way, any sizeable reduction in domestic pump prices can be ruled out, as any potential room offered by international oil prices, will be utilized to levy more taxes.

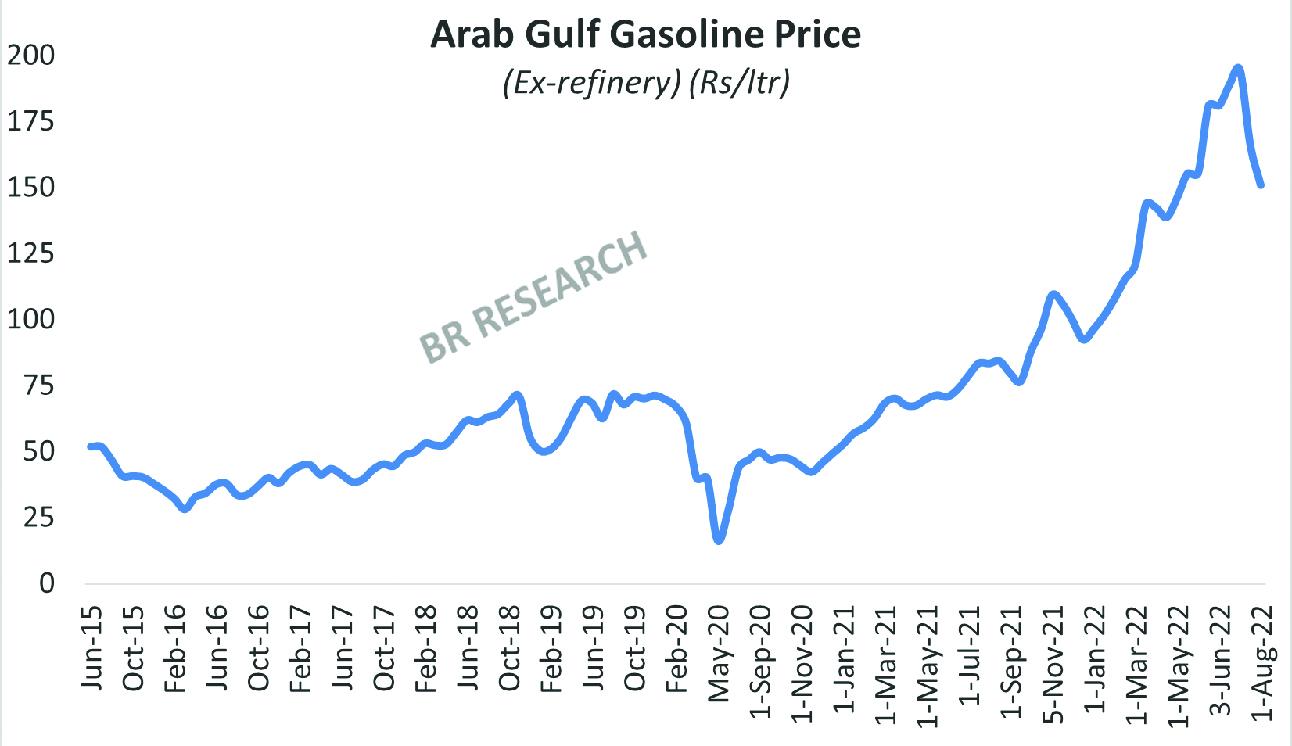

The dealer margins have also gone upby 43 percent to Rs7/ltr. Next in line are the OMC margins, which are expected to witness a similar increase. While the global crude oil prices have eased from the historic highs seen a couple of months ago, it was thewidening of crack spread, that led to skyrocketing base prices. The refined product prices have gradually started to move closer to the historic spreads. Whether or not, this will last is guesswork at the moment.

The benchmark gasoline prices were down 16.4 percent versus previous fortnight from $127.5/bbl to $106.6/bbl. If it was not for the sharpest currency depreciation in ages during the reference period from Rs207 to Rs225 per US dollar – the relief could have been close to Rs16/ltr, even after adjusting for higher PL.

The 9 percent depreciation over the previous fortnight meant the base price in rupee terms was down by 9 percent only at Rs150.9/ltr. The Arab Gulf gasoline price at $106.6/bbl was the lowest since mid-Feb 2022 revision, whereas in rupee terms, it was lowest since May-2022 revision. While the base oil price has lost 15 percent since the government took over – the rupee has lost 22 percent against the greenback to shut down the relief doors.

Comments

Comments are closed.