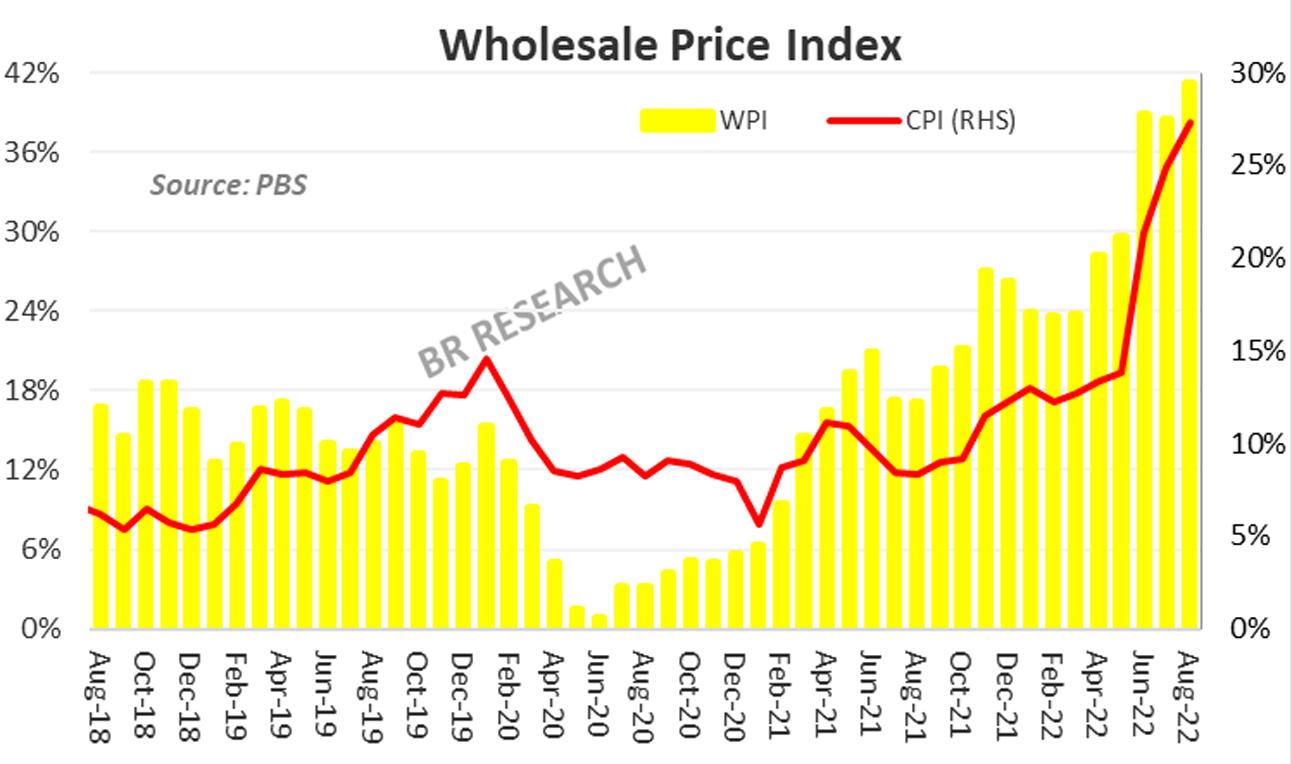

SPI, CPI, or WPI. Take your pick. Records are being broken everywhere. The Wholesale Price Index (WPI) for August 2022 broke its previous high, recorded only a couple of months ago, clocking an all-time high 41.25 percent. This is the fourth straight month where WPI has stayed clear of 30 percent – and 12th since it crossed 20 percent.

The 12-month moving average WPI stood at 28 percent. For context, it was 12 percent in August last year. The latest to join the WPI rally is the gas and electricity sub-component, with 27 percent year-on-year increase. This is the highest increase reported in 30 month, as the fresh round of adjustment in energy prices is underway.

While some relief has been extended to domestic and agriculture consumer on account of monthly adjustment, further rounds of increase are next in line. The relief does not extend to the commercial and industrial sectors, and is likely to keep the wholesale pieces elevated. The increase so far is headlined by electricity tariffs only. A bigger increase in that of gas prices is just around the corner, and that would lead the next rally. There is no respite on offer in the next few months.

Transportable goods have continued to stay at all-time high with an increase of 86 percent year-on-year. Even as international crude prices come down from the recent peaks, prices at pump are likely to stay at current highs, if not higher. The government has agreed with the IMF to take the PL to the maximum limit on both HSD and petrol, while also increasing import duty and restoring standard GST ohm petroleum products. Good luck curtailing the distribution cost of all transportable goods that forms more than 22 percent of the WPI.

Floods are the new entry that will further feed into WPI rally, trickling to retail prices eventually. Agriculture WPI prices are going to take a big hit, as reports of crop losses come in. Fertilizer prices continue to stay high. LNG prices show no respite, and as winters approach, Pakistan will find it hard to manage supply or afford LNG. The WPI may well be nearing its peak, but the CPI is yet to show its impact in enterity.

Comments

Comments are closed.