Up till last year, there were two ways to look at growing petroleum sales in Pakistan. The rising consumption of petroleum products indicated rising demand which was fueled by many factors such as rising auto sector sales, improving industrial and manufacturing activity, higher agricultural activity, better control of smuggling through borders as well as improved economic activity. The other way to look at the rising petroleum sales was the significantly higher imports of the same which along with rising inflation was fueling the current account deficit.

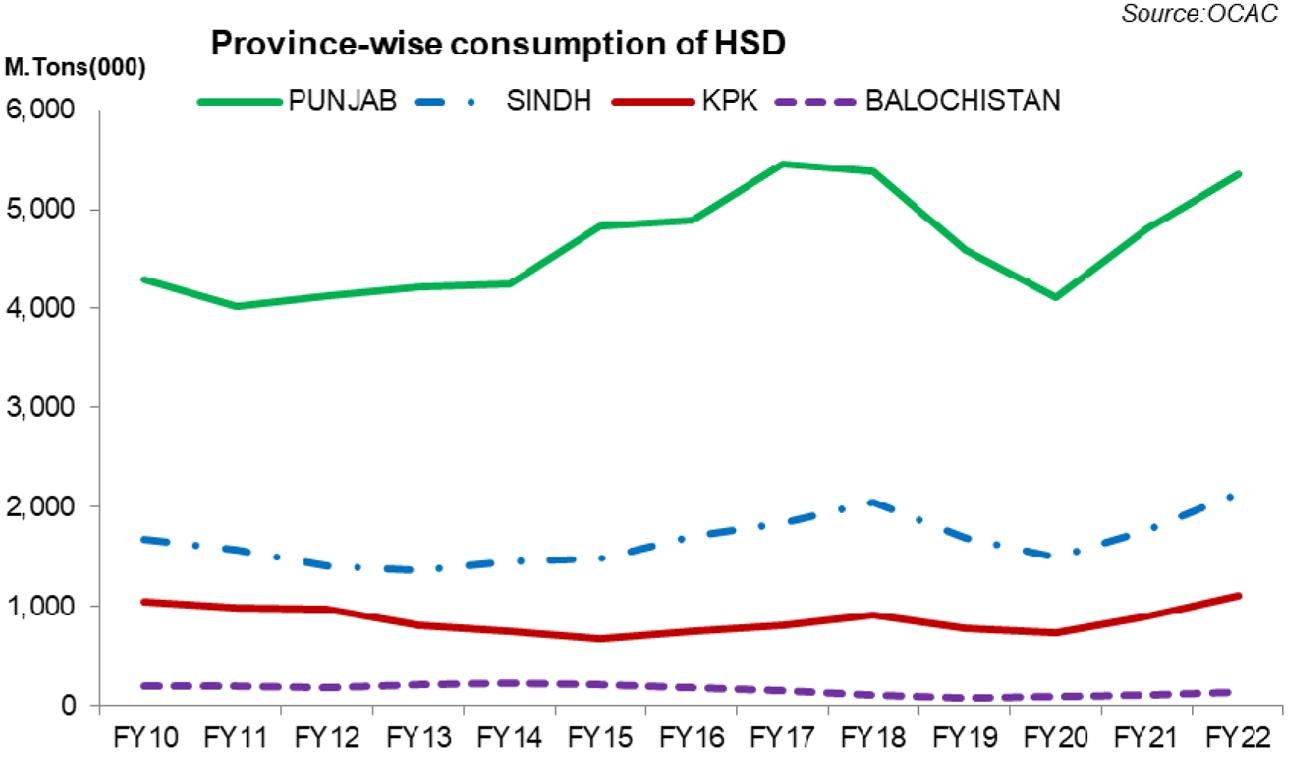

The situation completely changed since then. The first half of FY23 showcases the weakness in petroleum consumption due to weakening demand and rising prices. There has been a visible downward streak in petroleum consumption in the country whether it’s the monthly sales in December 2022 on a month-on-month basis, year-on-year basis, the entire year CY22 or for the overall six months ended Dec 2022 for FY23. Parsing petroleum consumption by provinces shows that the bulk of the consumption continues to come from Punjab; its share has stood at 59 percent in 1HFY23 in overall consumption that includes furnace oil, high-speed diesel, motor spirit, JP-1, Kerosene, etc.

The slump in oil consumption in 1HFY23 is due to weak economic activity and a pessimistic outlook. Weak LSM and manufacturing, falling exports, declining car sales, and subdued agricultural activity are key factors behind the decline in OMC sales. And then the high inflation in the country has been restricting the growth in offtake, while the continued political uncertainty leaves little hope for recovery this fiscal year.

Comments

Comments are closed.