Abbott Laboratories Pakistan Limited

Abbott is a multinational healthcare company engaged in providing efficient and life-changing medical technologies and services across the globe. Abbott Laboratories Pakistan Limited (PSX: ABOT) was set up as a publicly listed company in Pakistan in 1948. The company manufactures, imports, and markets pharmaceutical, diagnostic, nutritional, diabetic care hospitals, and consumer products. The company has its home office and manufacturing facilities in Karachi and its sales offices in Lahore, Peshawar, and Rawalpindi. The company also has distribution depots in Islamabad, Lahore and Multan.

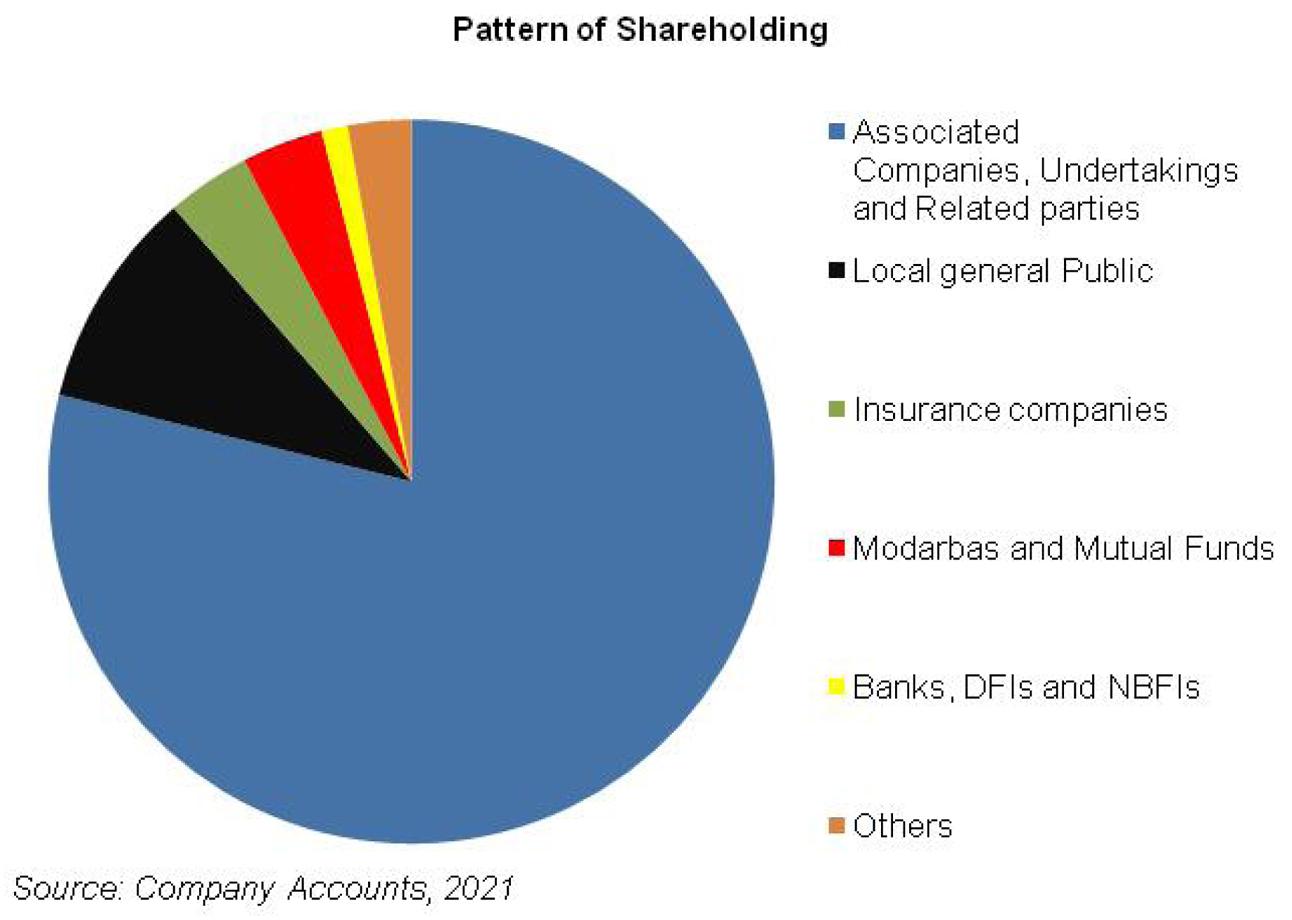

Pattern of Shareholding

As of December 31, 2021, ABOT has 97.9 million shares outstanding which are held by 2,548 diverse shareholders. Associated Companies, Undertakings, and Related parties hold the biggest chunk of the company’s shares i.e. 78.85 percent. Under this category, M/S Abbott Asia Limited dominates with over 76 million shares. Local General Public grabs the next spot with ownership of 9.77 percent of ABOT’s shares. This is followed by Insurance companies and Modarbas and Mutual Funds with a stake of 3.75 percent and 3.63 percent respectively in ABOT. Banks, Development Finance Institutions, and Non-Banking Finance Institutions hold 1.17 percent of the company’s shares. The rest is held by other categories of shareholders.

