After 14 months: KSE-100 powers past 44,000 with over 600-point gain

- Settles at nearly 44,200 on news that IMF board meeting is set for July 12 to consider Pakistan's SBA

Bolstered by developments on the International Monetary Fund (IMF) front, the Pakistan Stock Exchange (PSX) witnessed another bullish run on Thursday as the benchmark KSE-100 Index closed well over the 44,000 level – widely seen as a resistance point earlier in the week.

This is the first time the index has closed over the 44,000 level since May 2022.

Index-heavy sectors including banking, cement, chemical, telecommunication, oil and gas exploration companies as well as OMCs settled in the green, while some automobile assemblers remained in the red.

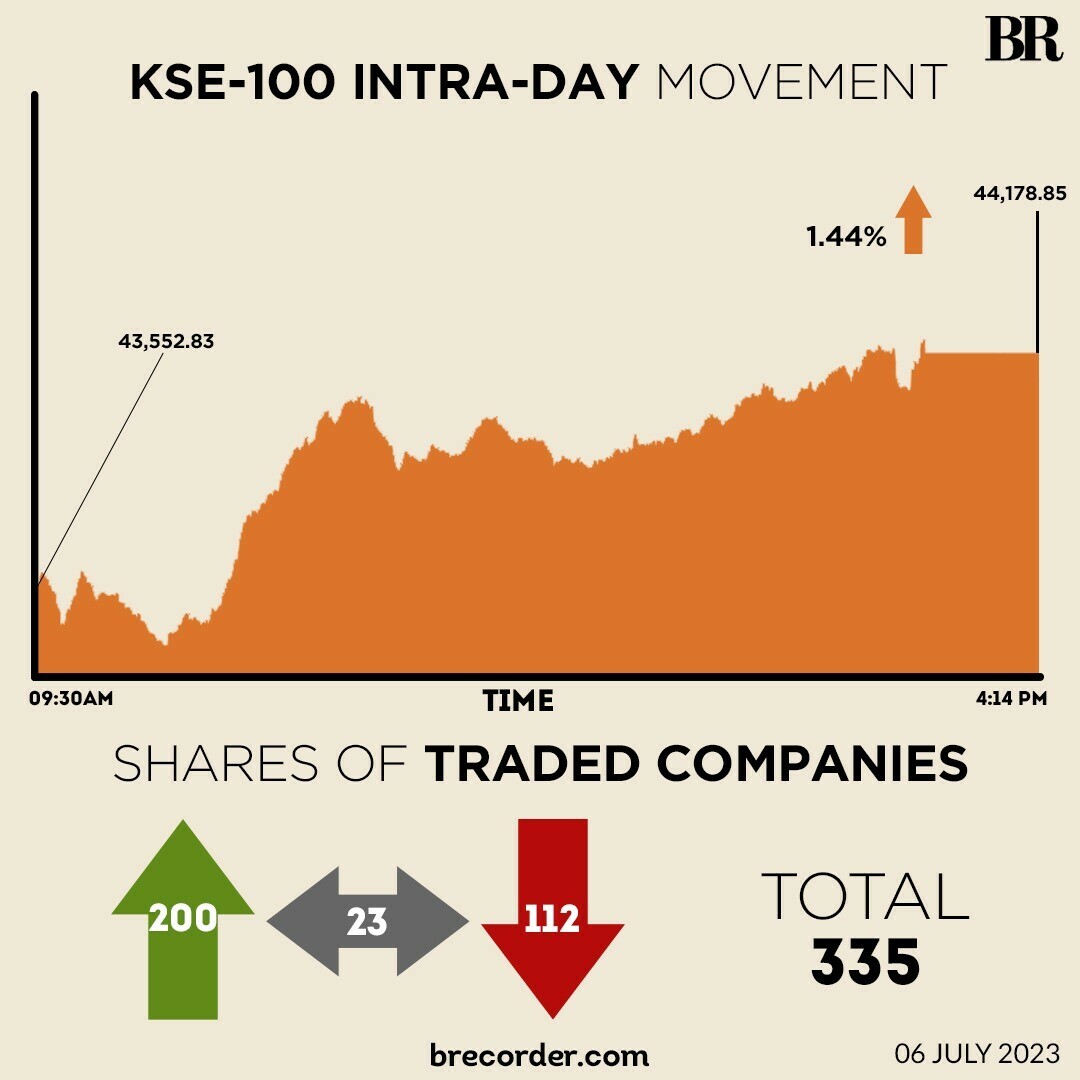

Earlier during the day, the index was seen unable to sustain the level over 44,000, and retreated to around the 43,900-point mark. However, bulls returned to help the KSE-100 settle at 44,178.85 for an increase of 626.01 points or 1.44%.

Experts said the development comes as investors expect approval of the loan from the IMF during its Executive Board meeting in the coming days.

The IMF Executive Board meeting on Pakistan to consider a $3 billion loan programme will be held on July 12, the lender confirmed to journalists via email on Wednesday night.

Pakistan clinched the IMF’s staff-level approval last week.

On the economic front, as per data released by the State Bank of Pakistan (SBP), the Pakistani rupee registered marginal appreciation against the US dollar, strengthening 0.13% in the inter-bank market on Thursday.

Sectors driving the benchmark index upwards included, banking (160.19 points), oil and gas exploration (120.42 points) and cement (78.86 points).

Volume on the all-share index fell to 297.8 million from 351.2 million on Wednesday, however, the value of shares traded improved to Rs12.4 billion from Rs12 billion recorded in the previous session.

WorldCall Telecom was the volume leader with 28.8 million shares followed by Pak Elektron with 16.2 million shares and Pak Petroleum with 14.1 million shares.

Shares of 335 companies were traded on Thursday, of which 200 registered an increase, 112 recorded a fall and 23 remained unchanged.

Comments

Comments are closed.