Consumption of petroleum products in the country has been on a downward trajectory. Weak economic activity amid unprecedented inflationary pressures and political turmoil is eating away demand for the same. Consumption has been waning due to record high fuel prices for over 10 months. The decline in demand has also resulted in a downward slide in import of petroleum products.

The recent number from Pakistan Bureau of Statistics show that imports of petroleum group that include crude oil incurred a decline of around 18 percent year-on-year during 10MFY23. Looking at the quantity of petroleum products, PBS data show that total quantity fell by 38.2 percent year-on-year. In value terms, petroleum products witnessed a decline of 28 percent year-on-year during 10MFY23. At the same time, imports of LNG also fell by 16 percent year-on-year during 10MFY23.

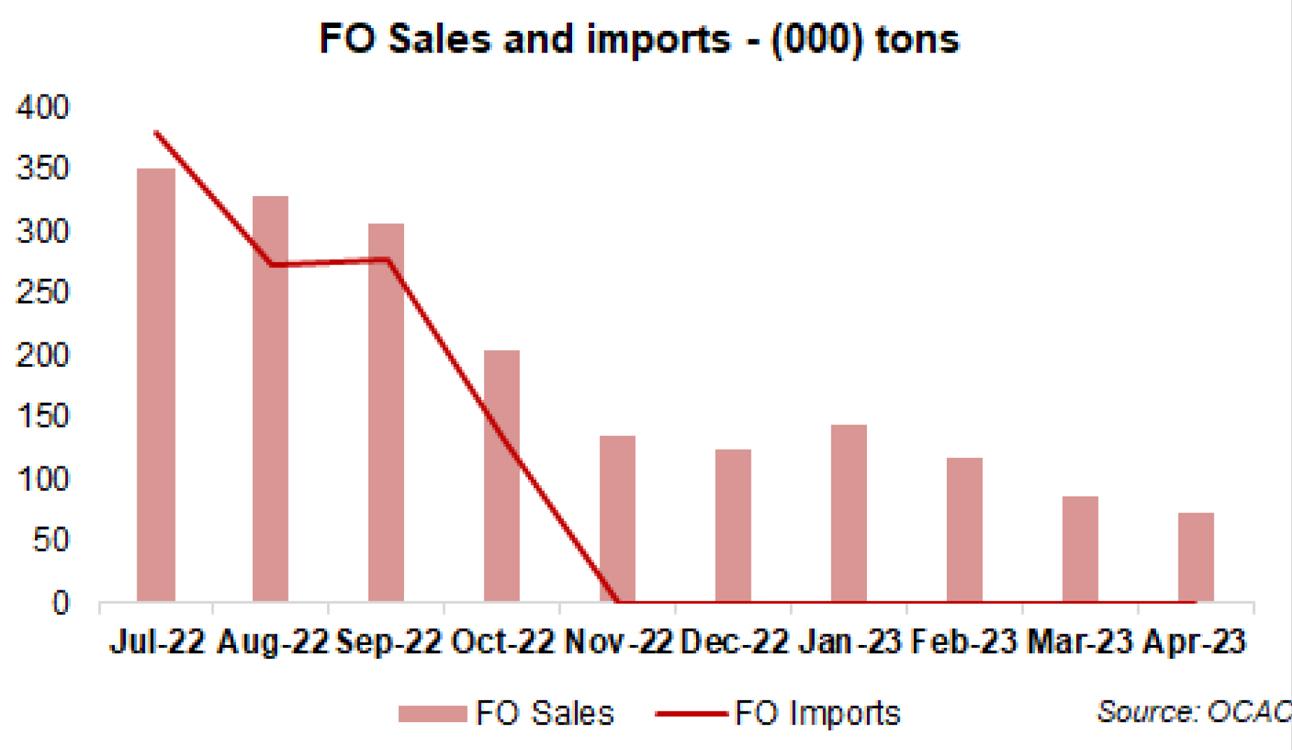

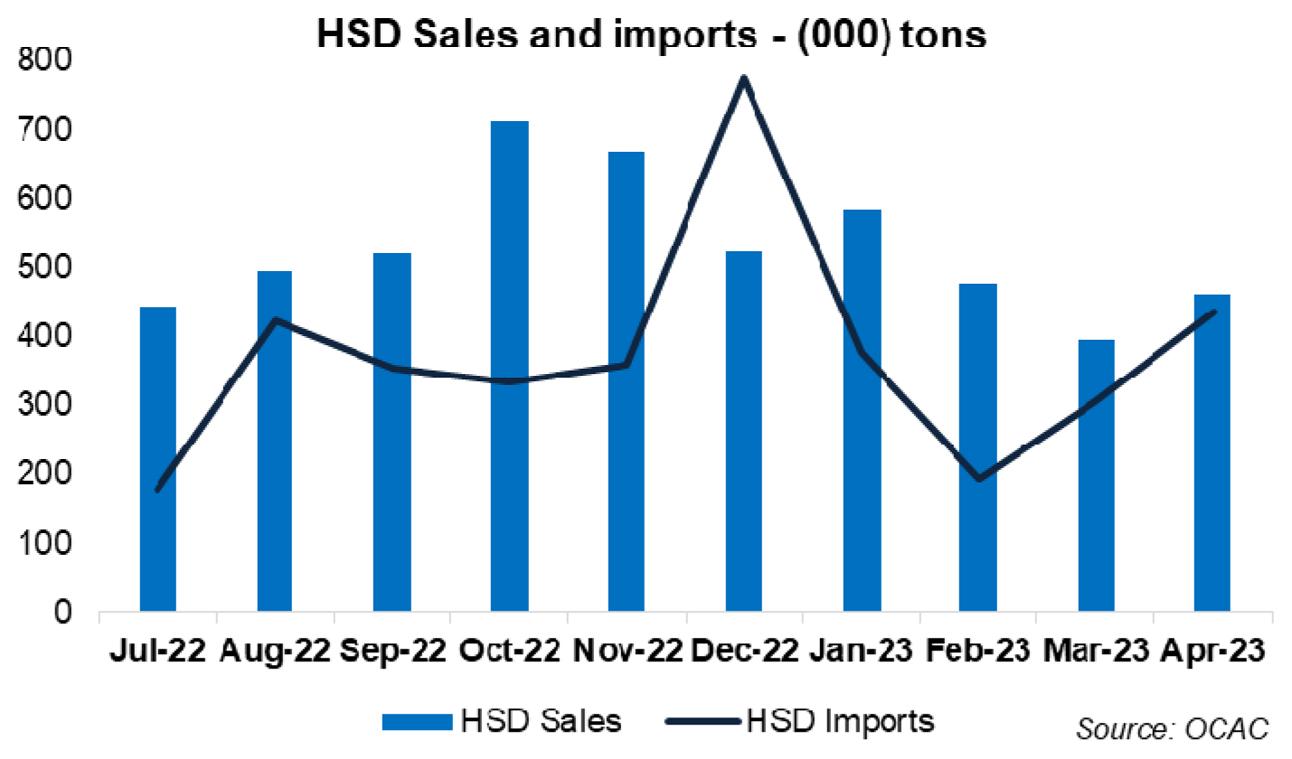

This can also be seen from the volumetric sale of petroleum products by the oil marketing companies. Monthly data from OCAC shows that furnace oil imports by the oil marketing companies has completely come to an end since December 2022, while imports of petrol (motor gasoline) has also been weaker specially in the latest month (April 2023). On the other hand, some improvement has been seen in diesel import volumes over last couple of months.

Some rise in petroleum imports is expected in the coming months as prices of petroleum products have come down. Moreover, imports of crude oil from Russia is also believed to have joined lower fuel prices. What impact will the Russian crude have on petroleum prices at home however depends on certain factors. One, the deal is likely to be a test run, so the feasibility is not certain. Second, there are rumors that Russia wants payment in its own currency, Chinese Yuan or UAE’s Dirham, which will pose a currency reserve challenge. Most importantly, western world’s resistance to a deal with Russia poses a major risk of scuttling the deal in case foreign policy considerations trump the need for cheaper fuel.

Comments

Comments are closed.