Freeing the currency may have brought Pakistan out of (dar) knees, but it is certainly pushing the country further into the grey. IMF funds are critical to avoid default, but even with the latest tranche in place, it is not going to be a magic pill that would cure the country of all its woes—all of which are well-documented. Businesses and consumers are bracing for impact—more debilitating inflation, higher taxes, potential salary cuts or layoffs. Latest readings for the consumer and business confidence surveys recorded by the SBP show a marked decline in sentiments for current as well as future economic conditions as was expected. But the survey offers a few rather interesting nuggets of information for the reader to chew on.

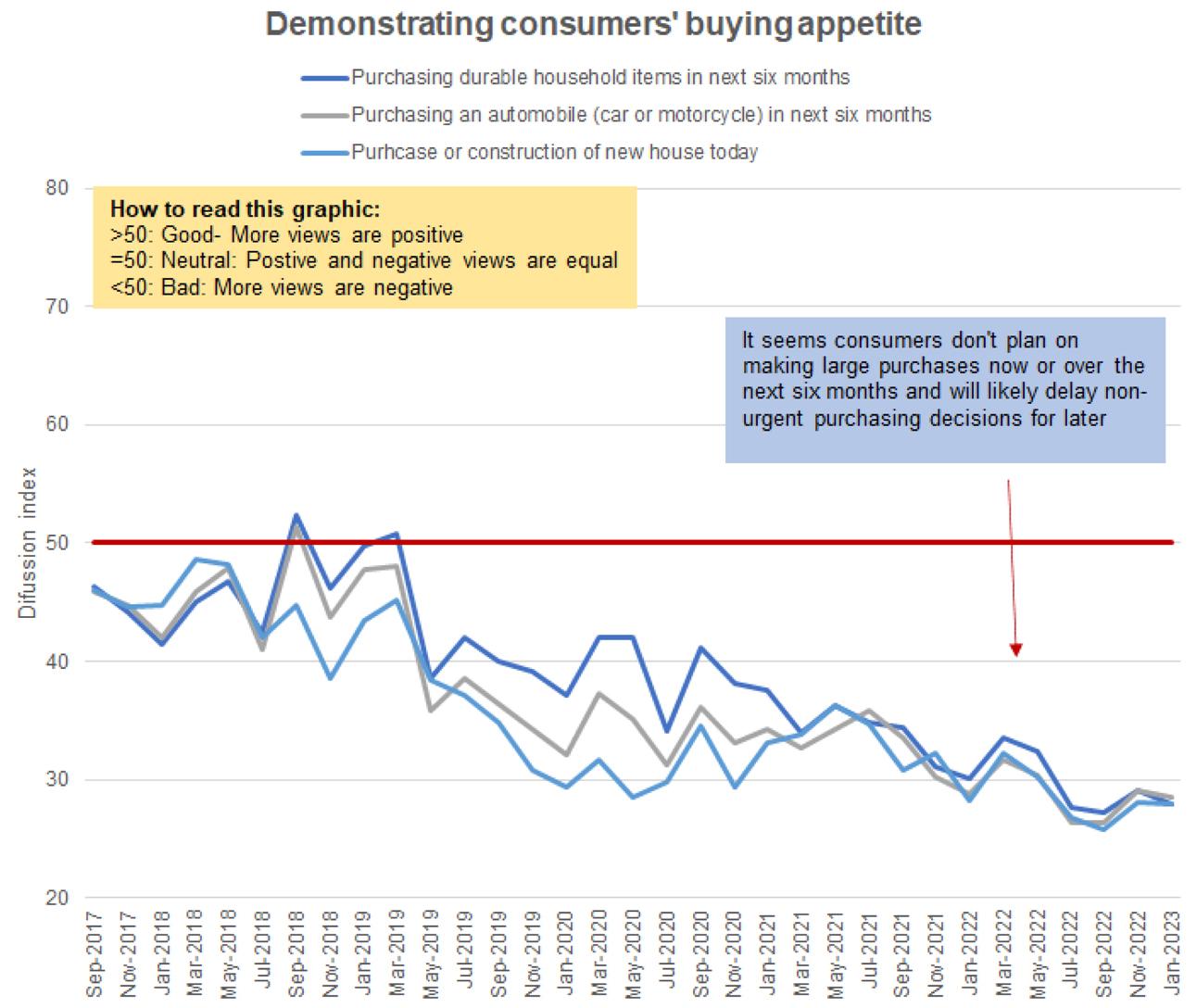

First, buying appetite is significantly low. When asked whether consumers plan on buying durable household items, cars, or property over the upcoming months, the responses were resoundingly negative causing the diffusion index to plummet even below the time period when covid was in full swing. Consumers were more optimistic about buying these goods in the midst of a global pandemic and country-wide shutdown than they are now.

Second, according to the purchasing managers index, production, new orders, and quantity of raw material purchases over the past six months are looking a bit dull. Crucially though, global supply chain disruptions have eased and managers are no longer facing significant delivery delays. This would be welcoming if managers could actually import right now. The critical dollar shortage has all but halted imports of key raw materials and other goods which has necessitated plant shutdowns. Supply is so restricted; demand side factors contributing to the mess are blurry. Large Scale Manufacturing (LSM) indicators show a decline of nearly 4 percent, with demonstrable fatigue across most industries.

Third, and this one is the most curious one indeed. The SBP’s survey records consumer confidence across a range of different qualifiers such as region, gender, education level, profession, and income groups. There are three income groups categorizing respondents: i) those with incomes of less than Rs50,000 ii) those with incomes ranging between Rs50,000 to Rs100,000 and iii) those with incomes above Rs100,000. These are certainly very broad categorizations of income but a longer discussion on what constitutes middle-class and/or high-income would be beyond the purview of this particular piece. Nevertheless, taking it at face value and looking at the data dating back to 2017, for the most part, consumer confidence for the so-called high-income group category has historically always remained slightly above the other income groups. Since the last three cycles, the “rich” are slightly more disgruntled than the other income groups, even more than the lowest income group category. It is not surprising that sentiments are low for all income groups, but it must give pause that the highest income category here is even less happy. Surely, now we have truly done it.

Comments

Comments are closed.