Exide Pakistan Limited (PSX: EXIDE) was established as a private limited company in 1953. In 1982, it was listed on the Karachi Stock Exchange (now Pakistan Stock Exchange) and converted into a public limited company. It manufactures and sells batteries, chemicals, acid and solar energy solutions. Some of the company’s clients are Toyota, Honda, Suzuki, Audi, Mercedes-Benz, etc.

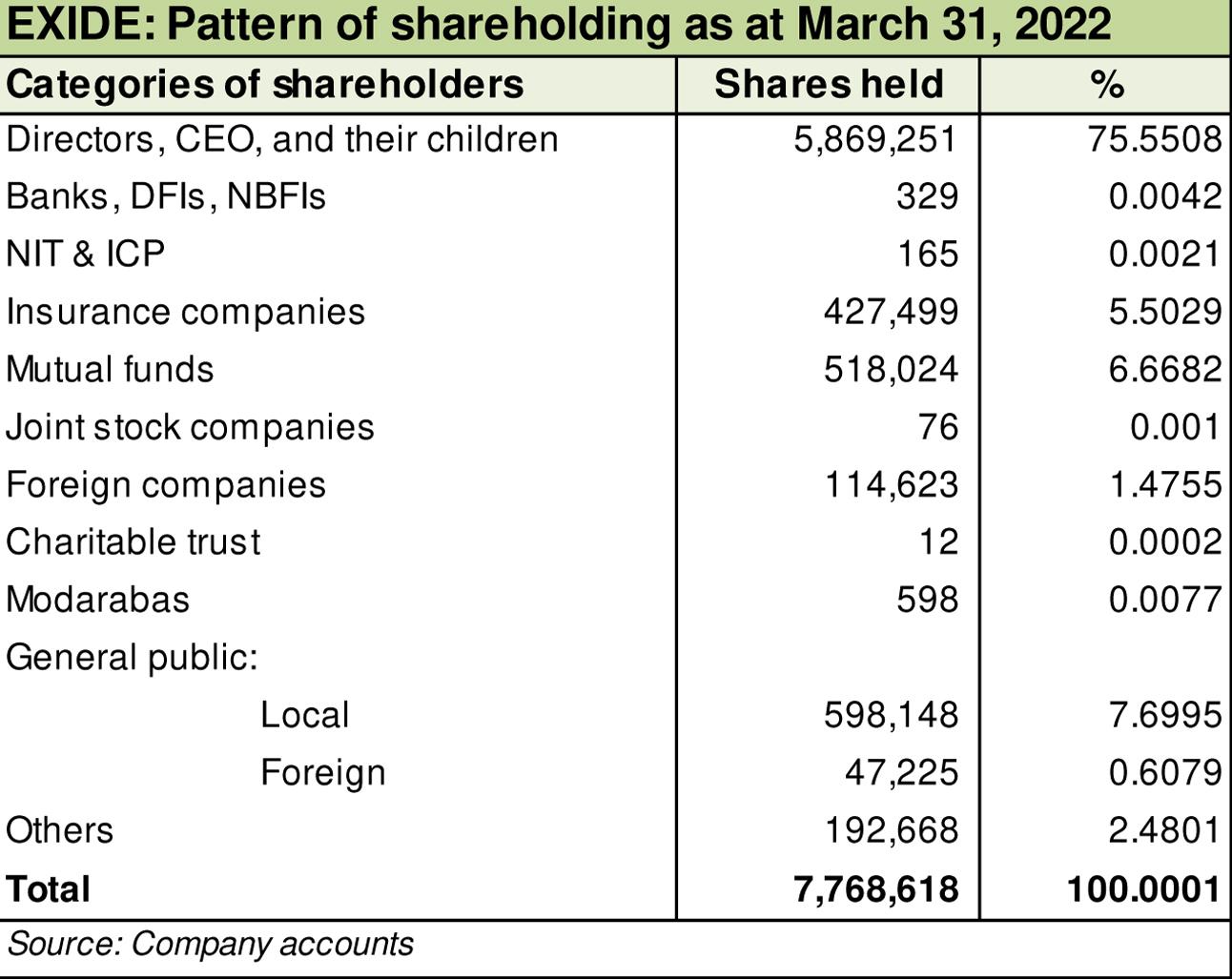

Shareholding pattern

As at March 31, 2022, the directors, CEO and their children own over 75 percent shares in the company. Within this the major shareholders are Ms. Sana Arif Hashwani and Mr. Zaver Hashwani. The local general public owns close to 8 percent shares, followed by over 6 percent and 5 percent held in mutual funds and insurance companies, respectively. The remaining about 5 percent shares are with the rest of the shareholder categories.

