Though earnings for Amreli Steel (PSX: ASTL) in FY22 fell by 3 percent, the company’s revenue and before-tax earnings performance show that it was delivering an excellent year until the very end when a super-tax was imposed amid very real inflationary pressures. In Q4 in fact, the company actually incurred a loss.

Revenue growth of 48 percent for Amreli was made possible by a strong volumetric increase. In 9MFY22, production grew 11 percent to over 290,000 with sales at more than 275,000 tons, growing 5 percent from the previous year period. In the last quarter, there was a shortfall in volumes but not because of the lack of demand, but because of filtering out debtors that had higher receivable days.

The overall growth during the year is surprising for sure as the same kind of growth in demand is not visible elsewhere in the construction industry. For context, according to Pakistan Bureau of Statistics (PBS) Large Scale Manufacturing data for production, billet volumes in the country grew 33 percent in FY22 compared to a decline in production of cement of 4 percent. High cost of construction has certainly dampened cement demand but steel production has persevered likely feeding into existing constructions happening in the commercial and public-sector projects. In Amreli’s case, majority of the demand is coming from Sindh as told by its management and only about a third of the demand comes from the north of the country (Punjab and KP). This is in line with cement as the commodity’s sales grew 9 percent during FY22 in the south versus a 3 percent decline in cement demand in the north.

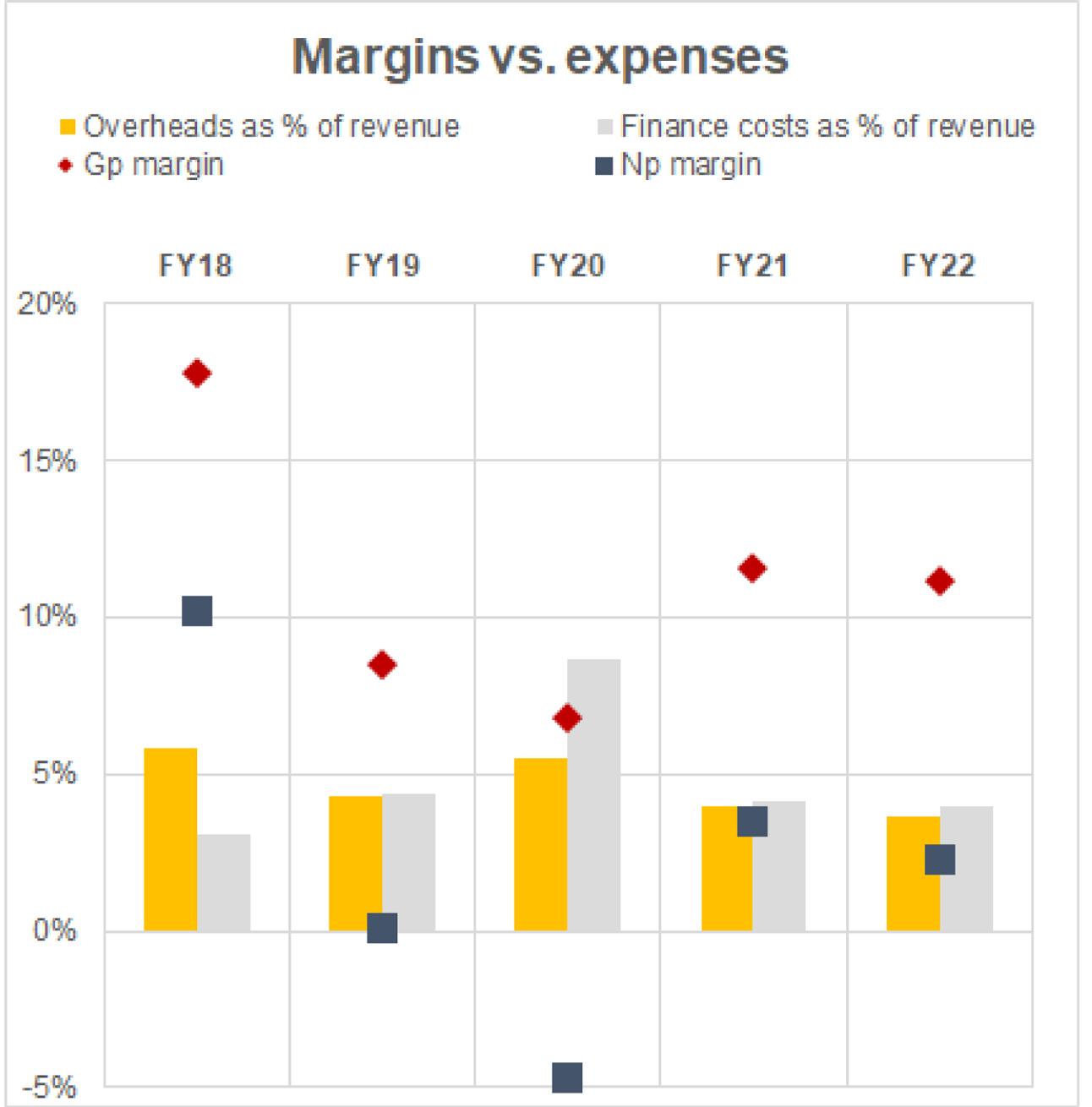

The strong revenue growth was also a function of more frequent price hikes during the year. On average, revenue per ton sold during FY22 was 51 percent higher than that of last year which contributed to the top-line increase. However, margins dropped slightly during the year owing to high scrap prices in the international market, rupee depreciation and considerably high electricity tariffs that include increment in fuel adjustment charges.

Amreli’s overheads together with finance costs stand cumulatively at 8 percent of revenue which isn’t too different from last year. In value terms, finance costs grew 50 percent due to higher borrowing and increased interest rates.

Reduction in the prices of steel rebars with a slowdown in demand does not bode well for the future given that cost of borrowing is high and cost of production is pressing down hard on margins. Scrap prices holding stable and rupee appreciation may however improve the company’s positioning in the coming quarters if demand also remains at its current levels and does not drop dramatically.

Comments

Comments are closed.