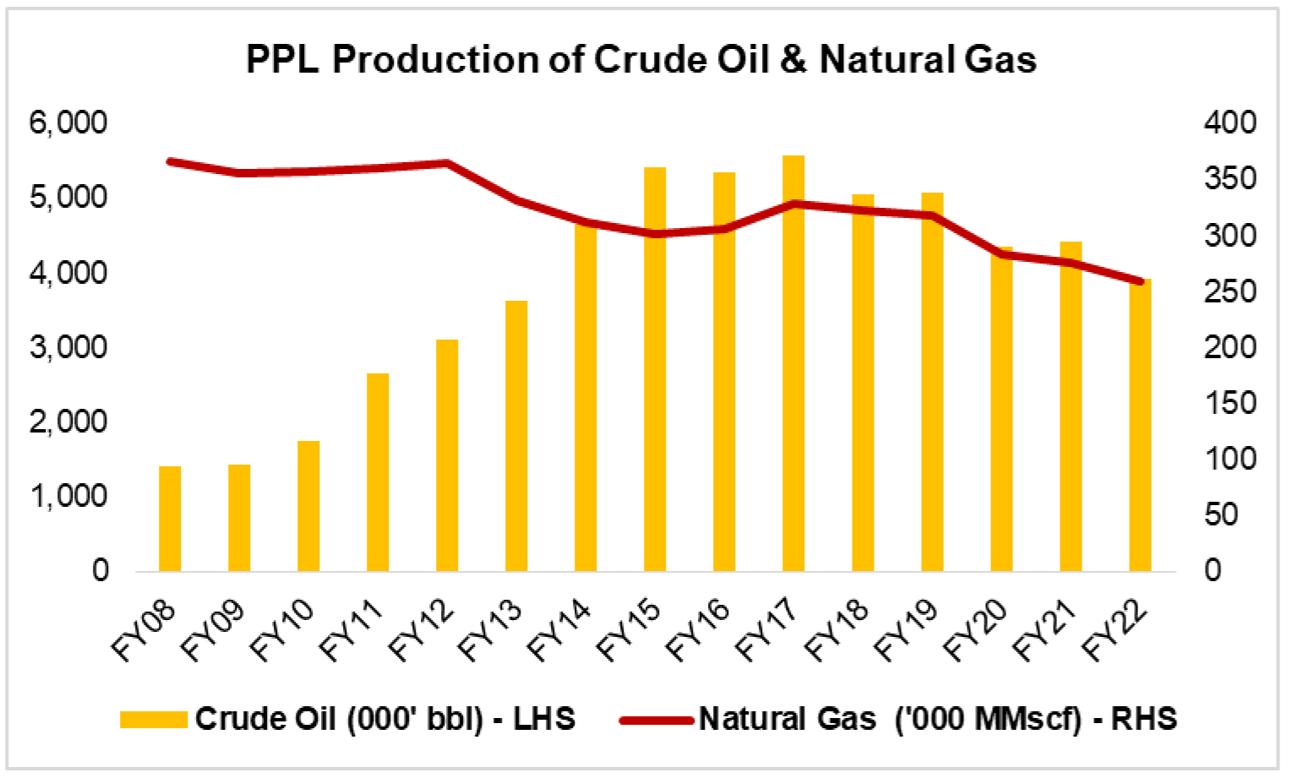

Oil and gas production in the country has been under pressure for quite some time now and the oil and gas exploration and production companies havecontinued to report falling volumesyear-on-year,which has primarilybeen due to depleting hydrocarbon reserves in the country along with small findsand discoveries despite aggressive drilling activities by the industry giants. Pakistan Petroleum Limited (PSX: PPL), an aggressive E&P player has too seen its volumetric sales slide. The company in itsrecently announced financial performance on the bourses, posted decline in the crude oil and natural gas production for FY22. The decline is estimated tobe around six percent for natural gas and 11 percent for crude oil year-on-year in FY22.

However, the company’srevenues grew by over 36 percent year-on-year, which was primarily due to whopping increase in international oil prices as well as increase in Sui gas wellhead prices. These are estimated to have increased by over 70 percent and over 15 percent year-on-year, respectively during FY22. Along with higher prices, PPL’s revenues also benefited from significant currency depreciation. with no noticeable increase in the operating costs , PPL’s gross profits jumped by 53 percent year-on-year, while gross margins were up from 58 percent inFY21 to 65 percent in FY22.

Despite more than twice increase in exploration and prospectingexpenses, the company’s profit before tax rose by 43 percent year-on-year. The rise in exploration expenses was due to surge in cost of dry wells during the year. The rise on exploration expense was accompanies by higher other expense and share of loss from associated in 2022. PPL incurred loss from its associate, Pakistan International Oil Limited during the year. Though the company’s profit before tax depicted noticeable growth in earnings, PPL’s bottomline grew only by two percent year-on-year due to the imposition of super tax.

Comments

Comments are closed.