DGKC & MLCF: Fair warning

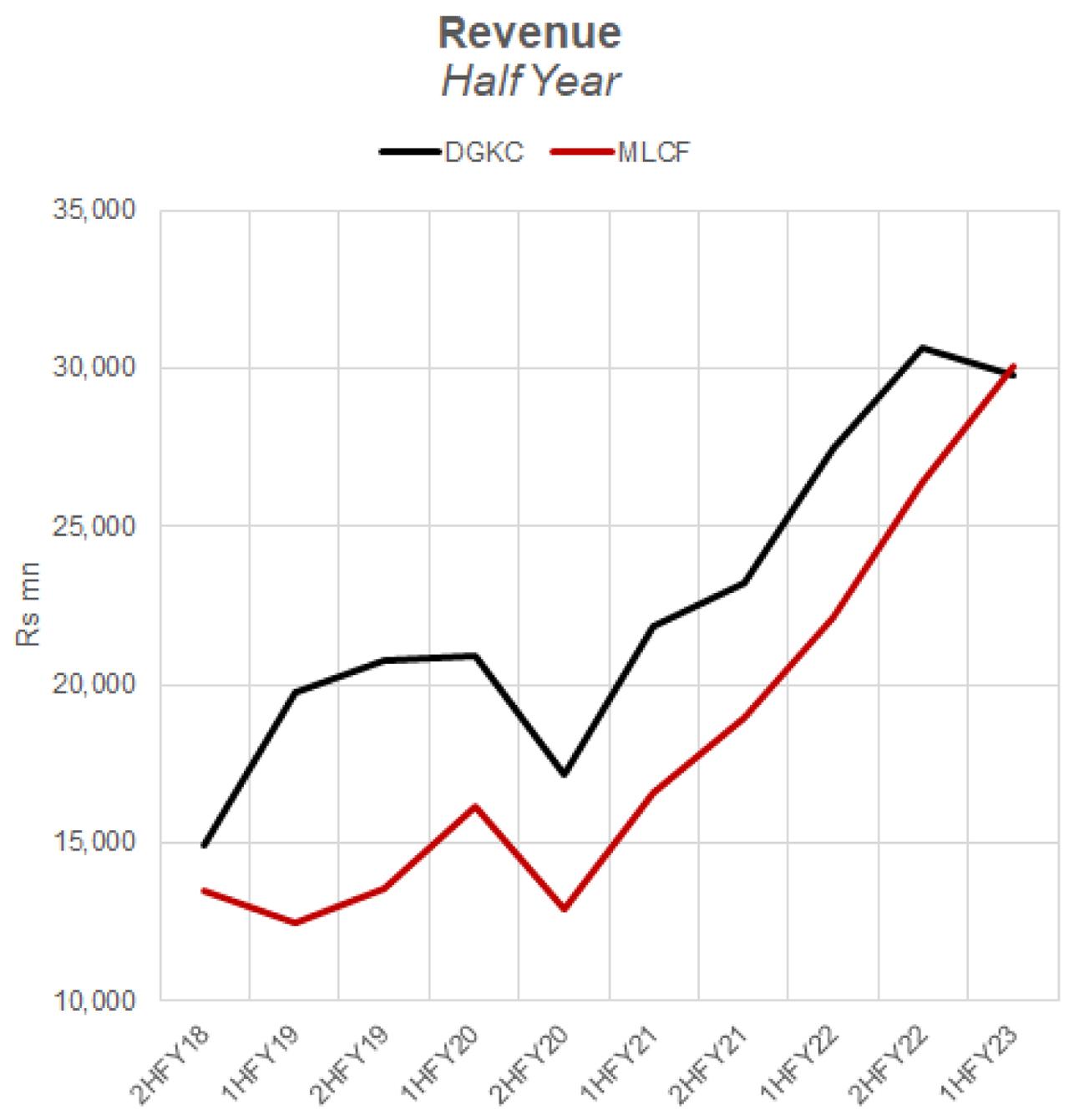

Here is a direct quote from the financial report of prominent cement player DG Khan Cement (PSX: DKGC) for the first half of the current fiscal year; it goes: “Sales [] registered growth primarily due to stable local cement prices. [The] whole effect of inflation, high energy and fuel prices could not be passed on to the consumers”. The company is referring to its 8 percent revenue growth—which granted is not as high as some other cement players—but is reasonably positive compared to the company’s volumetric decline of 20 percent. The reason for that growth, though, is not “stable” prices. Its jerky prices, with big jumps over very short periods of time.

Cement prices have had quite a journey over the last year. Pakistan Bureau of Statistics (PBS)’ weekly price indices suggest on average, cement price during the Jul to Dec period (of FY23) was about 46 percent higher than average weekly prices in the same period last year. DGKC’s own revenue per ton sold (estimated using its revenue and volumetric dispatches numbers) shows the increase in price in 1HFY23 compared to the same period last year was 36 percent.