Historical Performance (CY17-21)

While the other sectors of the economy would have definitely given a moan of despair in CY20 when the global pandemic hit and their operational activities were badly impeded, it was the other way around for the pharmaceutical sector. The historical performance of ABOT speaks volumes of the merry times it enjoyed in CY20. The margins of the company that had been shrinking since CY18 rebounded in CY20 with its NP margin reaching 13 percent in CY20 vis-à-vis 4 percent in the previous year.

In CY20, the company bagged a hefty topline growth of 17 percent year-on-year. The growth was mainly supported by the nutritional segment of the company which majorly comprises of adult nutritional supplements. While export sales couldn’t gain momentum during the year might be due to supply chain bottlenecks amidst lockdown and restrictions on the movement of people and goods, local sales attained massive growth during the year. GP margin of the company flew from 28 percent in CY19 to 34 percent in CY20 mainly on the back of improved prices as well as elevated sales volumes in the nutritional segment followed by the pharmaceutical segment. Operating expenses took a nosedive in CY20 owing to fewer travel costs and promotional activities. Other expenses increased on the heels of the workers’ profit participation fund, workers’ welfare fund, and central research fund, but to set this off, other income exponentially grew mainly on account of liabilities written back by Abbott B.V. Netherlands. Hence, operating income grew by 1.47 times during the year. It is to be noted that the finance cost multiplied despite the low discount rate backdrop. While the company is sufficiently liquid and doesn’t require short-term or long-term financing facilities, finance costs grew on account of markup on lease liabilities recognized for business and vehicles. The bottom line burgeoned by 2.49 times in CY20.

Just a year ago, ABOT wasn’t doing this good. Sales had grown by a meager 1.5 percent year-on-year in CY19 with GP margin standing at 28 percent versus 33 percent in the yesteryear owing to inflation and devaluation of the Pak Rupee. Operating expenses couldn’t be contained either owing to greater travel charges and promotional activities. Other expenses showed some respite mainly due to better management of exchange loss. Other income also dropped due to a decline in income from savings and deposit accounts. Finance costs also hit the bottom line hard due to an increase in discount rates during the year coupled with an increase in lease liabilities. The bottom line couldn’t help but shrink by 52 percent year-on-year in CY19.

After the company achieved new highs in CY20, it continued to follow a growth trajectory in CY21. The topline boasted a year-on-year growth of 21 percent in CY21 mainly on account of diagnostic sales which multiplied by 75.9 percent due to Covid testing and increased OPD activities. General Health Care and Diabetic Care segment also shored up the topline by attaining a growth of 60.8 percent. These two segments were followed by the nutritional and pharmaceutical sectors bagging a year-on-year growth of 17.7 percent and 15.5 percent respectively in CY21. Better products mix and upward price adjustments played their due role in keeping the margins buoyant during CY21. GP margin touched the 38 percent mark in CY21 as against 34 percent in CY20. Operating expenses which were muted during the Covid period rebounded in CY21 on account of increased promotional drives and travel charges. Then Pak Rupee Depreciation and ABOT’s dependence on imported raw materials and finished goods marred it in terms of exchange loss which along with other factors shored the “other expense” up. The bottom line could still post a healthy year-on-year growth of 32 percent in CY21 culminating in an NP margin of 14 percent as against 13 percent in CY20.

Recent Performance (9MCY22)

Net sales of the company continued to achieve new heights during 9MCY22 by boasting a year-on-year growth of 18 percent. The growth mainly came on the back of the nutritional and pharmaceutical segments. GP margin, however, shrank owing to inflation, an increase in the prices of raw materials, and the devaluation of the Pak Rupee.

Besides playing its due role in shrinking the GP margin, Rupee devaluation proved to be a double whammy for ABOT, as significant exchange losses magnified the “other expense” by around 80 percent year-on-year in 9MCY22. This squeezed the OP margin from 21 percent in 9MCY21 to 15 percent in 9MCY22. Then imposition of super tax during 9MCY22 increased the tax expense by 45 percent year-on-year and the NP margin turned out to be 7 percent vis-à-vis 14 percent during 9MCY21.

Future Outlook

With inflation setting new records and Pak Rupee not showing any signs of recovery amidst low foreign exchange reserves, the margins of the company are expected to further shrink. In the absence of a fresh agreement with the IMF, import restrictions will cause supply chain bottlenecks forcing the companies to put down their shutters and lay off huge workforce. This also implies that there will be a shortage of essential life-saving medicines and other surgical instruments. With the local pharmaceutical industry depending on around 90 percent of imported raw materials, such a situation would wreak havoc not only on the pharmaceutical sector but on the overall health sector of Pakistan and warrants serious deliberation.

Comments

Comments are closed.