Colgate-Palmolive (Pakistan) Limited

Colgate-Palmolive Pakistan Limited (PSX: COLG) was set up in 1977 as a public limited company by the name “National Detergents Limited”. It was renamed to what it is now in 1990 when it entered a Participation Agreement with Colgate-Palmolive Company, USA. The company manufactures and sells detergents, personal care and other related products.

Shareholding pattern

As at June 30, 2022, 59 percent shares are held under the associated companies, undertakings and related parties. Majority of the shares are owned by SIZA (Private) Limited and SIZA Services (Private) Limited. Over 35 percent shares are held under the category of “others” followed by 4.5 percent shares owned by the directors, CEO, their spouses and minor children. Within the latter, the chairman Mr. Iqbal Ali Lakhani is a major shareholder. The remaining 1 percent shares is with the rest of the shareholder categories.

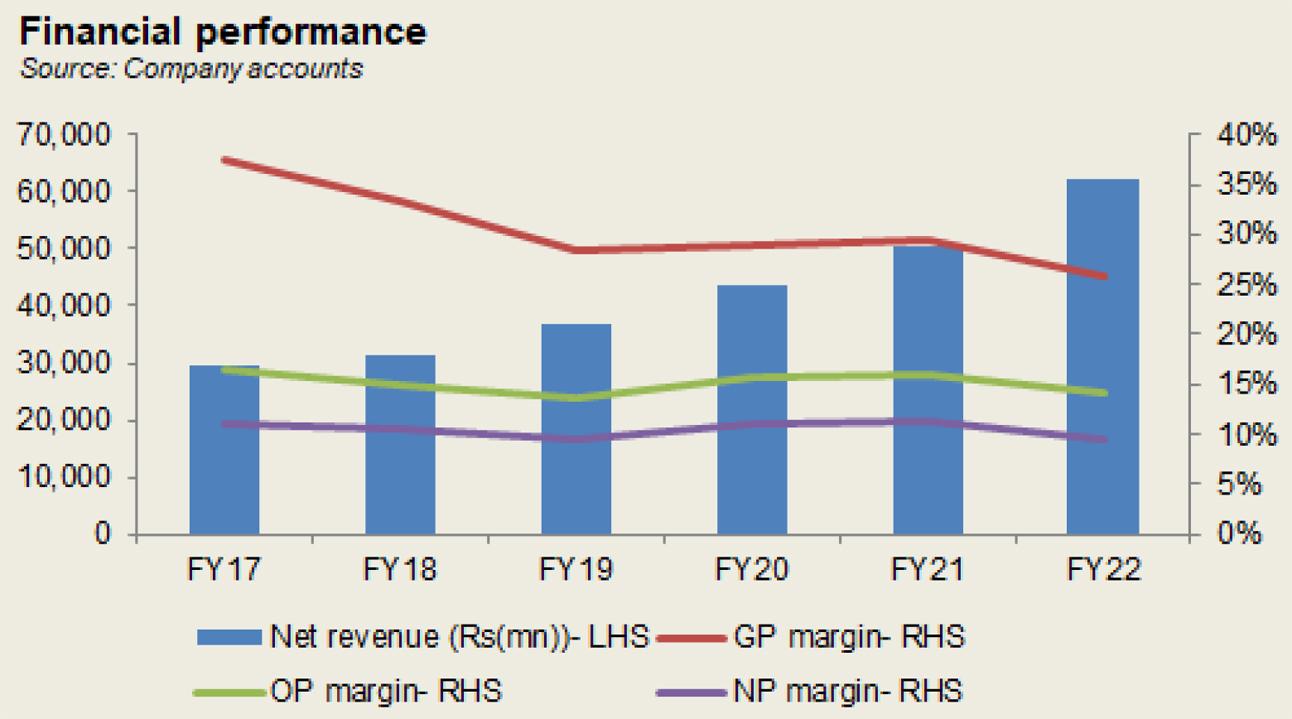

Historical operational performance

The company has consistently experienced a growing topline over the years. While operating and net margins have more or less remained stable, gross margin has seen a slight decline between FY17 and FY22.

