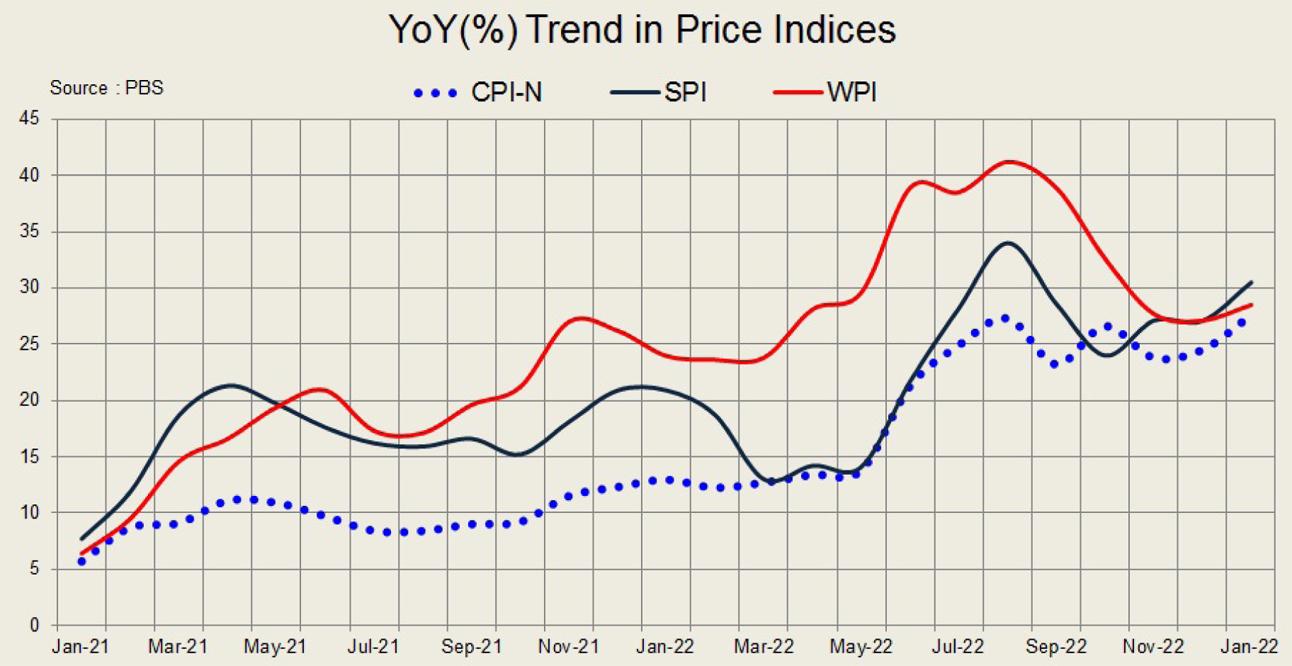

“Headline inflation is still projected to gradually decline through the rest of the fiscal year, particularly in the second half…”. (reads an excerpt from the monetary policy statement from October 2022). The central bank’s monetary policy committee might want to look the other way, as this clearly did not age well. Alternatively, they could also come up with a counterstatement, as taking criticism too well has not been a thing at the Chundrigar headquarters of late.

Mind you, the policy response based on this was the status quo back then. Mind you the floods, commodity price boom, energy price adjustments, and even Ishaq Dar had happened by then. Coming back to inflation, the national headline CPI rose to 27.6 percent – the highest in nearly half a century. Core inflation has crossed 15 and 19 percent for urban and rural areas respectively – the highest in decades. None of it comes off a low base either.

Food prices have risen like never before – going as high as 47 percent in rural settings. Perishable items continue to lead, but non-perishable is fast catching up, as supply chain disruptions owing to floods and later import restrictions are at play. Onions with only 0.5 percent weight in the urban CPI basket – contributed the highest to the rise, beating heavyweights; wheat flour and milk – both of which also raised appreciably year-on-year.

The much-documented soybean import sage is clearly showing in poultry prices. Pulses continue to be imported at significantly higher rates than last year (and in good quantity). Cooking oil was about the only food item showing negative change month-on-month. But that is going to be short-lived too, as the recent round of currency adjustment will weigh in from hereon.

All other categories, from textile to health, and education to transport rose significantly. With the sharp currency depreciation underway, and an upward adjustment in fuel prices (via currency adjustment and taxes), expect the wholesale price index to go up once again, having moderated recently (albeit from a high base).

The housing sub-index growing at under 5 percent year-on-year, looks like folklore. That too will be going drastically up despite the shortcomings that refuse to account for the removal of previous slab benefits. Try telling consumers that their average electricity bills are only up 0.7 percent from last year. More taxes, and energy price adjustments (electricity and gas) are almost a certainty now that Pakistan is back on the drawing board with the IMF.

Meanwhile, the medium-term inflation target of 5-7 percent by the end of FY24 will stay in all likelihood. There is every chance of that being achieved too, with all anchors well in place. The demand destruction that is in store from the heights that CPI threatens to reach before nearing the medium-term target, won’t be an easy view.

Comments

Comments are closed.