In contrast, Mapleleaf Cement (PSX: MLCF) that was behind DGKC last year is at least a shoulder ahead with lower decline in dispatches (down 12%), a higher revenue growth of 36 percent, brought on by robust pricing. Revenue per ton sold for the company rose 55 percent during the period.

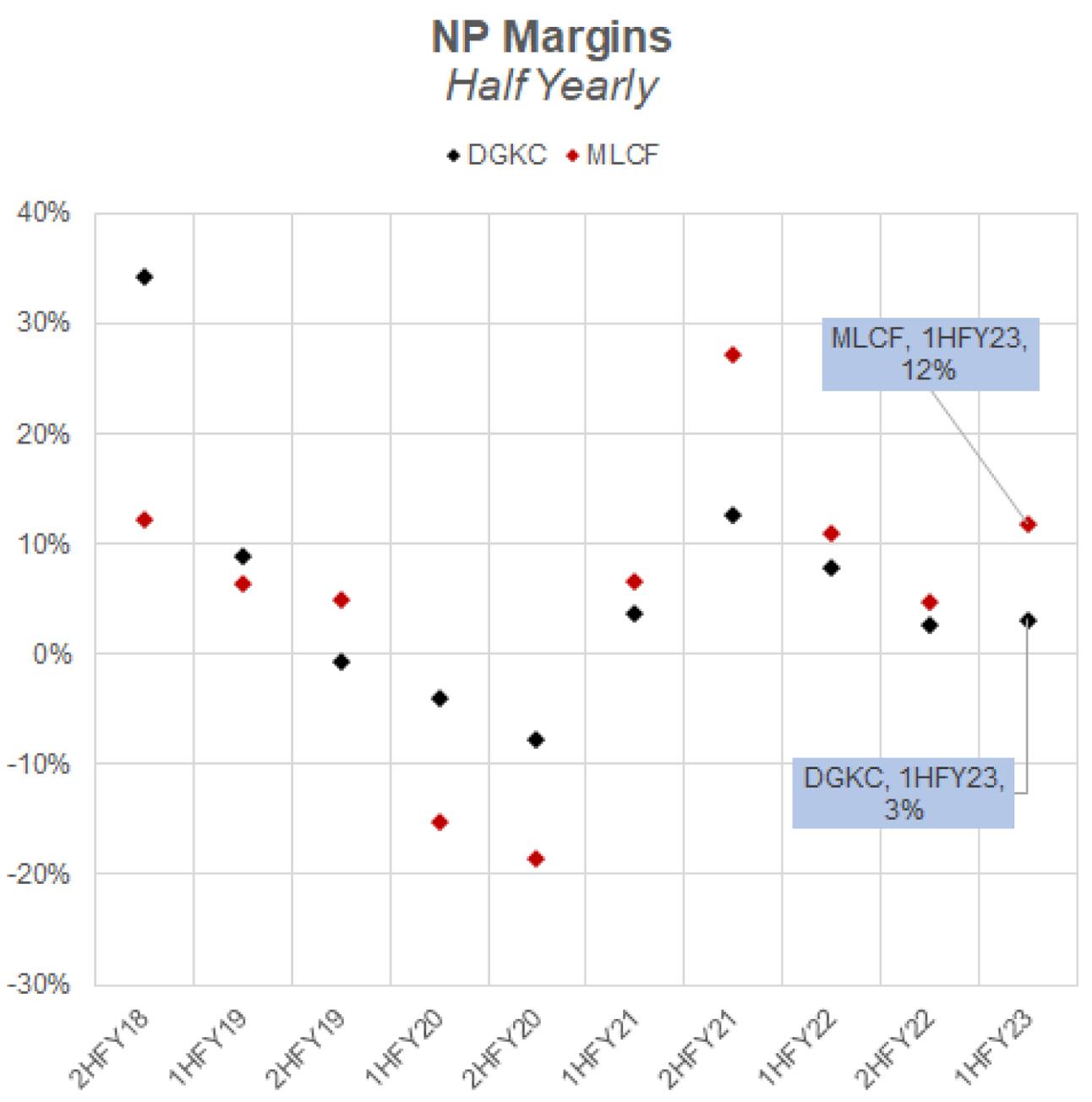

It is evident that while DGKC actually couldn’t pass on the effect of higher cost inflation on the pricing it landed on, when many others like MLCF very well could. DGKC’s cost per ton sold rose 41 percent, vs. the 49 percent increase recorded by MLCF—the difference is, MLCF sold at better average prices. One very obvious reason is that DGKC also supplies to the southern markets where prices have remained lower than northern prices, while MLCF is entirely located in the north where the company targets its supply. Comparatively, gross margins for MLCF are much higher at 29 percent vs. DGKC’s 14 percent. The company has reduced reliance on grid electricity by investing in captive power

