RMPL: price hikes ain’t enough!

The weekend following Independence Day saw a flurry of activity at the bourse. The benchmark index is up over 800 points, as energy and banking sectors posted record profits in quarterly result announcements. Unfortunately, other industries have remained impervious to the charms of peaking interest rates and oil prices, noting a sharp decline in bottom line.

Rafhan Maize Products Company Limited (RMPL) is one such unlucky scrip. Even a 32 percent rise in the topline – now all set to take annual revenue above Rs50 billion by calendar year end - couldn’t protect the bottom from rapid erosion. All profitability indicators – from contribution margin to before-tax profits – took substantial battering. Thankfully, the steady revenue stream from its four business divisions and commanding market share meant that the company shall remain protected against incurring any losses.

Gross profit margin saw the worst fall, declining from 30.7 percent in H1-CY21 to a little over 22 percent in the outgoing half-year. But even if record GPM of H1-CY21 is ignored, gross margin is only the second lowest in five years – hardly beating the two Covid lockdown quarters of CY020.

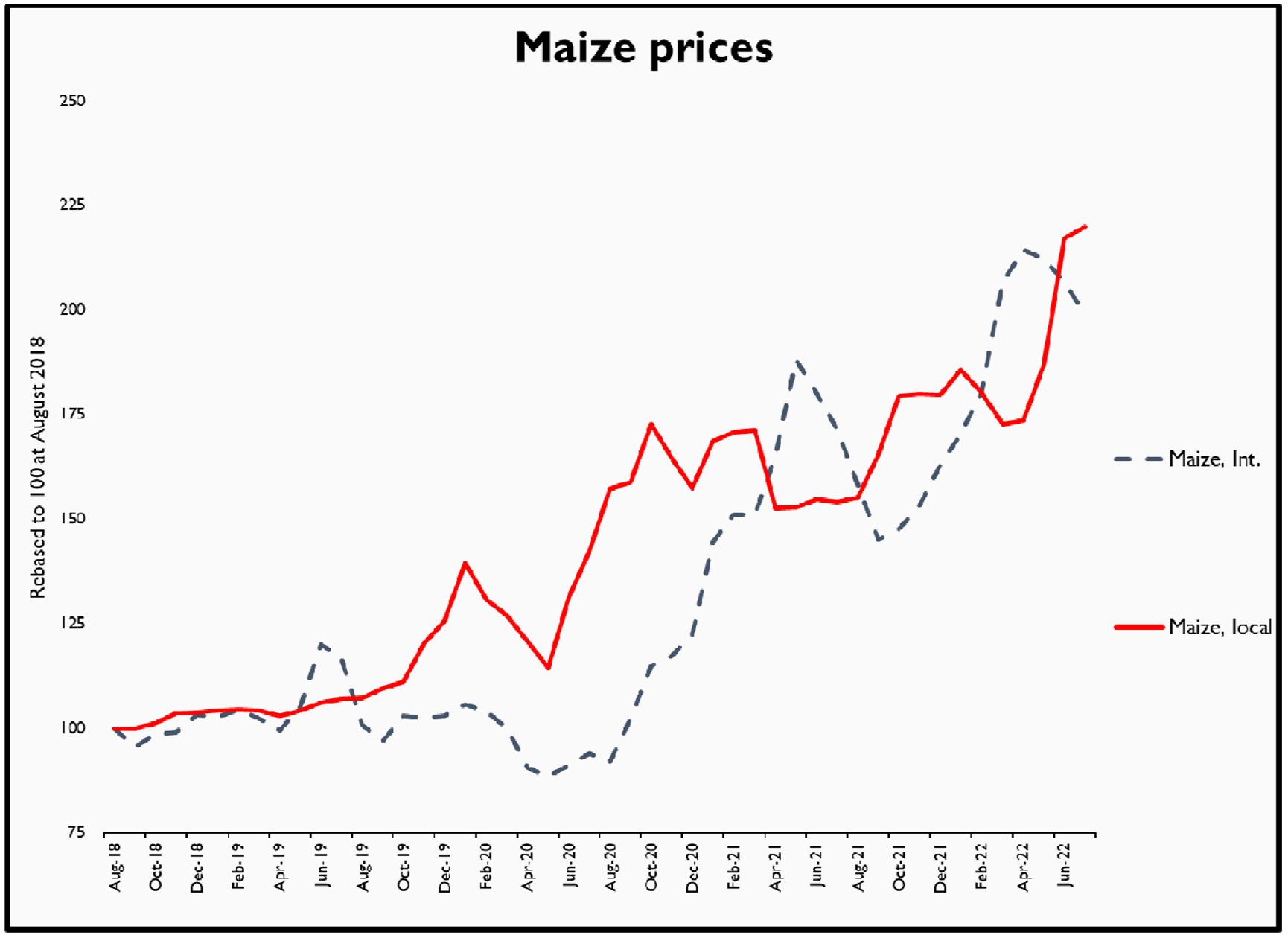

But compared to the remarkable 8.6 percentage points fall in gross margin, EBIT and PBT margins fell by almost a percentage point less (7.8pp) versus same period last year. Thus, the half year performance appears to be an indicator that the company is already seeking efficiencies to generate cost savings. And the way maize prices have been raising in the local market since March 2022, RMPL will need those savings all the same, maybe even more, in the H2-CY22.

Comments

Comments are closed.