Ittehad Chemicals Limited (PSX: ICL) was set up in 1962 by the name of United Chemicals. It started production two years later in 1964. In 1971 it was nationalized and was renamed to Ittehad Chemicals. More than two decades later, it was privatized in 1995. The manufacturing facility is located in District Sheikhupura where it manufactures caustic soda and other allied chemicals.

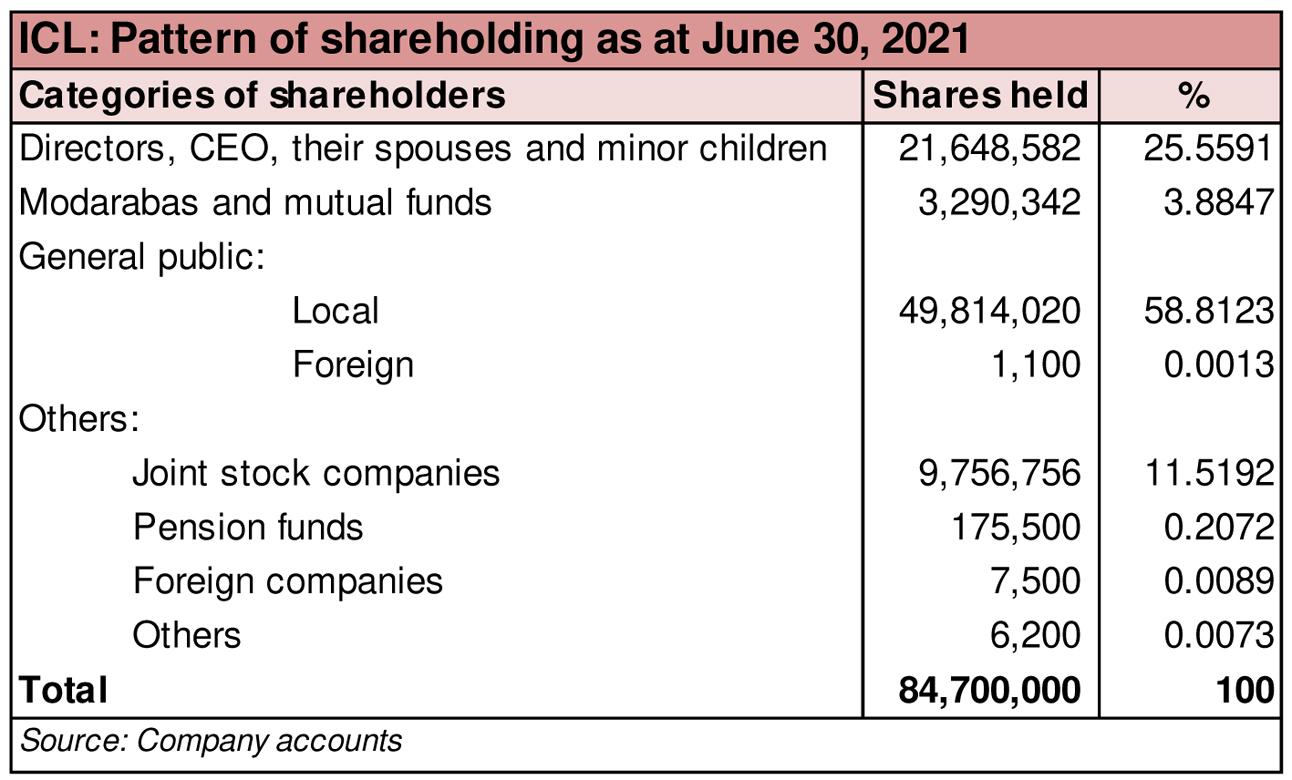

Shareholding pattern

As at June 30, 2021, about 25.5 percent shares are owned by the directors, CEO, their spouses and minor children. Within this category, the chairman Mr. Muhammad Siddique Khatri is a major shareholder.The local general public owns close to 59 percent shares, followed by 11.5 percent shares held in joint stock companies. The remaining about 4 percent shares are with the rest of the shareholder categories.