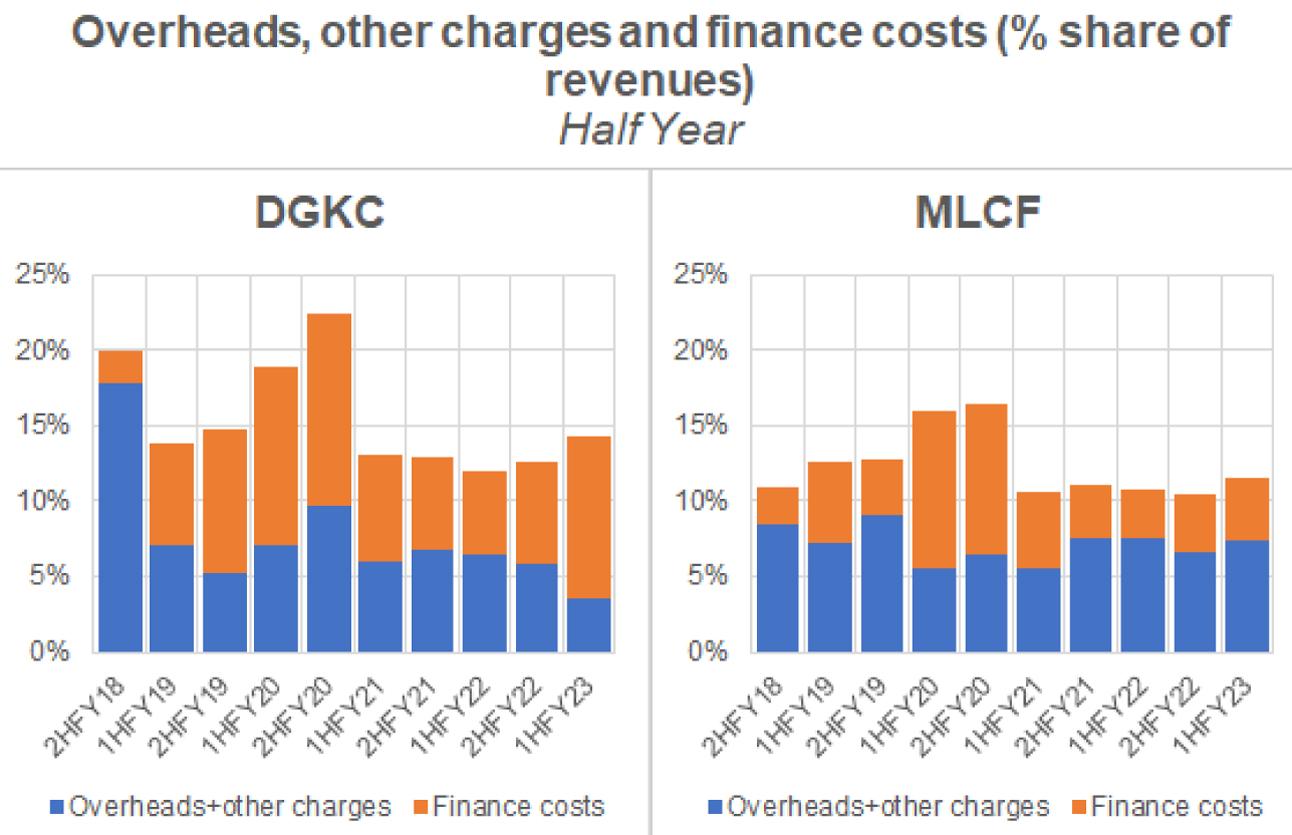

Though DGKC’s overheads and other charges declined, down to 4 percent of revenue from 6 percent last year in 1HFY22, and much lower than previous years when clinker sales were higher and more coal was being imported from abroad, its finance costs are atrociously high at 11 percent of revenue. Comparatively, last year, finance costs as a share of revenue were nearly half at 6 percent. Higher borrowing and rising interest rates have caused finance costs to balloon.

In contrast, MLCF’s finance costs remained in check at 4 percent. Whereas MLCF’s profits rose nearly 50 percent in 1HFY23, DGKC’s earnings declined about the same (down 57%) due to a bigger drop in dispatches, lower retention compared to other players, and higher expenses.

The second half of the year may not be dramatically different. Additional FED on cement will further increase end-user prices for buyers and over the rest of the year, continue to hurt demand which is already affected by PSDP cuts, flood related construction halts and reduced buying power.

This will put further pressure on companies like DGKC but also MLCF as there is only so much that strong pricing can do in a market starved for offtake. Utilization is already low for the entire cement industry based on its capacity which is on its way to increasing. Though many expect flood related rehabilitation to boost demand, it remains to be seen how soon that would materialize.

Comments

Comments are closed.