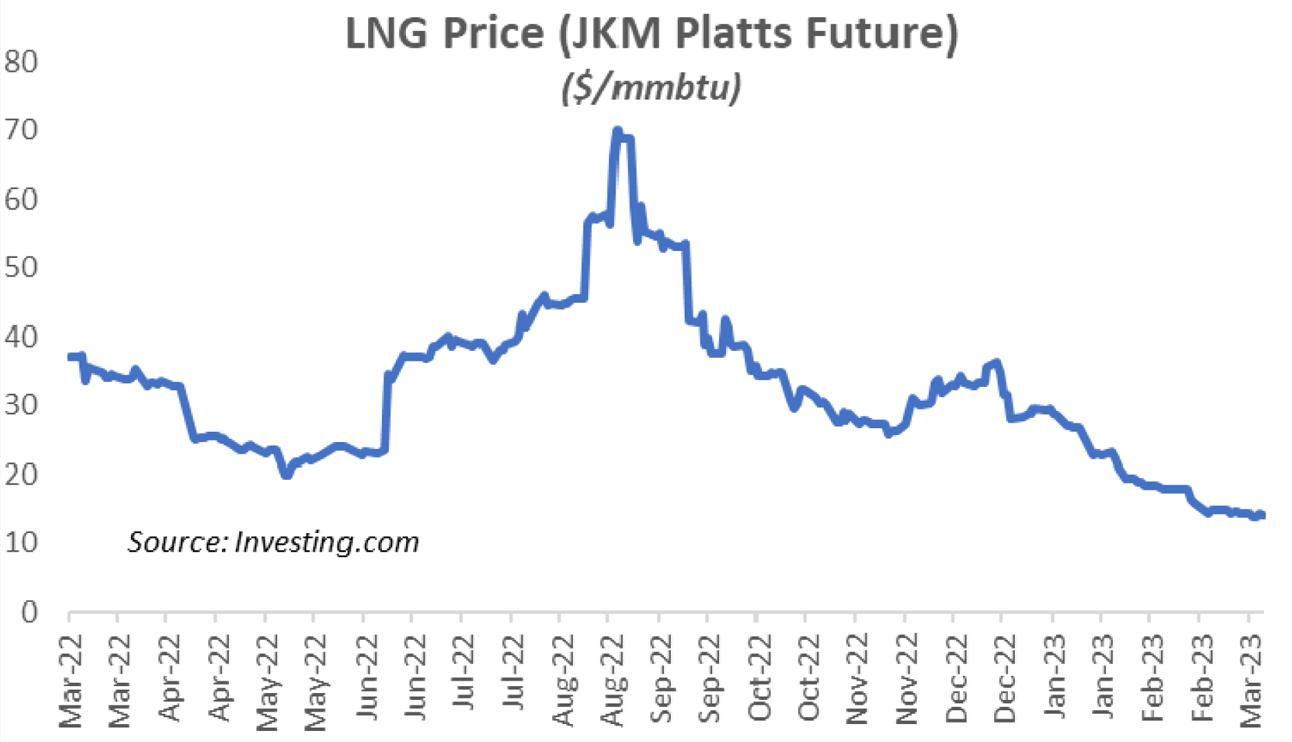

As Europe seems to have escaped a harsh winter, LNG prices have come down quite a bit from the peak seen six months ago. LNG Japan-Korea Marker (JKM) benchmark future contracts have reduced to a fifth from the peak of September 2022 – last seen trading at a little over $14/mmbtu. Pakistan meanwhile has slipped further down the pecking order of countries, making a marked difference to global LNG supply and demand dynamics – from being a key player outside of Far East giants not so long ago.

Of course, the paucity of dollars ensured Pakistan was not even in the race. But even before the dollar shortage had hit hard, there were not enough vessels doing rounds around the Pakistan shores. There just simply was not enough LNG available for the likes of Pakistan, at a time when Europe was stocking on gas like there is no tomorrow. Despite all the talks of isolating Russia in the energy export market – the European Union was the second largest buyer of Russian LNG in 2022 – and more of the same could be in store for 2023.

The LNG price drop could not have been more ill-timed for Pakistan, as there is not much to look forward to. Even if dollars were arranged today, Pakistan would struggle to find a willing seller outside the long-term government agreements, under which 6-8 cargoes have been regularly arriving every month. The Pakistan LNG Limited (PLL) has not bid for a spot cargo since July 2022 – when it failed to attract a single bid. Another attempt at a 6-year arrangement found no takers a month later – as Europe was paying hefty premium – and vessels were happy queuing up for weeks instead of looking eastwards.

The price dip may not last long, as supply disruption in France and more importantly much faster than expected demand resurgence from China will come to the fore. The long-term contract delivered LNG price for Pakistan is expected to stay in the range of $10-11/mmbtu for 4QFY23 – as the outlook for Brent crude stays north of $85/bbl for Mar-Jun – to keep the 3-month trailing average price around current levels.

As electricity demand gradually starts to go back up with rise in temperatures at home, RLNG demand will be created and most likely remain unmet, creating disallowance of fuel charge variances on account of deviation from economic merit order. China and West have been gearing for longer term contracts – which is likely to leave Pakistan at the mercy of bigger players. From politicking on the failure to have an additional LNG terminal a year ago to now staring at idle capacities has been quite a story.

Comments

Comments are closed.