Karam Ceramics Limited (PSX: KCL) was established in 1979 as a public limited company. It manufactures and sells tiles that are utilized for indoors, outdoors and for bathroom flooring. Some of its clients include Kidney Centre, Dolmen Mall, Saima Mall, Bahria Town, Karachi and Model Town, Lahore.

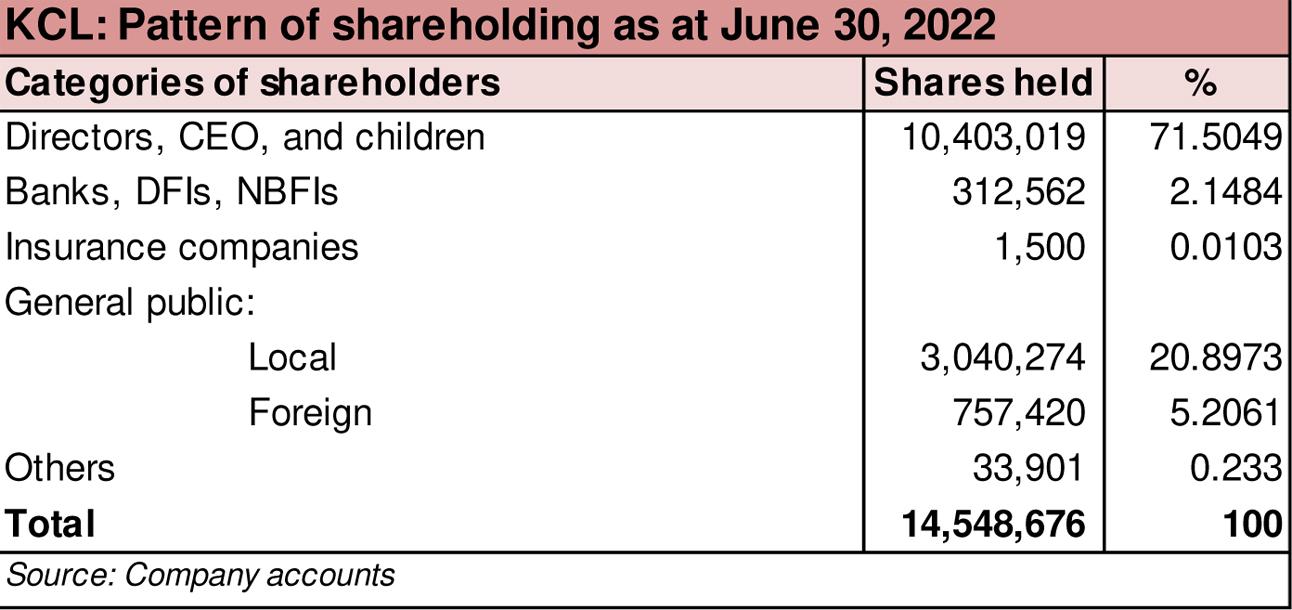

Shareholding pattern

As at June 30, 2022, over 71 percent shares are owned by the directors, CEO and children. Within this, Mr. Irshad Ali Shaban Ali Kassim and Mr. Munawar Ali Kassim are major shareholders. The local general public owns close to 21 percent shares while the remaining about 8 percent shares are with the rest of the shareholder categories.