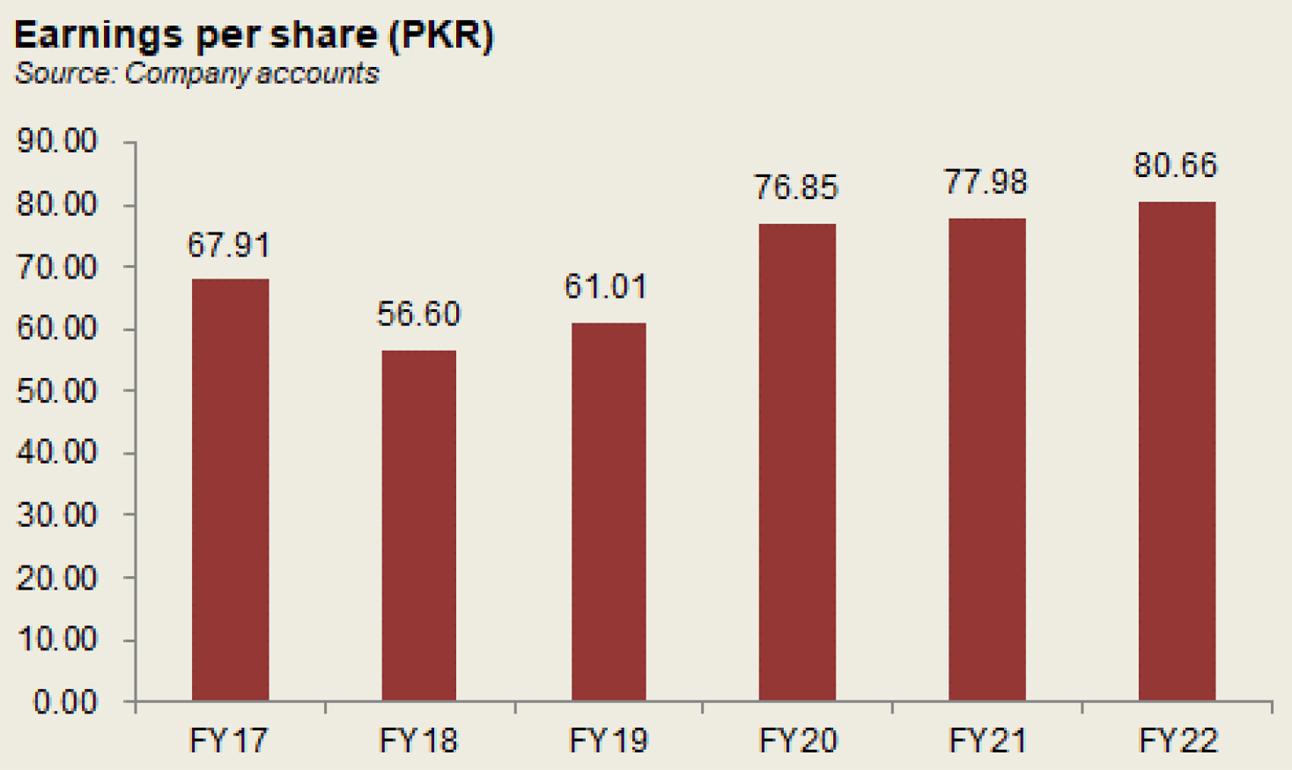

Revenue growth in FY18 stood at 6.6 percent to cross Rs 31 billion in value terms. Oral care was a major contributor to total revenue, however, personal care division also exhibited double-digit growth, especially in the shampoo and soap bars category. There was significant competition in the detergent powder category with the entry of a number of local players that spent considerably on media and promotions. However, the higher topline did not translate into a higher gross margin as cost of production increased to nearly 67 percent of revenue, versus 62.5 percent in FY17, due to currency devaluation. In addition, international oil prices created an adverse impact on gross margins. But net margin, recorded at 10.4 percent, did not fall drastically as distribution expense reduced as a share in revenue.

In FY19, revenue increased by over 18 percent to reach close to Rs 37 billion as a result of a rise in selling prices as well as sales volumes. The company saw an increase in its market share in the Oral care category, whereas local production of Palmolive shampoo also helped profitability. On the other hand, the fabric care category faced competition from the unorganized sector. But with continuous currency depreciation and a rise in global commodity prices, profitability could not be raised as net margin was recorded at a lower 9.5 percent for the year.

The company remained on its growth trajectory in FY20 as it witnessed a rise of nearly 18 percent toreach Rs 43.5 billion. This was again attributed to a rise in sales volumes and prices. In addition, the second half of the year saw the outbreak of the Covid-19 pandemic that led to strict lockdowns. As a result, the population resorted to panic buying for hygiene products that provided a further boost to the company’s sales. While cost of production was largely maintained that kept gross margin stable at around 29 percent, net margin improved to 11 percent due to considerably higher interest income that raised total other income.

