FY23 has proving to be a weak year for oil sales by the oil marketing companies. Oil consumption has been fizzling out and the impact is visible in the OMC monthly sales and volumes. Starting with July-22, oil sales went down sharply followed by another weak month where Auguest-22 sales dipped by 22 percent year-on-year, and 2MFY23 oil sales down by 24 percent. And now with September-22 sales also down by 22 percent year-on-year, total OMC sales shrunk by 23 percent year-on-year.

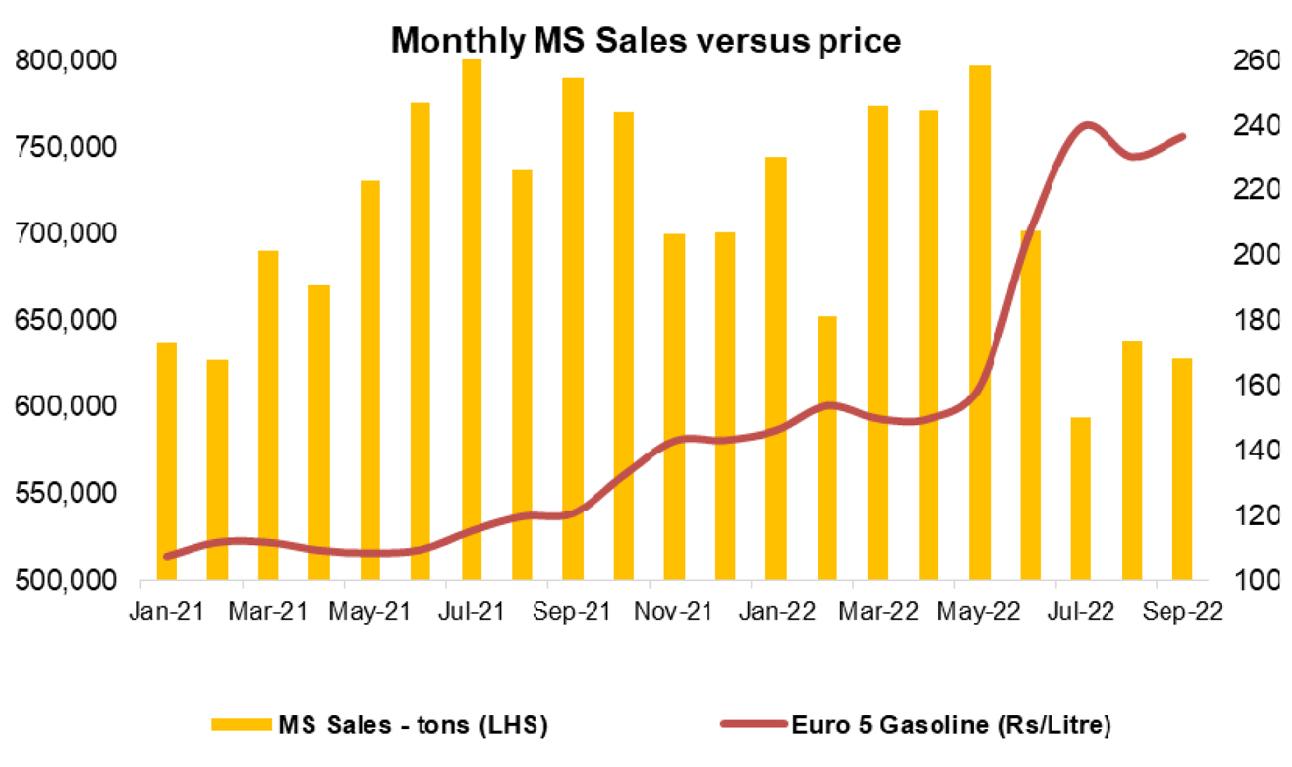

All demand and growth drivers are pointing down with oil consumption remaining below par. The decline in September volumetric sales for the OMCs has been due to floods in the previous month, which restricted mobility and transport massively; then there petroleum prices are too high albeit the recent decline announced. Increased rains increased the demand for hydel power generation, which also meant weaker furnace oil demand as seen in September as well. And as the overall demand subsides, automobile sales have seen a slump too, affecting the petroleum consumption in the country.

