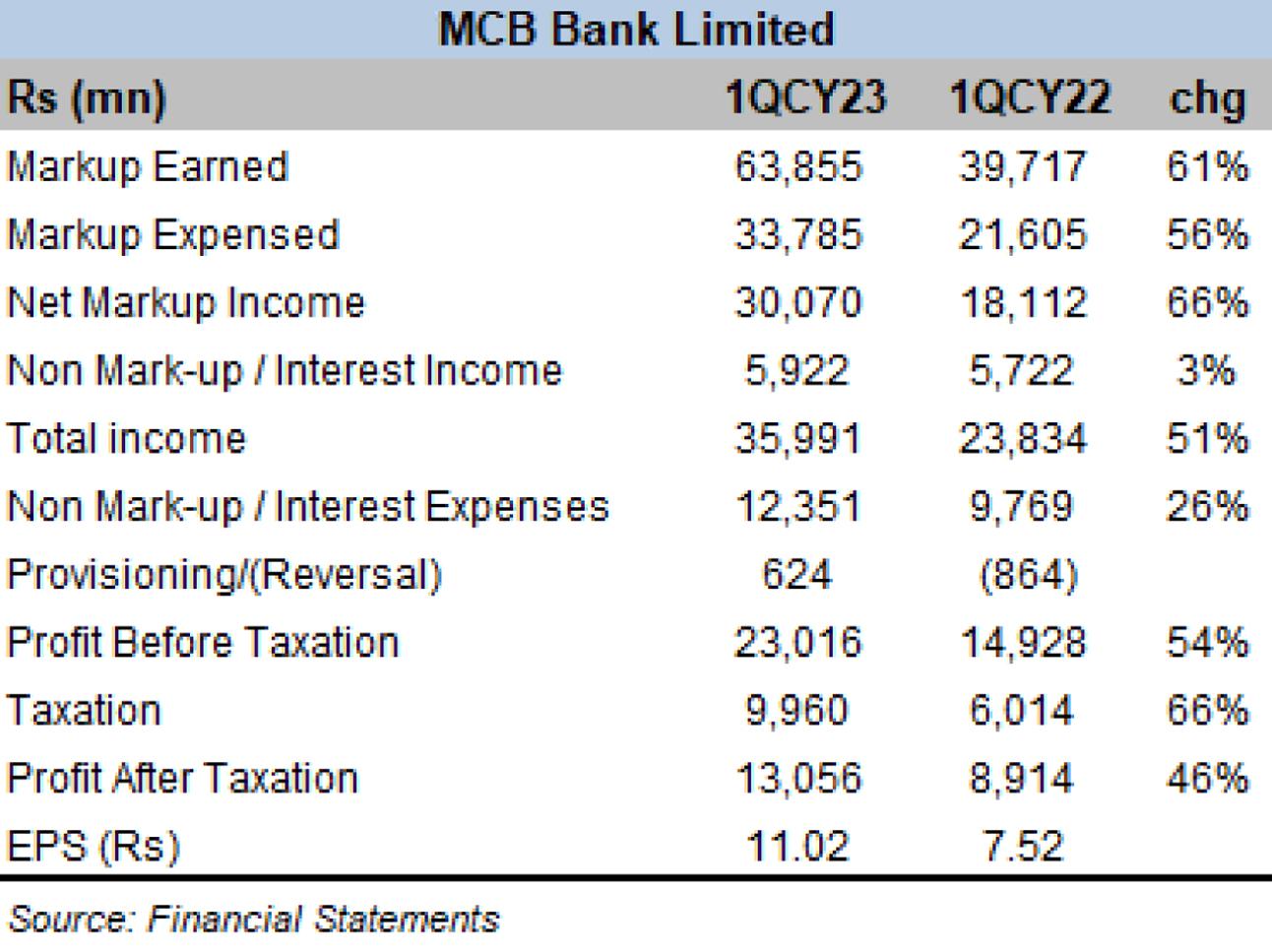

MCB Bank Limited (MCB) began 2023 from where it left 2022 – announcing Rs6/share first interim cash dividend to shareholders, as the bank announced its 1QCY23 financial results last week. Strong year-on-year growth in pretax profits is built around strength of the core income, as the net interest income soared 66 percent year-on-year – largely due to favorable policy rate variance and timely and effective duration management of investment portfolio.

While the industrial and commercial sectors may well be feeling the pinch of record-high policy rate, banks have found a way to bolster the profits. Branch managers and staff may now well be the most valued employees – having spent years playing second fiddle to the treasury staff. Reducing the cost of deposits should always be anyone’s goal, never more important than today, and MCB’s managers seem to have done exceptionally well on that front.

The non-remunerative current account deposits soared by a massive 31 percent or Rs178 billion over a year ago, outpacing industry average deposit growth. Current account deposits have overtaken saving deposits (likely for the first time in MCB’s history) – now representing 51 percent of total deposits, up from 40 percent in 1QCY22. MCB’s deposit mix has consistently been among the best in the industry, and it just got better. Average cost of domestic deposits stayed at 7.15 percent, higher by 210 basis points over the same period a year earlier.

On the asset side, both advances and investments went down over December 2022, as lending to financial institutions picked up pace. The ADR slipped below 50 percent, having momentarily crossed 50 percent at the end of 2022. Provisioning charges remained considerably higher from a year ago, primarily on account of diminution in value of investments. Infection ratio slightly inched up to 7.8 percent, with a coverage ratio of 82 percent.

Administrative expenses were reflective of persistently high inflation and significant currency depreciation – increasing 25 percent year-on-year. Non-salary related expenses went up 34 percent year-on-year, as utilities, stationary and other expenses shot up. Compensation expense grew in the double digit at 17.6 percent but was contained way under the headline inflation rate. The cost to income ratio improved by nearly 700 basis points to 32.77 percent.

Pakistan’s economic outlook for rest of 2023 appears far from rosy, as uncertainties are aplenty. An uptick in genuine credit appetite is not likely anytime soon and inflation is expected to stay near record high levels for at least another quarter. MCB and peers have so far managed to be proactive, especially in terms of improving deposit mix to keep the profits coming. It will not get easier from hereon.

Comments

Comments are closed.