By choice or otherwise, Pakistan’s national grid power generation was down 10 percent year-on-year in July 2022. Less than 14 billion units for July, which has historically been the peak demand month, is the lowest July generation since July 2018. Even July 2020 during peak Covid had higher generation numbers.

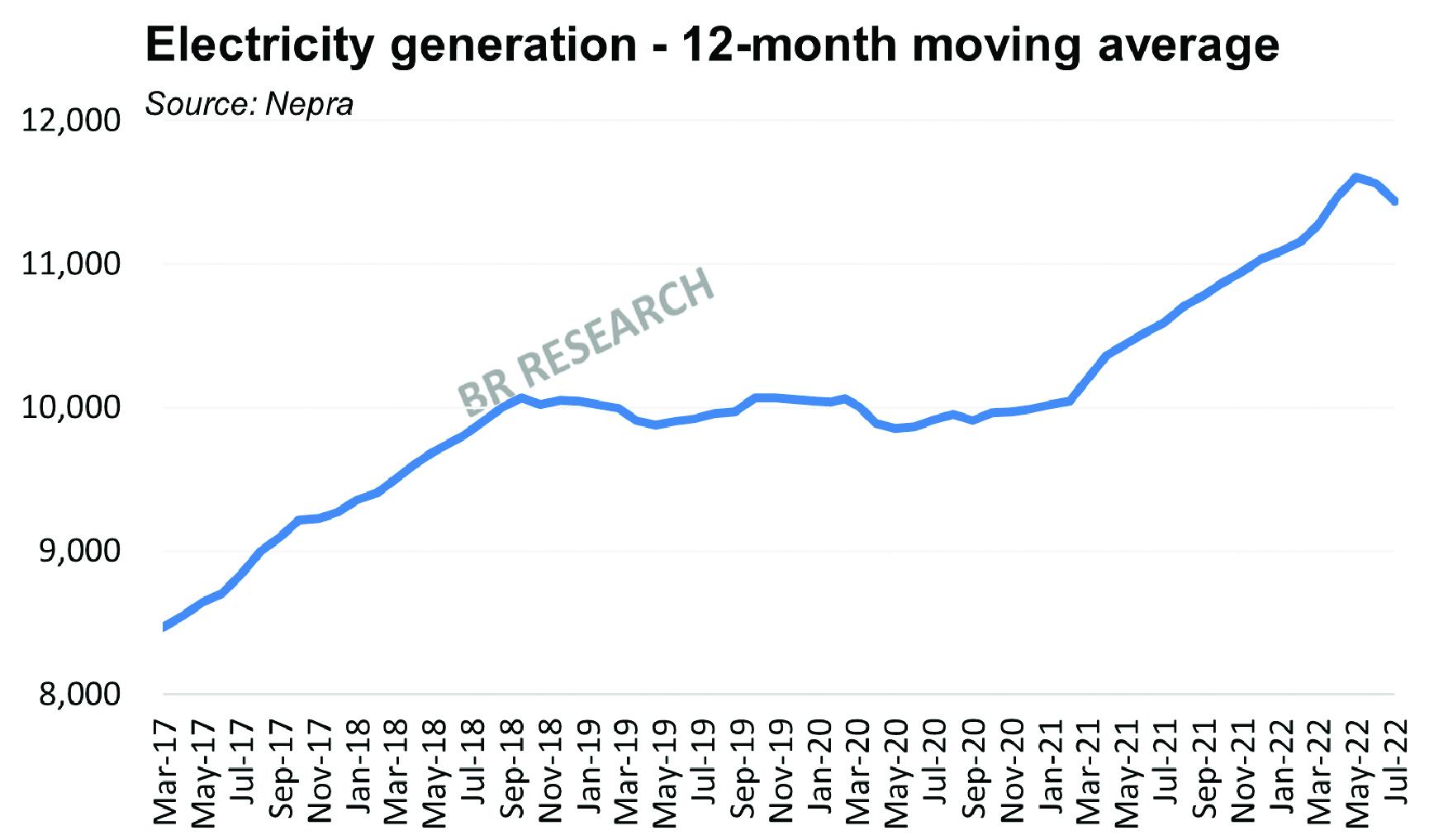

You could put it down to reduced temperatures, as monsoon came early, but continued load shedding across the length and breadth of the country suggests, the system was managed to make up for shortage of fuel. July was the second month running that year-on-year power generation went down, taking the 12-month moving average growth to 8 percent. It was hovering around 11 percent for the past six months.

There are signs of economic slowdown emerging, looking at high frequency statistics of the last two months. Industrial activity also seems to be slowing down, some of it forcibly to manage the country’s balance of payment. It is quite a setback considering that the government pinned its hopes on increasing the grid generation by 50 percent, and in the process bring down the power generation cost to Rs12/unit. There was no way it was going to be achieved ever, but things have actually turned for the worse. Not only have the demand and the capacity to generate at optimal efficiency dwindled, the affordability part of the equation has also gone haywire.

RLNG generation continues to be far from optimal, given how tight the spot market has been. August and September promise to be worse in terms of RLNG availability, as Pakistan authorities have been unable to attract successful bids for spot cargoes. Coal, on the other hand, is not as scarce, but only 13 percent share in total generation from coal shows, there were not that many dollars available to ensure timely coal imports.

On the brighter side, hydel generation seems to be getting back towards normalcy, with the share going up to 35 percent. Nuclear generation has also picked up – and in a rare event, had a higher share in generation at 14 percent, than that of coal.

The fuel charges adjustment sought for July 2022 stands at Rs4.7/unit, as the generation cost of Rs10.98/unit beats the revised reference fuel cost of Rs6.29/unit. Mind you, reference fuel costs have once again been revised upwards, and July reference fuel cost is 19 percent higher year-on-year. With base tariffs already up, August and September electricity bills will have significantly higher effective tariffs, given extremely high FCA.

Fuel adjustments stayed record high in FY22 and should cool down in FY23. But that will not necessarily mean lower effective tariff, as much of that has been incorporated into revised base tariffs. The base tariff is all set to go up for next two months as well, and high FCA will just make matters worse.

Comments

Comments are closed.