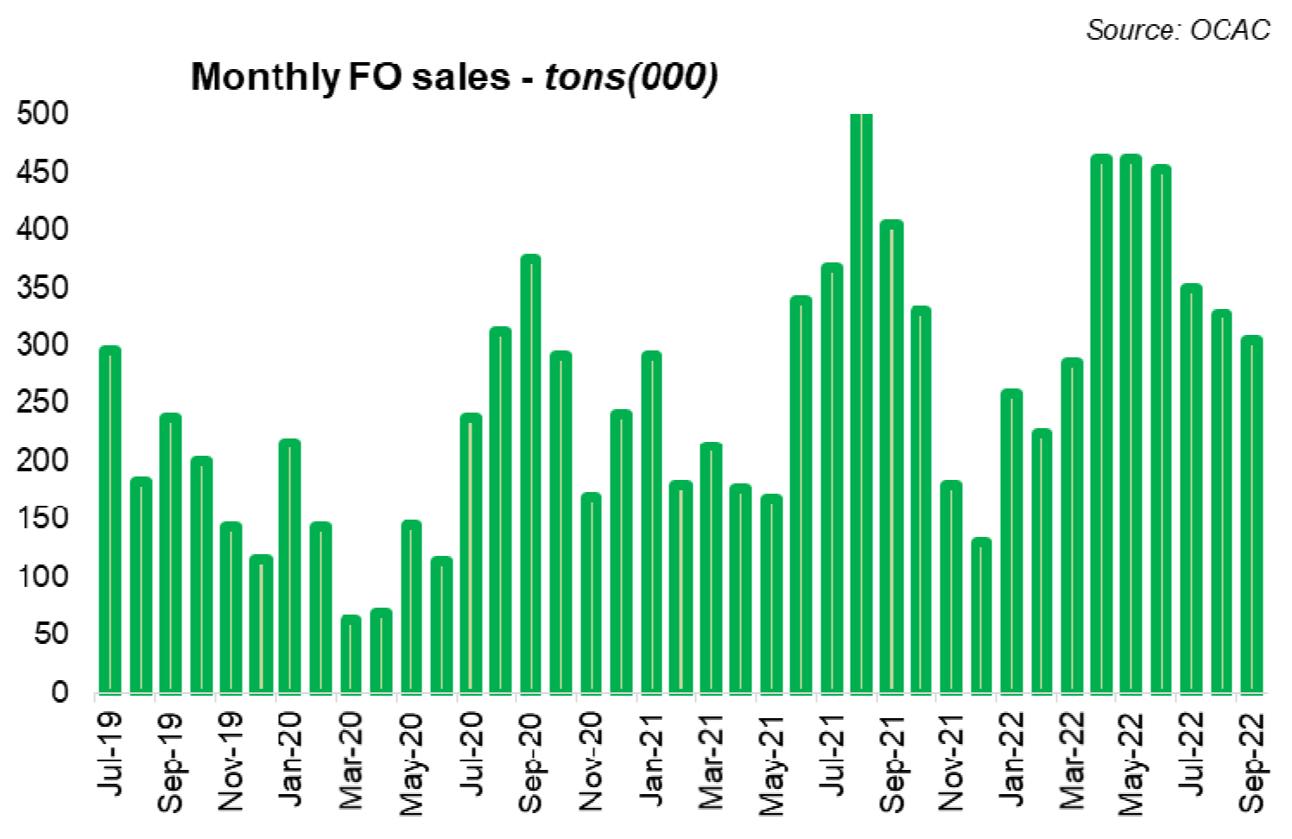

In September, all three key products registered doubled digit year-on-year decline. Motor Gasoline was down by 22 percent; High Speed diesel was lower by 26 percent year-on-year; and Furnace Oil volumes plunged by 25 percent year-on-year. Overall, MS sales were down by 21 percent, HSD by 30 percent; and FO by 23 percent.

Going forward, the petroleum demand in the country will continue to remain weak due to the ongoing political uncertainty leading to high inflation and significant economic slowdown. The Rabi season will be impacted by the climate catastrophe, which will affect the diesel volumes. The coming winter months can push up FO based power generation mid shortage of gas as well as RLNG. However, the high prices and affordability will likely impact overall consumption.

Comments

Comments are closed.