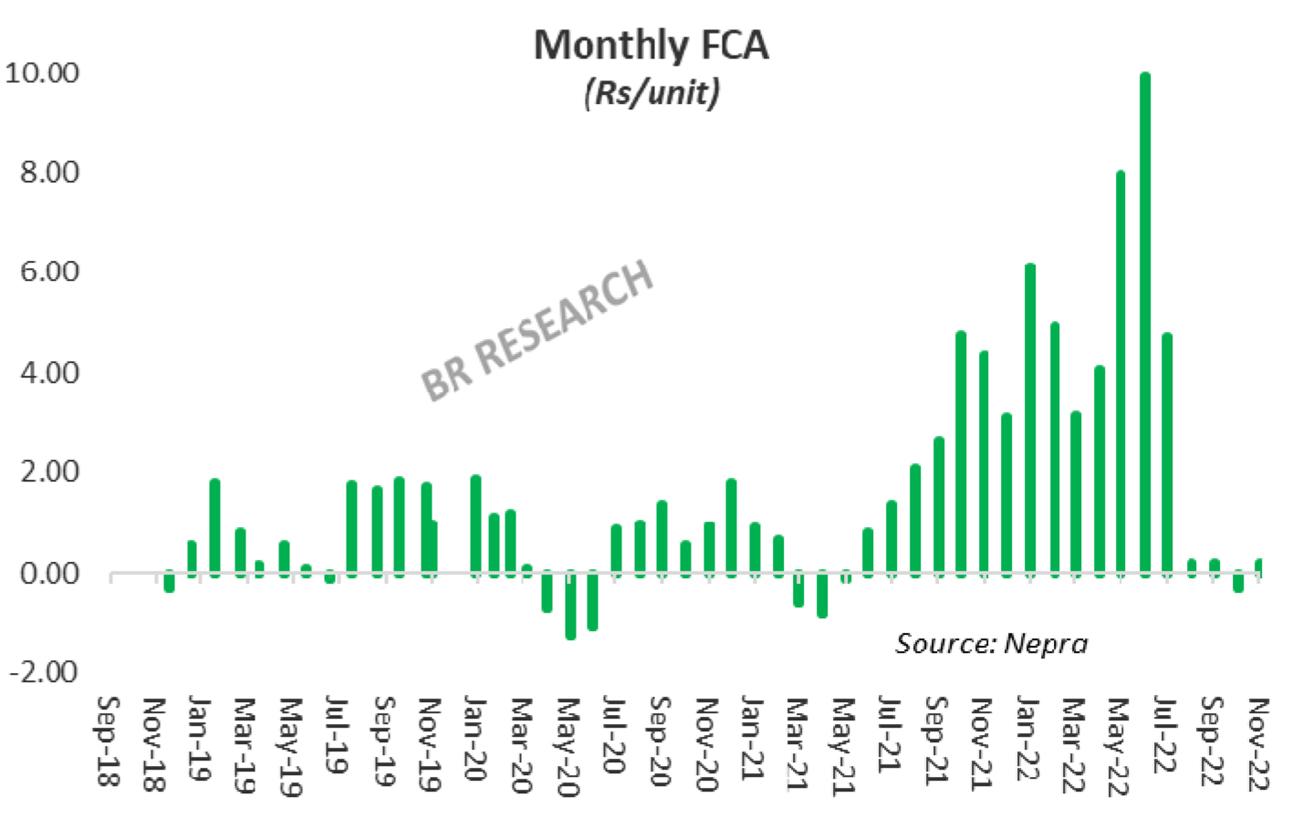

As power generation goes down due to a combination of reduced demand owing to the economic slowdown, high prices, and forced load management – the power generation mix seems much improved from the same period last year. The commodity prices too, have come down in the past few months, and reduced dependence on imported fuel, has led to four straight months of significantly low monthly Fuel Charges Adjustment.

The regulator has approved 19 paisas as monthly FCA for November 2022 to be collected in January 2023. This is also only the second time in over two years that monthly FCA year-on-year has come down in absolute terms. Monthly fuel cost at Rs6.27/unit is 22 percent lower year-on-year – mostly due to a significantly improved power generation mix as hydel and nuclear generation stepped up.

In yesteryears, the onus would generally fall on furnace oil, which was not the case this time around. In addition, increased generation capacity from Thar coal-based power plants has come online –evident from coal-based average unit cost – which is lower year-on-year, largely due to an increased share of local coal-based generation and not because of reduced international coal price.

All said one must not lose sight of the fact that the reference fuel tariffs have been revised upwards when the base tariff revision exercise was carried out. Reference fuel costs have increased by 70-100 percent from last year and reduced monthly FPA is a just outcome for most of the year.

The RLNG power plants are running at reduced output despite having an efficiency of over 65 percent. The regulator continues to point out the shortcomings as reduced LNG availability and transmission constraints continue to impact the system – leading to reduced load factors. Going forward, quarterly tariff adjustments are lined up which will keep the tariff higher year-on-year. The August FCA is still being collected from consumers at Rs1.65/unit spread over six months.

While consumers’ affordability has surely taken a massive hit – revised and rationalized prices will play their bit in controlling the incremental flow of circular debt. That said, reduced collection and deteriorating T&D losses remain the elephants in the room, and a failure to address them will keep the financial health of the entire sector critical.

Comments

Comments are closed.