Gas load shedding during winters is not a new phenomenon in Pakistan anymore. So much is worked around the winter season in terms of industrial and power sector usage to keep the stoves and geysers at homes running – that it has now almost become acceptable. These winters may not necessarily be significantly worse in terms of gas load shedding, from how things have shaped up so far. That said, there is a lot in the dark in terms of LNG supply come the three months starting December.

With China inking the largest ever LNG deal with Qatar – there is not much in the market till at least 2026. The market observers assert that the LNG long-term contract market has no more room for anymore supply contracts for at least three years. The vessels hovering around Western shores are slowly but surely finding their turn to unload. All said, Europe has by and large ensured enough supply, even if the winter season is harsher than last year.

This does not mean the LNG becomes a bear market, because Europe remains the preferred destination and the spread between East and West has further increased, as Europe’s buying from Russia dips to new lows every passing day. The near certainty around long-term contracts does mean there will be stability in prices, given most deviation will come from the spot market.

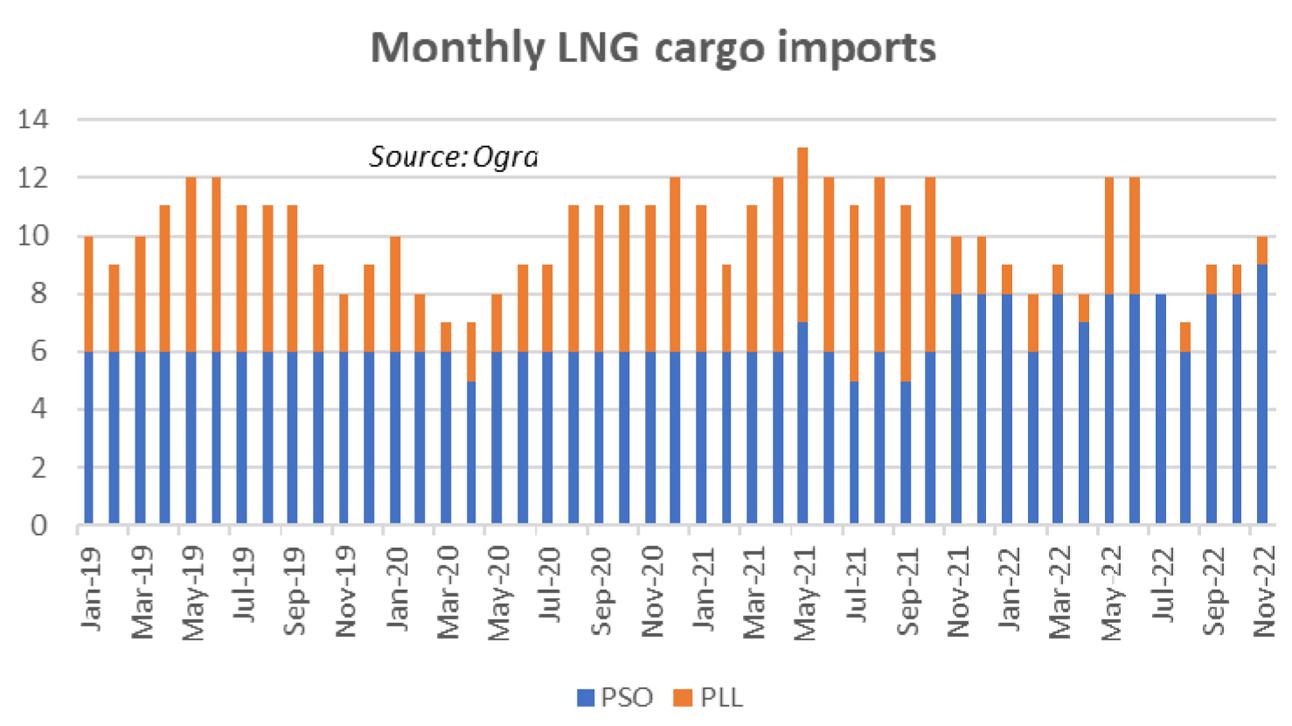

Pakistan managed 10 LNG cargoes for November price determination reference period – remaining unchanged from last year. What has changed is the composition, as Pakistan’s invitations to bids from the spot market have not received any takers for quite some time. The LNG import is almost entirely based on long-term contracts with various partners at different rates.

Last-minute cargo cancellations in the spot market have been far and few– unlike last year. But there is not much to be cancelled as Pakistan is relying mostly on supply from the state-owned contracts, which have a better record of being honored. Lower Brent prices are going to come handy as the Slope is based on trailing three-month Brent oil price average.

Average consumer RLNG price excluding GST for November has been worked out around $14/mmbtu – largely unchanged month-on-month and on a steady decline since June 2022. PSO contracts at 10.2 percent of Brent now make up nearly half of the long-term contracted supply, further lowering the average Delivered Ex-Ship Price.

The government has shown no indication to alter the strategy of keeping domestic sector at top priority. But the decision on weighted average gas pricing remains pending, despite written commitments with the IMF. Recall that the government had agreed on revising consumer gas prices by more than what has been prescribed by authorities. Gases prices may well have peaked, but availability will remain short of season’s demand.

Comments

Comments are closed.