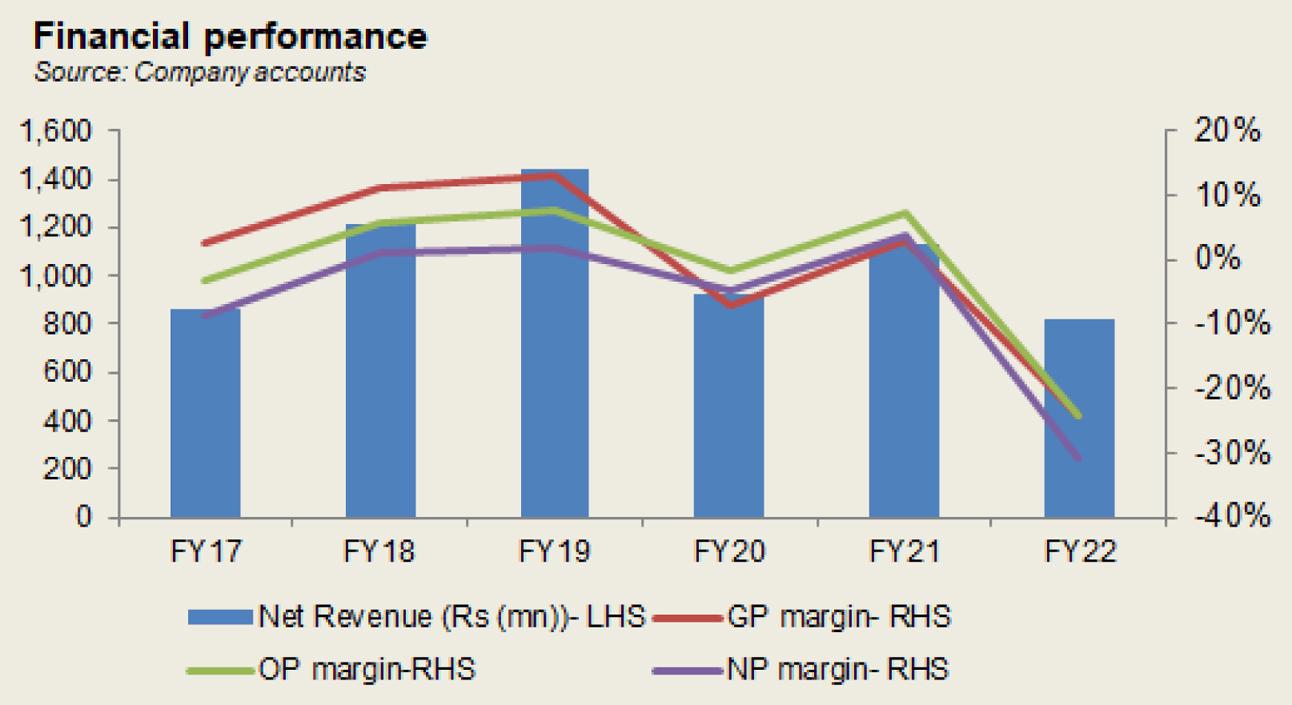

Historical operational performance

The company has seen a fluctuating topline over the years, while profit margins in the last years have largely followed a declining trend.

In FY18, topline increased by an all-time high growth rate of over 40 percent, to reach Rs 1.2 billion in value terms. This was a result of an improvement in selling prices as well as sales volumes. On the other hand, cost of production reduced drastically from over 97 percent of revenue in the previous year, to almost 89 percent in FY18 that allowed gross margin to increase to 11.2 percent. This also trickled to the bottomline that was recorded at Rs 14 million compared to net losses seen in the last two years.

Topline continued to grow in FY19, by almost 19 percent to reach an all-time high of Rs 1.4 billion in value terms. This was again attributed to an upward revision in prices, as well as an increase in sales volumes. This is reflected in the higher gross margin recorded at the highest at 13 percent. With decreases in other factors too, as a share in revenue, operating margin was also posted at its highest of nearly 8 percent. But increase in net margin was a little less pronounced due to a higher taxation figure. Net margin stood at 2 percent for the year, whereas the bottomline was recorded at a four-year high of Rs 29 million.

Revenue in FY20 witnessed the largest drop by over 35 percent. This was predominantly a result of the outbreak of the Covid-19 pandemic that led to strict lockdowns. The company resumed operations in end of May 2020, which resulted in loss of considerable sales and production days. However, fixed costs are unavoidable, therefore, the company incurred a gross loss of Rs 67 million. There was some support from other income that was unusually high at Rs 90 million, sourced from “present value adjustment on modification of interest free loan from directors”. But with finance expense continuing to consume a larger share in revenue due to higher interest rates, net loss was recorded at the highest seen thus far, at Rs 44 million.

In FY21, topline recovered as it grew by over 21 percent to reach Rs 1.1 billion in value terms. This can be attributed to a resumption of business activities, and easing down of lockdowns that led to some growth in demand. Cost of production consumed nearly 97 percent of revenue that allowed some room for profitability as seen by a positive gross margin, albeit nominal, at 3 percent. “Present value adjustment on modification of interest free loan from directors” continued to support the bottomline, under the category of “other income”. Coupled with a reduction in operating expenses as a share in revenue, and a positive taxation figure, the company posted an all-time high net margin of 3.7 percent, and the highest bottomline figure of Rs 42 million.

Recent results and future outlook

Topline in FY22 contracted by over 27 percent, falling to an all-time low of Rs 818 million in value terms. This was attributed to lower production. The latter is also seen in considerably lower capacity utilization that fell from over 36 percent in the previous year to 21.5 percent in the current period. In terms of units, actual production for the year was recorded at 1,392,304 compared to 2,357,994 representing a decrease of 41 percent year on year. Unable to cover costs with lower revenue, the company incurred a gross loss of a notable Rs 198 million. With other income also halving in value terms, and operating and finance expenses incurred, net loss stood at an all-time high of Rs 252 million.

Until last year, the expectation was that with the rise in construction, that increased the demand for steel and cement then, there would also eventually be a demand generation for tiles. However, given the present political and economic scenario, construction and its related industries have been deeply and adversely impacted. This has been witnessed in the financials of FY22 whereby the company incurred the biggest loss seen since FY10. With considerable inflationary pressures and significant uncertainty on the political front, demand for the company’s products also seems uncertain.

Comments

Comments are closed.