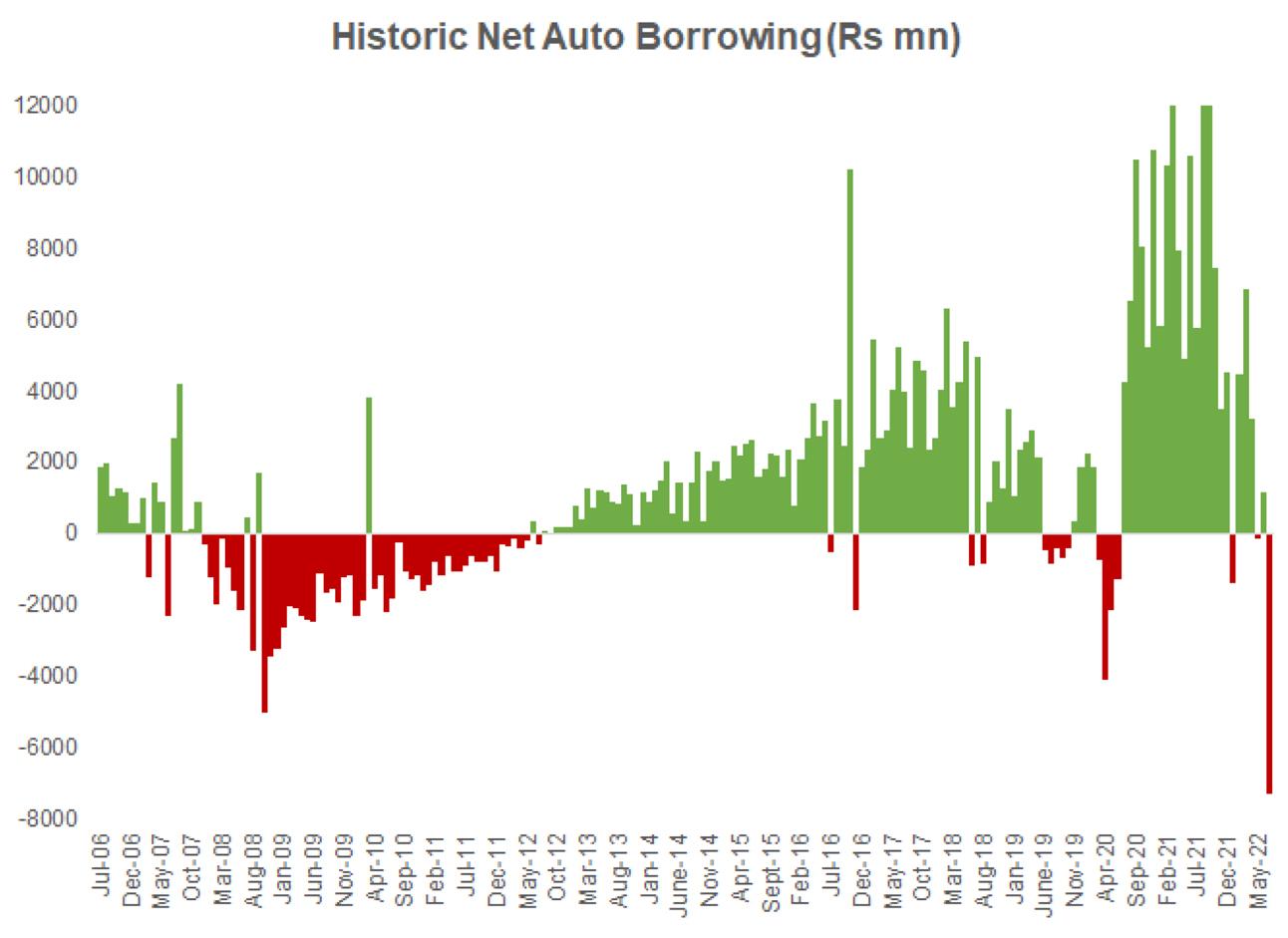

Having had a spectacular two-year run where auto loans hit their historic peaks as demand for vehicles surged, new models entered the market and interest rates trailed low, vehicle financing is now slowly but surely heading downward. For the latest data made available by the Central Bank, net auto borrowing turned substantially negative in Jul-22 for the first time since interest rates began their upward climb. At prevailing rates, it is near prohibitive for new borrowers seeking vehicle financing.

This trajectory will certainly put a dampener on demand which has already begun to dwindle on the back of rising car prices, and reduced buying power. Supply-side obstacles meanwhile have already forced assemblers to halt production which will keep volumes low even if the demand remains constant. Certainly, this serves the government well as it flounders to somehow curb imports and minimize the current account deficit. The supply shortage in automotive kits is a direct result of SBP restricting imports through banks.

The SBP has tried to curtail demand from other avenues too, and from nearly a year ago. Specifically, in Sep-21, the Central Bank amended the prudential regulations for consumer financing by reducing the maximum tenure of auto financing from 7 to 5 years and doubling the down payment requirement from 15 percent to 30 percent. This meant more cash up front and higher payments per month. The financing limit was also set at or below Rs3 million while used cars were to no longer be eligible for auto financing. Soon after these modifications were introduced, net borrowing began to visibly tumble; still remaining positive but not with the same kind of lustre as earlier.

Worth noting here that these regulations were for engines above 1000cc because on some level, the government wanted to keep the façade of sticking to their purported automotive development policy 2023 that promised to promote and encourage small engines. This was around the time when policy rate was first raised to 7.25 percent. Rates kept going up—in Nov-21, Dec-21, April-22, and May-22. Auto sales however were not as quick to respond to rate change, or even the frequent price hikes. There was pent-up demand. On average, monthly sales for passenger vehicles alone during FY22 was 19,500 compared to 12,500 the previous year; up 55 percent.

In May, the SBP doubled down on regulations by bringing smaller cars into the mix, reducing the maximum tenure of auto loans from 5 years to 3 years for engines above 1000cc and from 7 years to 5 years for engines below that displacement. Within two months of that, net borrowing in consumer auto loans has slid to its 16-year low. Counting bank financing out of the picture (in Jul-22, the 6M-kibor hit 16%), and substantially more expensive cars in the market, new cars are being bought—and will likely be bought—on cash which will reduce demand in the coming quarters especially in the “affordable” segment. Further demand slowdown would come due to floods shrinking demand in certain rural pockets. However, car demand in the Pakistani market does persevere against odds and given how many car buyers use the purchase as a store of value, the shrinkage—despite auto financing’s vanishing act—may not be as biting. In any case, auto assemblers have to first deal with their supply limitations and then perhaps worry about demand.

Comments

Comments are closed.