Pakistan Hotels Developers Limited

Pakistan Hotels Developers Limited (PSX: PHDL) was incorporated as a private limited company in Pakistan in 1979 as Taj Mahal Hotels Limited. It was converted into a public limited company in 1981. The principal activity of the company is hotel business besides owning and operating a five star hotel, Regent Plaza Hotel and Convention Centre, Karachi.

Pattern of Shareholding

As of June 30, 2022, PHDL has 18 million shares outstanding which are held by 415 shareholders. Directors and their relatives have the highest shareholding of 88.85 percent in the company with directors holding 36.55 percent shares. General public accounts for 9.92 percent of PHDL’s outstanding shares while joint stock companies have a stake of 1.2 percent in the company. The remaining shares are held by ICP units and Modarba & Mutual Funds.

Performance trend (2018-22)

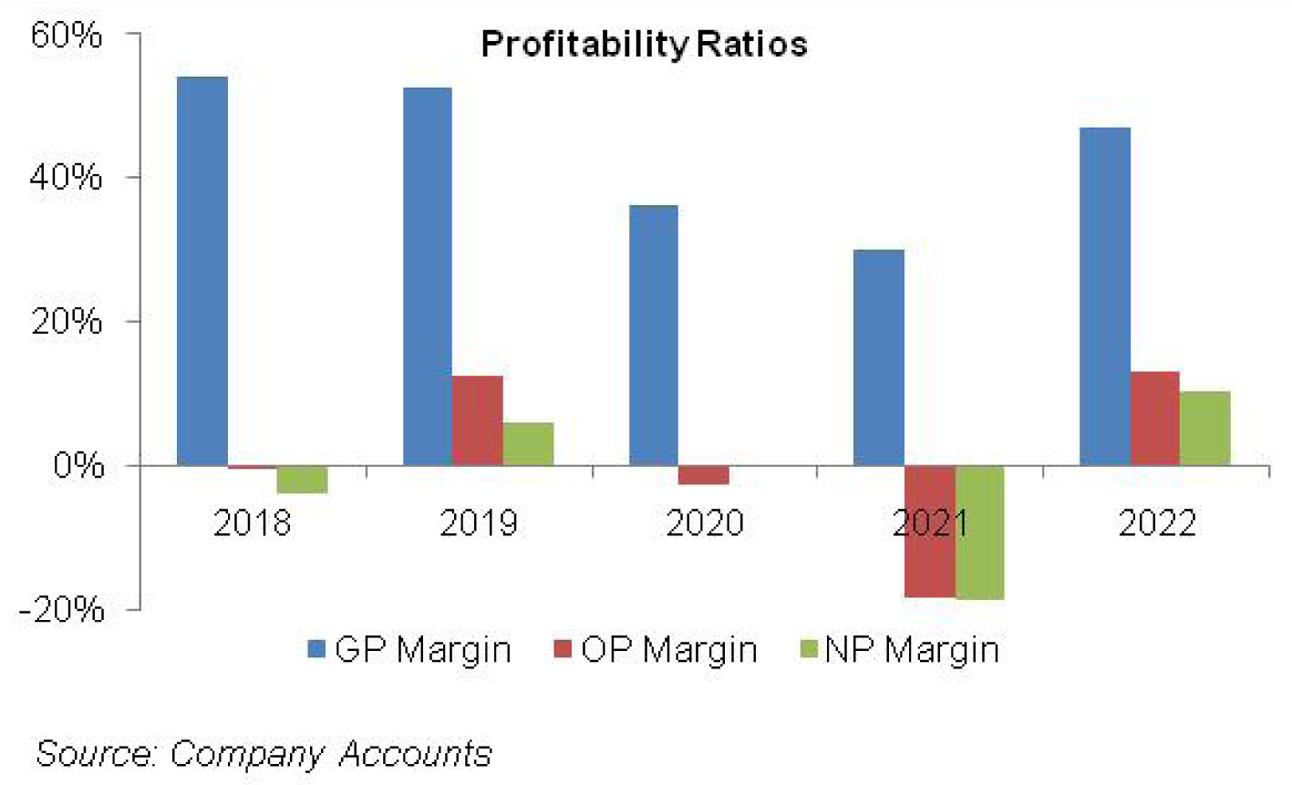

Amongst all the years under consideration, 2020 and 2021 appear to be in poor health whereby PHDL’s topline slid by 32 percent and 24 percent year-on-year respectively. The reasons are pretty obvious i.e. COVID-19 which brutally affected the hospitality industry due to widespread slowdown in the movement of people. In 2020, the company managed to post net profit worth Rs.0.44 million, however, in 2021, the bottomline entered the red zone posting a net loss of Rs. 2.62 million. 2018 was another year where PHDL posted a negative bottomline. The margins of the company which had been riding a downward journey since 2019 bounced back in 2022.

In 2018, the hotel restarted with limited capacity after 9 month suspension of business activity due to fire incident in the hotel building in 2017. The company’s turnover grew by 20 percent year-on-year in 2018. PHDL achieved a GP margin of 54 percent in 2018 with a 40 percent year-on-year growth in gross profit to clock in at Rs.225.39 million in 2018. The bliss proved to be short-lived as soaring operating expenses overshadowed the healthy growth in gross profit. Operating expenses mainly elevated on the heels of compensation to the affectees of fire incident as well as repair and maintenance expense. As a result, the company made an operating loss worth Rs. 2.21 million in 2018. Finance cost also magnified during the year as the company obtained running finance facility to meet its working capital requirements. In 2018, the company made a loss after tax of Rs. Rs.16.97 million up from Rs. 10.97 million in 2017. Loss per share also grew from Rs.0.61 in 2017 to Rs.0.94 in 2018.

