MCB: Investments and current account drive profit

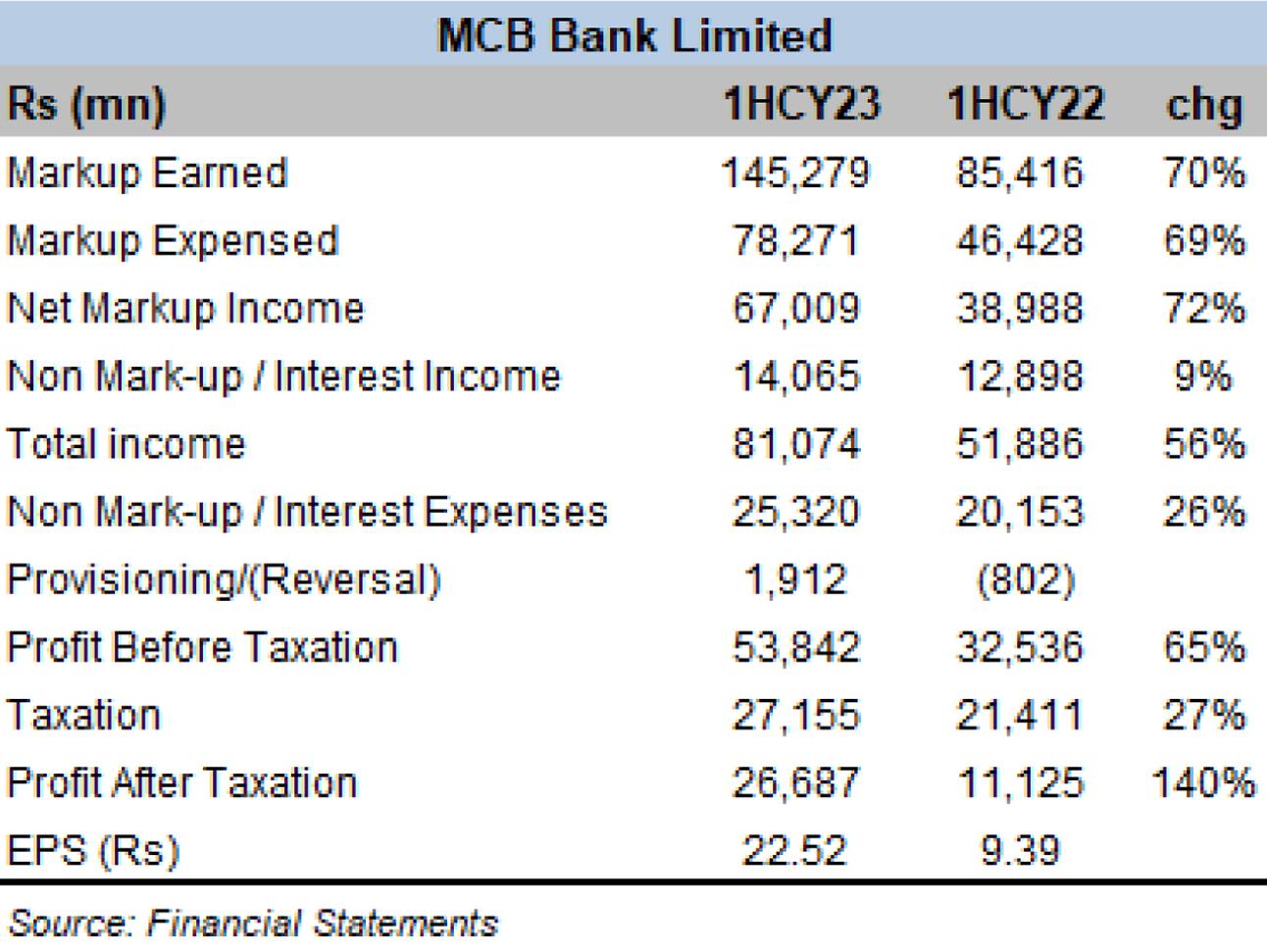

MCB Bank Limited (MCB) doubled on the impressive first quarter, raking in record half yearly after-tax profits at Rs26.7 billion – showing a stellar 140 percent year-on-year growth. Even after discounting for the higher effective tax rate in the same period last year – 65 percent pretax profit growth is also exemplary. To look at the country’s economic strife and people’s misery – and then look at the big banks – raking in record profits – the disconnect could not have been more obvious.

Or maybe that is actually more of a connection as the country struggles – her government ends up needing more money to borrow. With the central bank borrowing out of the equation, commercial banks are presented with a willing sovereign risk-free borrower. While one could argue about lazy banking that banks have long been accused of, genuine lack of credit appetite in a struggling economy in a high interest rate scenario, just makes more sense and is often the only avenue to lend to.

The contrasting growth of investments and advances portfolio in the asset base further amplifies the country’s macroeconomic situation. MCB’s advances fell 19 percent whereas investments soared 17 percent. The advances to deposit ratio continue to slide, and with the policy rate still north of 20 percent – expecting any significant trend reversal would be highly optimistic.

The deposit mix continues to be dominated and headlined by no-cost and low-cost deposits. Current account deposits during the period showed a growth of 32 percent in current account deposits – outpacing overall industry wide deposit growth by a fair margin. MCB has one of the best CASA ratios among the peer group, and the current account to total deposit now exceeds 52 percent, up more than 10 percentage points from the same period last year. The domestic cost of deposits was contained under 8 percent for the period – which is phenomenal given the exceptionally high interest rates during the period.

Administrative expenses inched up expectedly, much in line with the overall inflationary environment and significant currency depreciation. A sizeable increase in non-markup income, mainly stemming from fee commission, card related business and remittances – further improved the cost to income ration, to 29.5 percent, from 37.4 percent, a year earlier.

Provisioning charges stayed much higher than last year and understandably so. Banking industry is expected to register higher NPLs as the year goes on, but the likes of MCB seem to have provided adequately for the bad loans, and should be able to ride the tide.

Comments

Comments are closed.