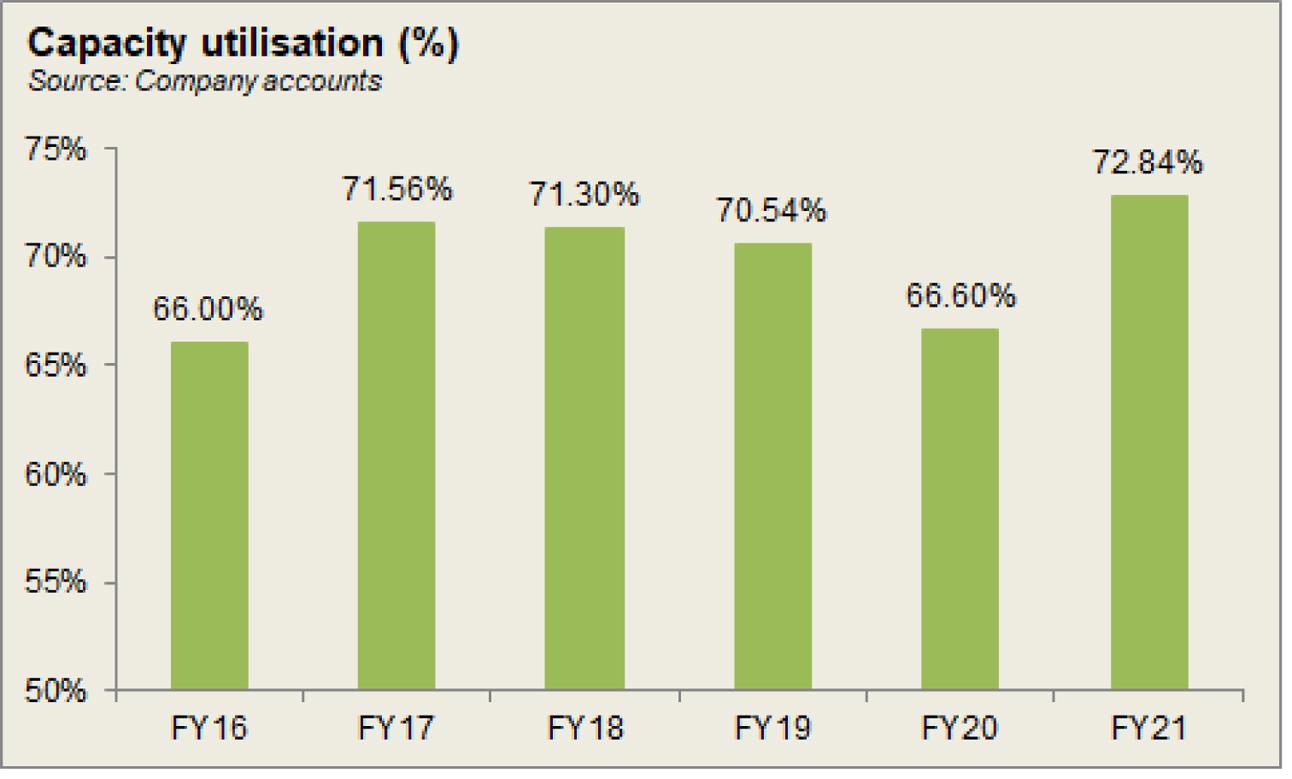

Historical operational performance

The company has mostly seen a growing topline, while profit margins in the last six years have grown between FY16 and FY19. They declined in FY20, before rising again in FY21.

In FY18, revenue registered a growth of 15 percent to reach Rs 5.7 billion in value terms. This was attributed to higher prices for Caustic Soda in the local as well as the international market. On the other hand, cost of production hovered around 83 percent due to transforming its entire production technology to power efficient and environment friendly Ion Exchange Membrane Plants. While gross margin remained more or less flat at over 16 percent, net margin inclined from 4.7 percent in FY17 to over 7 percent in the current period due to considerable support from other income. The latter was sourced from sales of scrap.

Revenue growth in FY19 stood at close to 16 percent with topline reaching Rs 6.6 billion. During the year, it commenced commercial production on its new cost-efficient plant IEM Plant-3. This is evident from the fact that cost of production reduced to a little over 79 percent of revenue. As a result, gross margin also increased to almost 21 percent. While this growth reflected in the operating margin, net margin on the other hand, was lower at 6.1 percent due to an escalation in finance expense that consumed almost 4 percent of revenue. This was due to a high mark-up rate.

In FY20, topline grew by an all-time high of over 33 percent to reach over Rs 8.8 billion in value terms. This was a result of including LABSA Plant in the company’s operations. But the higher topline did not result in higher profitability as gross margin fell to 13.3 percent. This was due to cost of production escalating close to 87 percent of revenue- the highest seen. The high cost of production was a result of high RLNG/LESCO Tariff Rates in addition to the general inflationary pressures. Furthermore, finance expense continued its upward movement, consuming over 5 percent of revenue. Thus, net margin was recorded at an all-time low of less than 1 percent, and bottomline was also at its lowest of Rs 61 million.

Revenue in FY21 registered a growth of over 25 percent to reach its peak at Rs 11 billion in value terms. This was largely attributed to a product line extension as LABSA sales made a significant contribution. The higher topline reflected in the gross margin as well that was recorded at an improved almost 17 percent, as cost of production made a lower share in revenue at 83 percent. With finance expense also reducing, net margin grew to 5.9 percent for the year.

