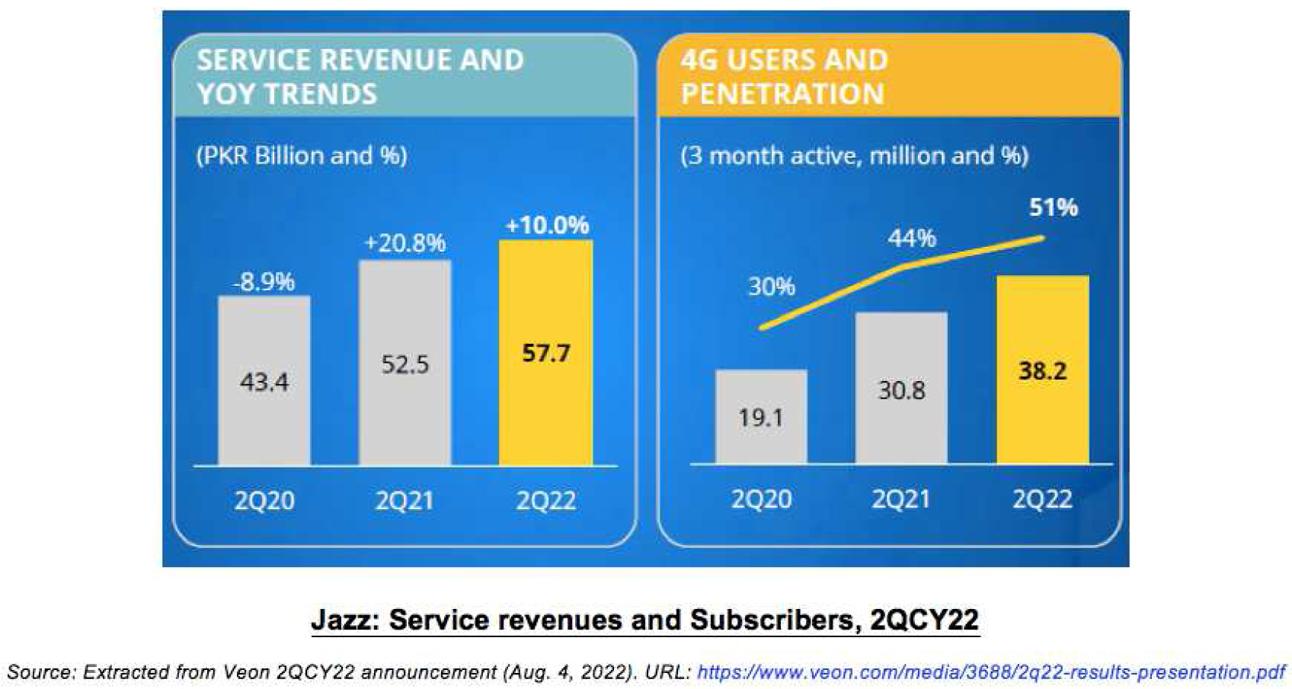

Pakistan’s leading mobile network operator (MNO) managed to score double-digit increase in key financial indicators in the most recent quarter, despite a challenging operating environment. Based on latest financial results posted by Veon, the parent company of Pakistan Mobile Communications Limited (‘Jazz’), the cellular giant’s total revenues grew by 11 percent year-on-year to reach Rs63.5 billion in 2QCY22, buoyed by continuing strong growth in data revenues driven by a higher tally of 4G subscribers.

At the Apr-Jun quarter end, the largest MNO’s 4G users had crossed 38 million in number, growing by over 24 percent compared to the same period last year. As a result, data revenues jumped 28 percent year-on-year to reach almost Rs27 billion. At this pace, by the last quarter of this year, Jazz data revenues may provide half of overall topline. The operator’s 4G coverage stood at 56 percent of the country as of June end, which was a marginal improvement over June 2021. This could be enhanced.

Overall, the operator’s ARPU (average revenue per user) at Rs253/month in the three-month period was a scant 2 percent improvement over the same period last year. In real terms, after adjusting for inflation, the ARPU growth goes into deep negative. And then on the group level, the view on ARPU (in foreign currency terms) becomes more disappointing considering the fast-declining PKR in recent times. It doesn’t help when taxation-related hikes (mostly, WHT on account recharge) further depress ARPU.

In another positive for Jazz, its EBITDA (earnings before interest, taxes, depreciation and amortization) improved by 20 percent year-on-year to Rs30 billion. This growth was disproportional compared to 11 percent topline increase. As a result, EBITDA margin jumped by over 3 percentage points over 2QCY22 to reach 47 percent in 2QCY22. Veon attributed this growth to one-off adjustmentsof SIM-tax reversal and license renewal charges of Warid paid in 2QCY21. Even after discounting those adjustments, Jazz EBITDA growth was higher than topline, despite massive rise in cost of fuel and utilities.

As per the latest report, Jazz added 400 more 4G sites to its data network in the quarter. But overall, the investments seem to be on a decline, as the first-ranked MNO’s capital expenditures declined by 18 percent year-on-year to reach Rs11 billion in the period under review. Considering the current volatile macroeconomic situation amidst the industry’s longstanding issues, operators may find it prudent to prioritize getting through this turbulent time without significant financial deterioration. Jazz, it appears, is able to achieve that objective better than other operators, thanks to its scale and strategy.

Comments

Comments are closed.