Long steel makers are urging the SBP to cut interest rates urgently so that steel manufacturers slipping into financial troubles can hoist themselves up again. Said troubles have come about due to a slowing down economy, now worsened only by the devastating floods that have sent demand hurtling down. The steel industry joins several other industries that are having trouble keeping afloat though they may be better positioned to weather the storms. Cement is certainly one such industry. The outlook however is bleak.

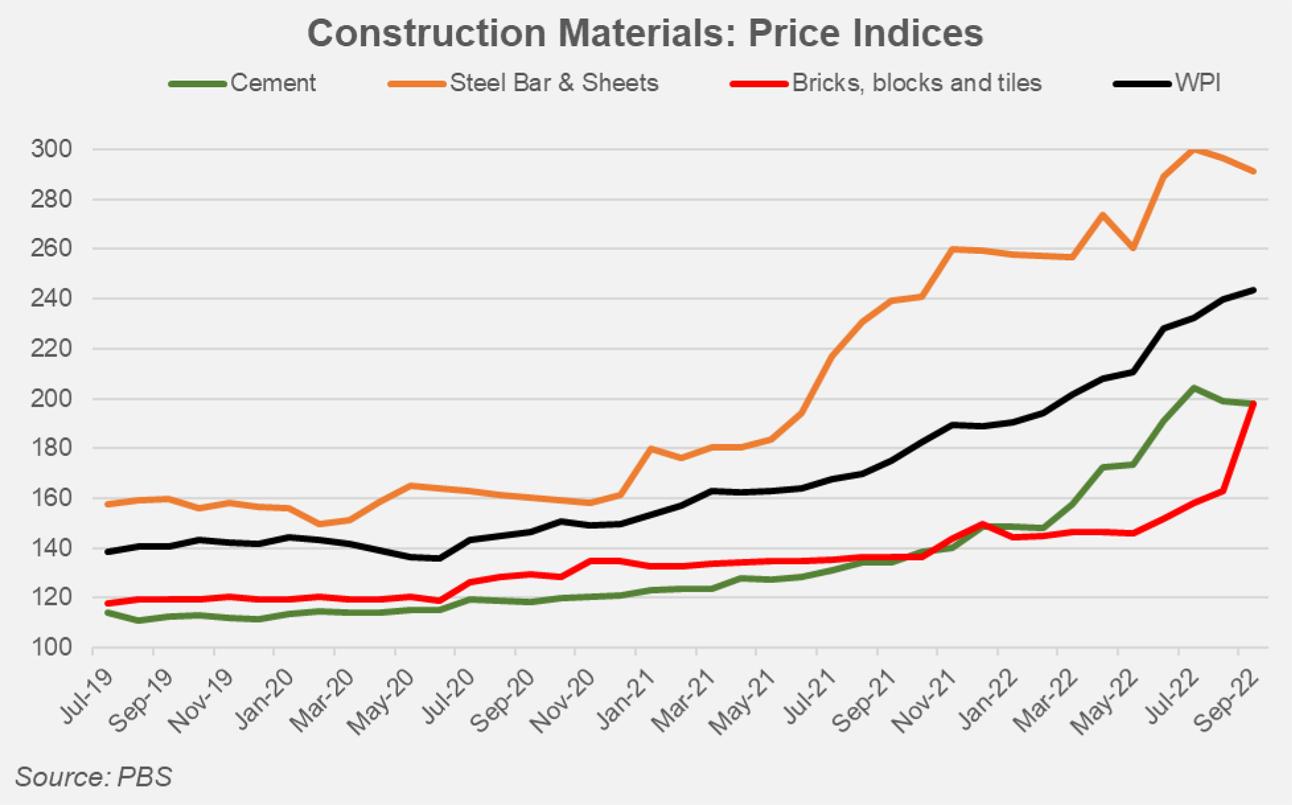

Steel and cement prices have had quite a rally over the past 20 months. Between Nov-20 till Jul-22, price indices for cement and steel bars rose 70 percent and 90 percent respectively. Comparatively, the wholesale price index during this period increased by 56 percent which is high but not as shocking as the key construction materials. One caveat here is that PBS seems to have clubbed steel bars (long steel) and steel sheets (flat steel) under one head which would complicate and may even mislead price analysis. Nevertheless, it is clear that both steel and cement have had quite a significant and frequent bump on their price tags owing mostly due to the rapid increase in their costs of production (coal and steel scrap prices along with energy and power costs have been rising). This has very evidently begun to affect demand. Both cement and steel billets are recording lower sales, hitting their lowest in Jul-22 since last year.

Both cement and steel prices are now showing signs of weakness but it may not be enough for demand revival. Inflationary pressures coupled with higher taxation are likely to force private sector participants—prospective homeowners, home renovators, builders, and constructors—to delay construction until they can absorb the surged costs. A reduction in development funding indicates lower demand forthcoming from the public sector. Having said that, funds from PSDP will be diverted toward rehabilitation and reconstruction of flood-affected areas which will boost demand temporarily for the construction industry. Meanwhile, the dream of the Naya Pakistan Housing Program remains that—a dream, a forgotten one at that. After hitting pause to it months ago, the SBP indicated that the Mera Pakistan Mera Ghar scheme that offered mark-up subsidy on mortgages would be revived—at some point, whenever that point may be.

For now, interest rates are too high—for consumers to take out home loans, for builders to take out business loans and for construction material manufacturers to safeguard net earnings, especially true for highly leveraged balance sheets.

Comments

Comments are closed.