In a grand display of what some would have found utterly petty and others totally justifiable, angry traders in a town hall meeting with the SBP presented what were presumably all the keys of the Karachi Chamber of Commerce and Industry (KCCI) to the governor of the State Bank; looking rather abashed. We cannot run the industries any longer, they said.

The independence (or lack thereof) of the SBP to make decisions relating to the currency, notwithstanding, businesses are indignant enough to express their sentiments on any occasion they can. As they should. Thousands of containers carrying imported goods—many of which are essential items such as food and medicines—are stuck at the Karachi port waiting to be cleared.

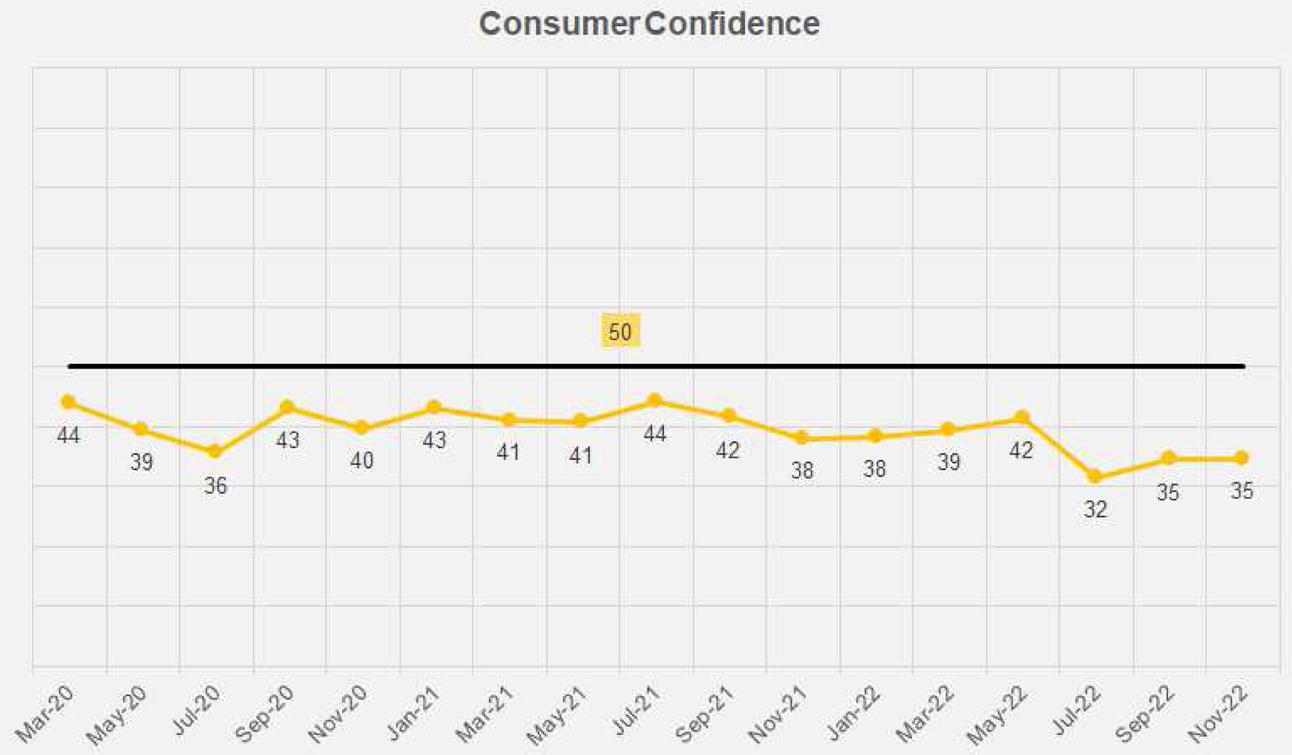

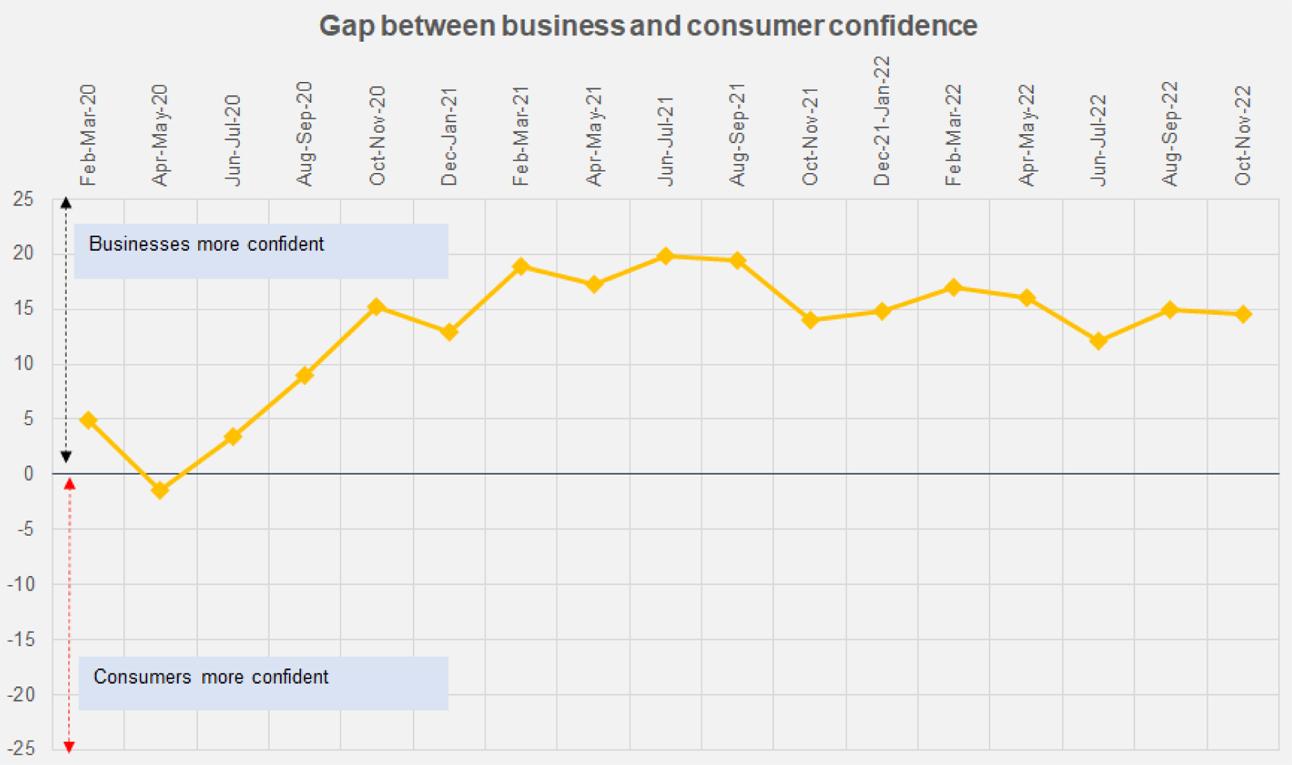

Perhaps, for the first time in recent history, businesses and consumers, both are feeling exactly the same. Unhappy! Latest surveys for SBP’s business and consumer confidence are not out yet but numbers will likely be bleeding red in the upcoming round on Dec-22 when both businesses and consumers express their true feelings about the economy. Unanimously.

As much as businesses decry the general high cost of energy and doing business in Pakistan, their pessimism has never been as high as consumers sitting at home—based on the readings of the SBP’s two confidence surveys. At least over the past two years, except for a brief period during covid when businesses were facing factory shutdowns amid nationwide lockdown, businesses have remained most confident about the economic conditions, always expecting a rosier sky over the next few months. Even during that period, many industries enjoyed exemptions for lockdowns allowing them to keep operating their plants.

A quick injection of funds, affordable financing, and demand reboot caused industries to quickly get back on track post-covid and remain mostly on track during the pandemic. Last year, big industries such as automotive and cement turned considerable profits. Consumers however faced job losses, and salary cuts, all the while incurring a high medical expenditure with no social safety nets available during covid. Soon enough though, the commodity super cycle, negligent decisions made by the government at critical junctions, and head-spinning political instability had the economy back in the trenches fighting a war it has never quite won—inflation, the balance of payment crisis, currency depreciation. Over the past year, inflation has become an untamed monster forcing purchasing power to erode tremendously, while the ongoing currency crisis has the economy down on its knees and on the verge of default.

Businesses are not happy. Larger businesses perhaps can survive for a bit longer, but without orders, smaller businesses are shutting down shop. This will blow back to consumers who rely on their incomes to put food on the table. In the last business confidence survey conducted in Oct-22, the employment index saw a slight downtick (under the threshold of “50” implying pessimism). The upcoming wave in Dec-22 will conceivably deliver more bad news yet.

Comments

Comments are closed.