The lull for foreign direct investment is stretching with continued political uncertainty and the disastrous economy. Not that FDI was pouring into the country prior to the last nine month-period; but why would foreign investors be interested in a country that has been on the brink of default?

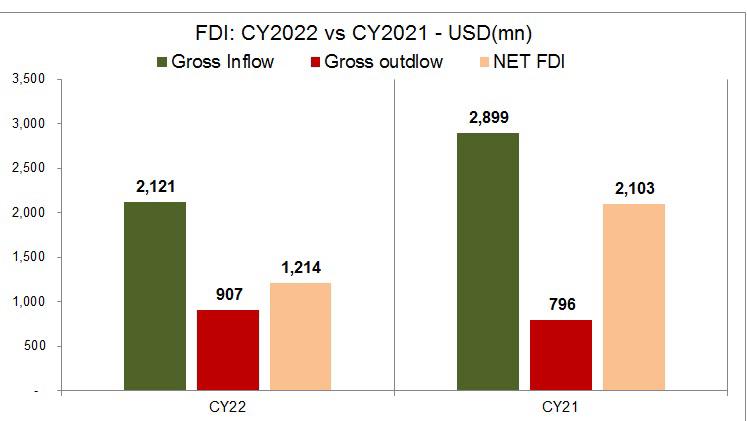

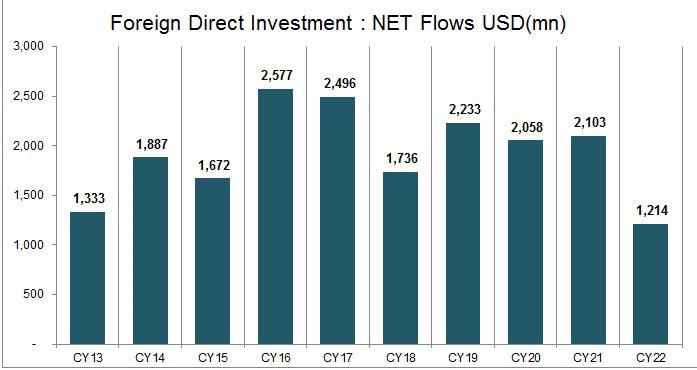

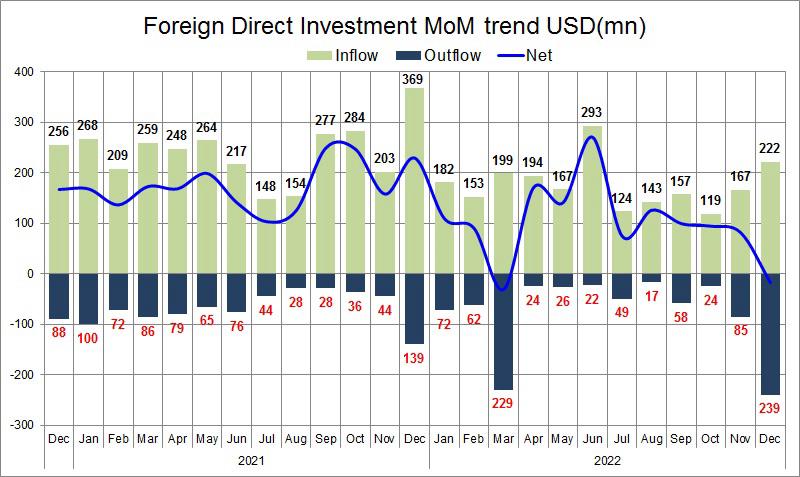

As per SBP’s recently announced data, FDI in Pakistan in December 2022 turned negative with a net outflow of $17 million. Month-on-month as well there was a decline into negative territory. Overall foreign direct investment into the country continues to remain on a downward trajectory and it fell by 59 percent during the first half of FY23 to only $461 million. On a calendar year basis, FDI in 2022 was at least the lowest in the last decade with $1.2 billion in net flows.

This trend of lower inflows and higher outflows has continued its way into FY23; rather intensified as the political temperature remains high amid economic instability. The net outflow of December 2022 came from the outflow from Australia, Norway, the United States, and the UK. Even in the overall picture, the inflows weakened in 1HFY23 while outflows increased during the period. With weaker inflows and increased outflows, the overall story remains the same. It is obvious that FDI in the country has continued to be concentrated in the traditional sectors; not only that, the amounts have remained small. A key factor of weakness has also been the inflows from China; the fall in the CPEC investment from China has also largely contributed to the decline in FDI during FY22 and 1HFY23.

Sector-wise again, the power sector was the top sector in terms of attracting FDI in 1HFY23.however, the overall power sector investment flows were down by over 45 percent year-on-year.

FDI is most likely to remain weak and fragile in FY23 due to the ongoing economic volatility as well as the year being an election year where any recuperation will likely depend on the change in the economic climate and political environment.

Comments

Comments are closed.