The market leader am-ong the mobile network operators (MNOs) seems to have had a mixed fortune in the most recent Jul-Sep quarter, as per the latest financial results released by Veon, which is the holding company of Pakistan Mobile Communications Limited (‘Jazz’). It was a tough three-month period for all MNOs weathering a combination of rising cost of services, exchange-rate volatility, higher taxes/tariffs, rising interest rates, and disruptions emanating from the latest natural disaster in the form of super floods.

During the three-month period ended September 30, 2022, on one hand the Jazz topline (total operating revenue)scored a healthy 12 percent year-on-year growth to reach Rs64.2 billion. On the other hand, the leading operator’s EBITDA (earnings before interest, taxes, depreciation and amortization) slipped during the same period by roughly7 percent year-on-year to Rs26.5 billion in 3QCY22, as operating cost presses remained elevated. Jazz’s capital expenditures declined 37 percent year-on-year to Rs6 billion.

The 12 percent topline growth was achieved mainly due to higher data revenues and subscription growth. This growth, which is still negative in real terms, could have been better had it not been for regulatory changes. “The increase in withholding tax from 10 percent to 15 percent on 16 January 2022 and further reduction in mobile termination rates from PKR 0.70last year to PKR 0.40 from 01 July 2022 were the key headwinds impacting revenue growth in the quarter,” the Veon report said about Pakistan operations.

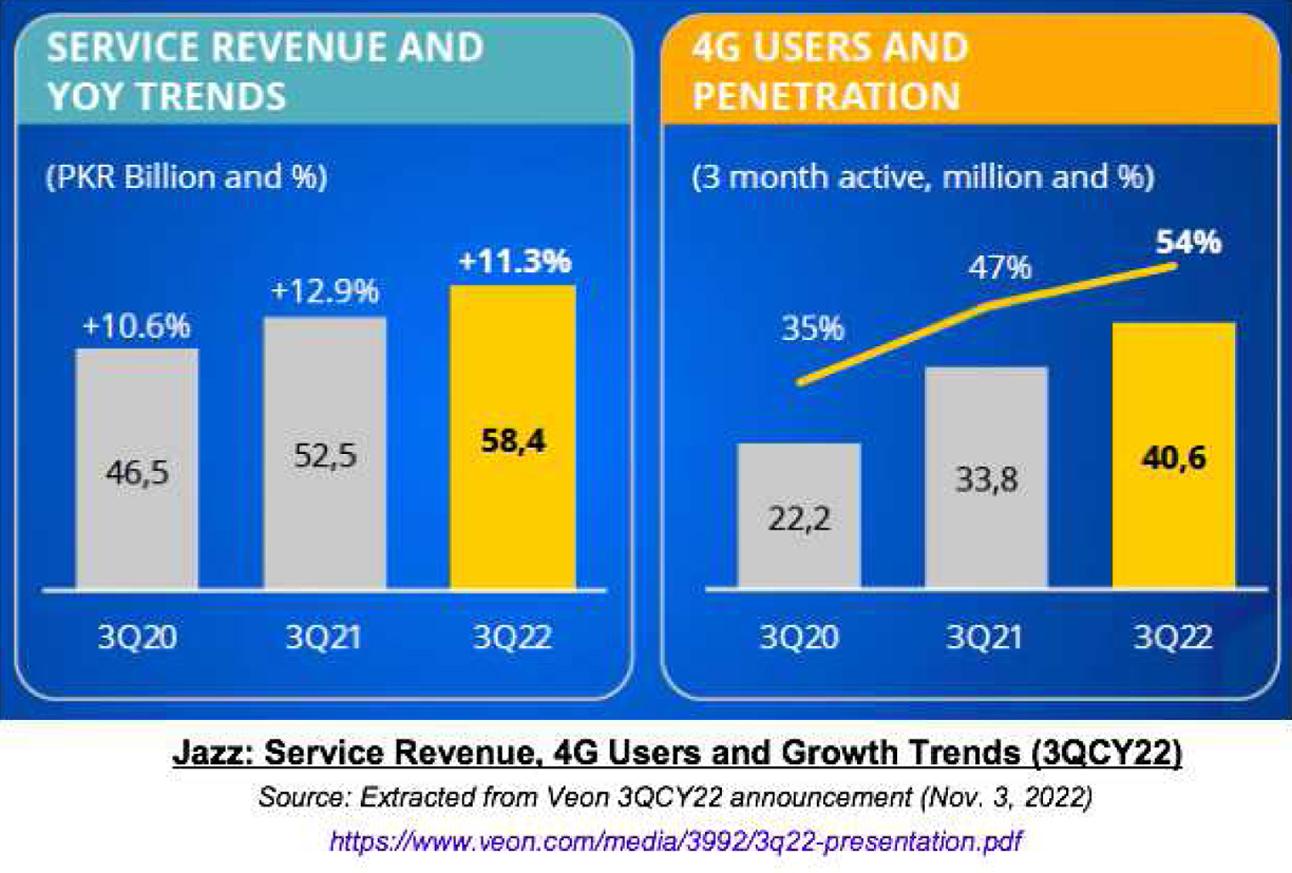

Within the topline, how did the promising revenue stream of mobile broadband (data revenues) fare? The report noted that Jazz data revenue grew at 20 percent year-on-year to reach Rs27 billion in 3QCY22. This was in line with the 20 percent growth in 4G users, reaching 40.6 million by September-end 2022 (a net addition of roughly 7 million 4G users since September-end 2021). Overall, the average revenue per user (ARPU) was 4 percent year-on-year better at Rs256 per month during the quarter under review.

It appears that there is a need to better monetize 4G user base. The report noted that Jazz 4G users constituted 54 percent of its overall customer base; but they contributed proportionally-lower 42 percent to the operator’s topline. In addition, the MNO’s 4G coverage stood at 57 percent of the country’s population at the end of September 2022, which was slightly higher than 55 percent seen in the same period last year. This could also be improved, especially by a large-sized operator. However, significantly scaling up 4G network for requires growing capital investments and macroeconomic stability.

Jazz’s EBITDA decline came about in 3QCY22 despite topline growth and “effective cost control”. Higher electricity tariffs and steep adjustments in prices of diesel and other fuels have impacted the earnings of all service providers. As a result, the Jazz EBITDA margin went down by over 8 percentage points to settle at 41.2 percent in the quarter under review. Overall, 9MCY22 EBITDA growth is still positive at 8 percent year-on-year to Rs84 billion. Let’s see what the final quarter has in store for Jazz.

Comments

Comments are closed.