2019 was a rather stable year for PHDL as the topline grew by 15 percent year-on-year on the back of higher occupancy as well as food and beverage sales. However, high cost of sales on the back of market driven increase in salaries coupled with guest supplies, heat and power prices kept GP margin under check which ticked down to 52.5 percent in 2019. The operating expenses which grew during last year also slid down by 15 percent year-on-year in 2019. As a result, PHDL was able to make an operating profit of Rs.59.87 million in 2019 with OP margin clocking in at 12.5 percent. Finance cost gave a major support to the bottomline as it plunged by 57 percent year-on-year during the year as the company settled its running finance facility obtained in the previous years to overcome the liquidity shortfall. During the year, the company obtained an interest free loan of Rs. 2.5 million from the director of the company for working capital requirements. Finance cost of the company comprises of remaining interest payable on short-term borrowing as well as interest on lease liabilities as it purchased furniture and fixtures and a vehicle through leasing during the year. The company posted a profit after tax of Rs.28.01 million in 2019 with an NP margin of 5.8 percent. During the year company also made capital investment in fire safety equipment to avoid any mishap in the future. Further, the management asked the tenants of their shops to vacate the premises for safety and security reasons. This added to operating expenses as rent receivables were written off.

While the PHDL was in the process of recovering from the shocks of fire incident happened in December 2016 (FY17), the unpredictable COVID-19 jolted its subsistence. The business activity of PHDL halted for more than three months which culminated into a topline drop of 32 percent year-on-year in 2020. The cost of sales also followed due to low occupancy and food and beverages sales. The GP margin nosedived to 36 percent in 2020. Thankfully, operating expenses gave some breather as they slid by 34 percent year-on-year as there was no compensation to the fire incident affectees as well as no shops premium this year. Repair and maintenance cost also shrank during the year. Other income grew significantly as the company disposed its assets and earned profit on saving accounts, however, in absolute terms, other income of Rs.1.2 million wasn’t capable enough of providing any support to the bottomline. The company made an operating loss of Rs. 8.7 million in 2020. Finance cost dropped off by 74 percent year-on-year in 2020 as the company fully paid the interest charges on its short-term borrowings last year. Deferred taxation allowed PHDL to post a positive bottomline of Rs0.44 million in 2020 with an NP margin of 0.1 percent.

The economic headwinds that came with the global pandemic were not over in 2021. The room occupancy of PHDL which slid down to14.99 percent in 2020 further dropped to 9 percent in 2021. The company nearly halved its workforce from 151 workers in 2020 to 75 workers in 2021. The topline also shrank by 24 percent year-on-year with GP margin sinking further to 29.9 percent in 2021. Operating expenses also dropped by 5 percent year-on-year on account of low guest turnover. Operating loss further magnified to Rs46 million. Finance cost represents interest on lease assets. The net loss for 2021 stood at Rs47.17 million with a loss per share of Rs. 2.62.

PHDL, which had been grappling firstly against the fire incident and then against COVID-19 heaved a sigh of relief in 2022 as its topline grew by 86 percent year-on-year. Room occupancy grew to 20 percent as the signs of global pandemic began to fade and the hotel and tourism industry picked up. Cost of sales also increased due to market driven increase in salaries coupled with high heat, light and power charges. The GP margin grew to 47 percent in 2022. As the company made capital investments in air-conditioning, equipments and restaurants for improvement in its services, so the related repair and maintenance along with other expenses amplified the operating expenses by 30 percent year-on-year in 2022. Yet, the company was able to post an operating profit worth Rs. 60.6 million in 2022 with an OP margin of 13 percent. Finance cost continued to diminish during the year and PHDL was able to post a net profit of Rs. 47.8 million and an EPS of Rs.2.66. This is the highest bottomline as well as operating margin and net margin seen by the company since 2017.

Recent Performance (1HFY23)

During 1HFY23, the topline of PHDL grew by 28 percent year-on-year, yet high cost of sales on the back of inflationary pressure kept the margins under pressure. GP margin slid to 46 percent in 1HFY23 from 50 percent during the same period last year despite year-on-year growth of 19 percent in gross profit to clock in at Rs.139.8 million. Administrative overheads also pushed the operating expenses up by 57 percent year-on-year in 1HFY23. This reduced the operating profit by 29 percent year-on-year in 1HFY23 to clock in at Rs.36.6 million. OP margin stood at 12 percent in 1HFY23 from 22 percent in the same period last year. The company incurred no finance cost during the year, yet the bottomline dipped by 22 percent year-on-year to rest at Rs. 30 million. NP margin dipped to 10 percent in 1HFY23 from 16 percent in 1HFY22. EPS for the period turned out to be Rs. 1.67 down from Rs. 2.15 during 1HFY22.

Future Outlook

The future of hospitality industry in Pakistan is highly dependent on the political and economic stability of the country as well as law and order situation. Karachi, being the economic hub of the country, receives corporate visitors’ traffic round the year, from both domestic and external origins. This might buttress the topline of PHDL. The company has also been rigorously investing in the infrastructure of its restaurants, rooms and convention halls to attract customers and increase its room occupancy. However, high cost of sales and administrative overheads will keep the margins under pressure.

Comments

Comments are closed.