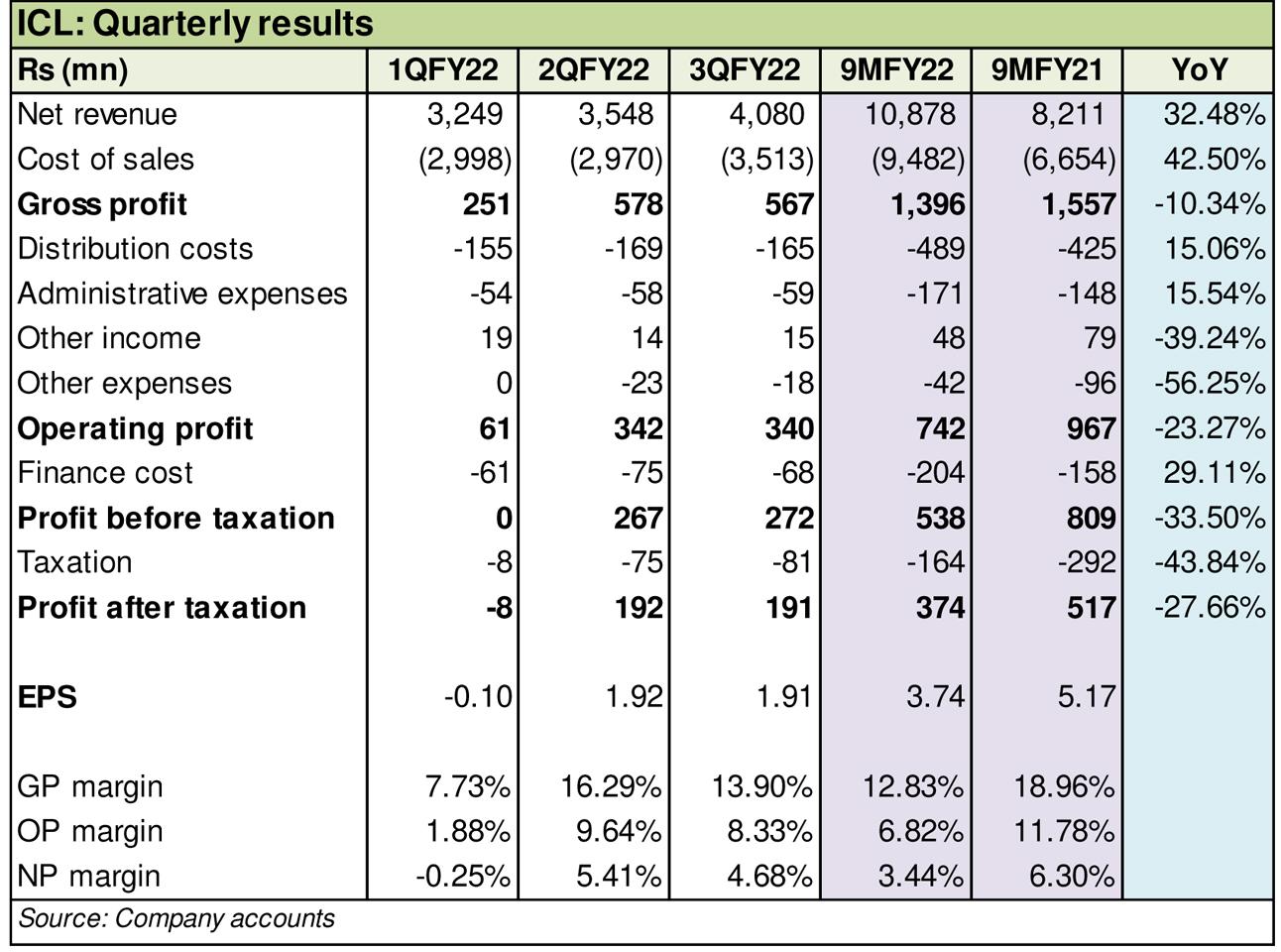

Quarterly results and future outlook

Revenue in the first quarter of FY22 was higher by over 35 percent year on year. However, significantly higher cost of production shrunk profit margins as evident by the loss incurred for the period of Rs 8.5 billion. The higher cost of production that consumed over 92 percent of revenueis attributed to rising energy costs.The second quarter also higher revenue year on year, by over 22 percent. Similar trend followed as cost of production was higher at nearly 84 percent of revenue, versus over 78 percent in 2QFY21. Thus, net margin was also lower at 5.4 percent compared to 8.8 percent in the same period last year. However, profitability was better in 2QFY22 compared to the previous quarter 1QFY22 due to better demand and prices of the company’s products.

The third quarter saw revenue higher by nearly 40 percent year on year. However, there was a marginal decline in production cost as a share in revenue at 86 percent that allowed gross margin to increase to a similar extent. Net margin was further up at 4.7 percent, compared to 3 percent in 3QFY21, as operating expenses made a smaller share in revenue. The rise in policy rate is expected to increase in finance expense. Additionally, the upcoming quarters may benefit from capacity enhancement of LABSA/SLES Plant and upgradation of power plant engines that are expected to be fuel-efficient.

Comments

Comments are closed.