In FY21 revenue grew by 16 percent to crossRs 50 billion in value terms as selling prices were adjusted and sales volumes increased. The company also made some changes to its product mixes to ensure improved profitability. Moreover, the company launched and relaunched a number of products, while in the low-price segment, the unorganized sector continued to give stiff competition to the company. With a marginal decline in production cost as a share in revenue, gross margin remained flat at around 29 percent. With little changes in other elements, net margin was also only slightly elevated at 11.23 percent for the year that was recorded at an all-time high, while bottomline stood at Rs 5.7 billion.

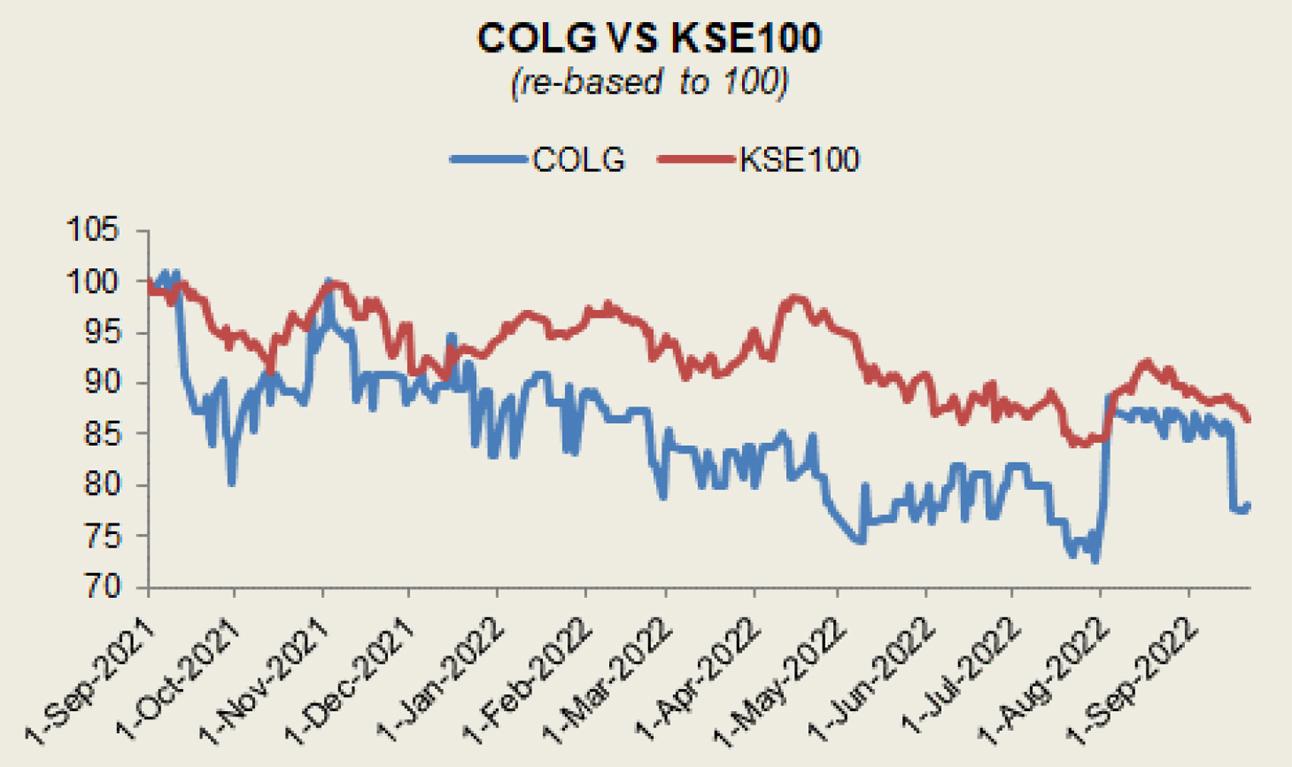

Recent results and future outlook

Topline witnessed the biggest growth in FY22 by over 23 percent to reach an all-time high of over Rs 62 million in value terms. This was partly attributed to a rise in selling prices. The soap bars and shampoo continued its growth momentum, but the toothpaste segment saw increases in raw material prices, while the home care category saw significant competition. However, the higher topline did not reflect in profitability as cost of production grew to its highest of over 74 percent causing gross margin to slide to 25.7 percent due to rising commodity prices, energy costs and currency depreciation.But, net margin that fell to 9.4 percent did not see a huge slump due to a decrease in operating expenses as a share in revenue. Additionally, other income, largely coming from dividend income, provided considerable support to the bottomline that reached a peak of Rs 5.8 billion.

While topline has been growing, maintaining and growing profit margins have remained a challenge as inflationary pressures have adversely impacted disposable incomes. Moreover, political instability and depleting foreign exchange reserves have also led to currency depreciation that further impacts profit margins for businesses.

Comments

Comments are closed.