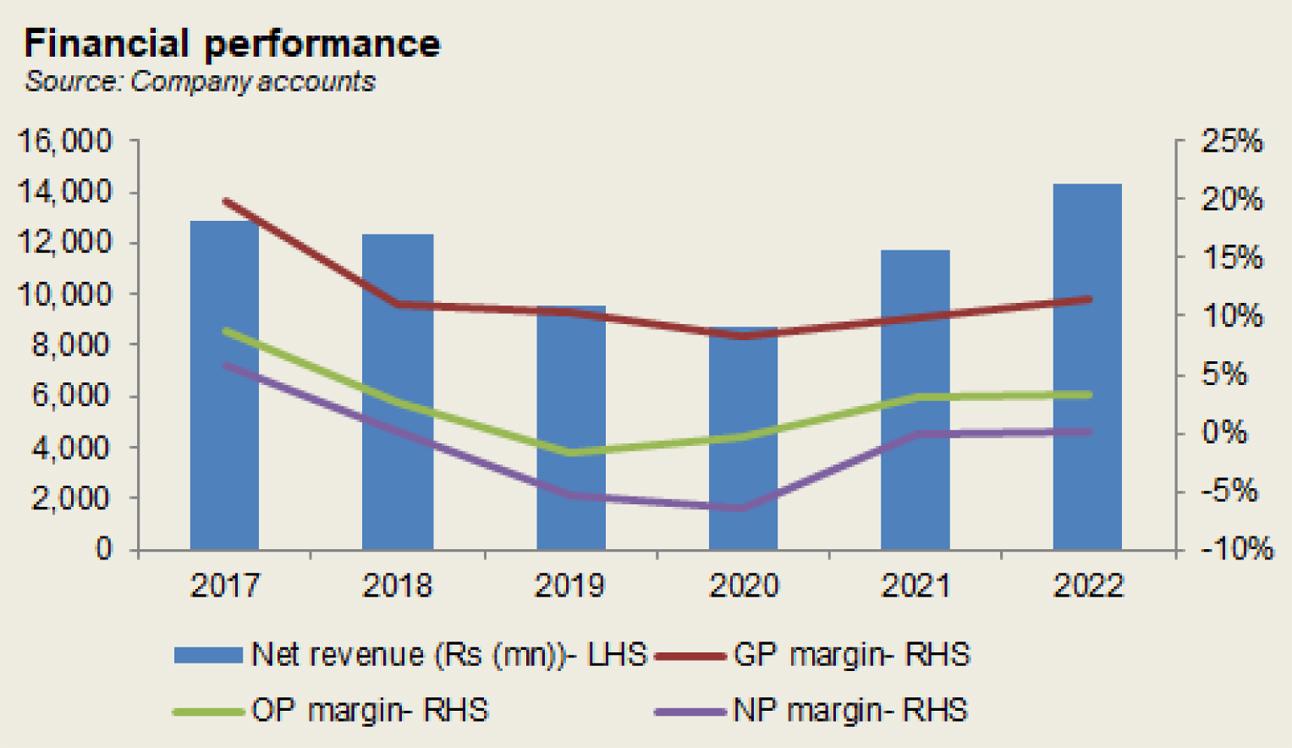

Historical operational performance

The company has mostly seen a growing topline, with the exception of a few years, while profit margins, in the last six years, have declined between 2017 and 2020, improved thereafter and remained more or less flat in 2022.

In 2019, topline contracted significantly, by almost 23 percent to fall to Rs 9.5 billion in value terms. This was a result of a decline in volumes, particularly in the batteries division. Generally, there was a decline in sales of locally produced cars, LTV, and jeeps by 7 percent, buses declined by 31 percent while farm tractor registered a 30 percent decrease. This was attributed to a restriction placed on non-filers for purchase of new vehicles. With cost of production nearing 90 percent of revenue, gross margin decreased to 10.2 percent. Coupled with an overall increase in operating and finance expenses as a share in revenue, the company eventually incurred a loss of Rs 505 million.

Revenue declined by over 8 percent in 2020 as decline in sales volumes in the batteries division continued. FY20 saw demand in the auto sector shrinking with escalated prices, imposition of taxes, rupee devaluation and increase in interest rates. The loss in revenue reflected in the gross margin that decreased to over 8 percent. Other income was abnormally higher due to gain on disposal of property, plant and equipment. This supported operating margin to an extent, but net margin reduced further to a negative 6.4 percent due to rising finance expense. Net loss grew to an even bigger Rs 559 million for the year.

In 2021, topline recovered as it posted a growth of over 34 percent to reach close to Rs 12 billion in value terms. This was attributed to a gain in volumes, and increase in prices. Demand also improved. The economy grew by 3.94 percent, with all the sectors seeing a recovery, a year after the Covid-19 pandemic. With better farm income, and lower interest rates, auto sales improved. However, production cost hovered around 90 percent of revenue that allowed gross margin to incline marginally to almost 10 percent. But with a decline in finance expense as a share in revenue, due to lower interest rates and borrowing, as well as some curtailment in distribution expense, net profit stood at nearly half a million for the year.

Topline growth continued in 2022 at over 22 percent with revenue crossing an all-time high of Rs 14 billion in value terms. This was again attributed to an improvement in demand, sales volumes and prices. Car sales increased by 51 percent, truck and buses by 52 percent and farm tractor sales by 51 percent. The higher revenue somewhat translated into higher gross margin. The latter was recorded at 11.4 percent. Finance and distribution expense increased slightly as a share in revenue, but the increase in topline offset the impact. Thus, net margin was recorded at less 1 percent with a bottomline of Rs 29 million, compared to net losses in 2019 and 2020 and nominal net profit in the previous year.

Quarterly results and future outlook

Revenue in the first quarter of MY23 was higher by over 19 percent year on year. This was largely attributed to an improvement in prices. Within the auto sector, car sales were higher by 55 percent, farm tractors by 16 percent, and truck and buses by 49 percent. For the company, production cost as a share in revenue increased slightly to 90 percent that reduced gross margin to 9.6 percent. Operating margin saw some support in the form of a prominent decrease in distribution expense as a share in revenue. However, the increase in net margin year on year was less pronounced due to a higher finance expense. Although in value terms, net profit was double year on year, from Rs 25 million in the same period last year to Rs 50 million in 1QMY23.

The organized battery industry is expected to face competition as industry capacity enhances, whereas profitability is expected to be trimmed down due to an increase in prices of raw materials, salaries, and currency devaluation that will have an adverse impact on the overall cost of production.

Comments

Comments are closed.