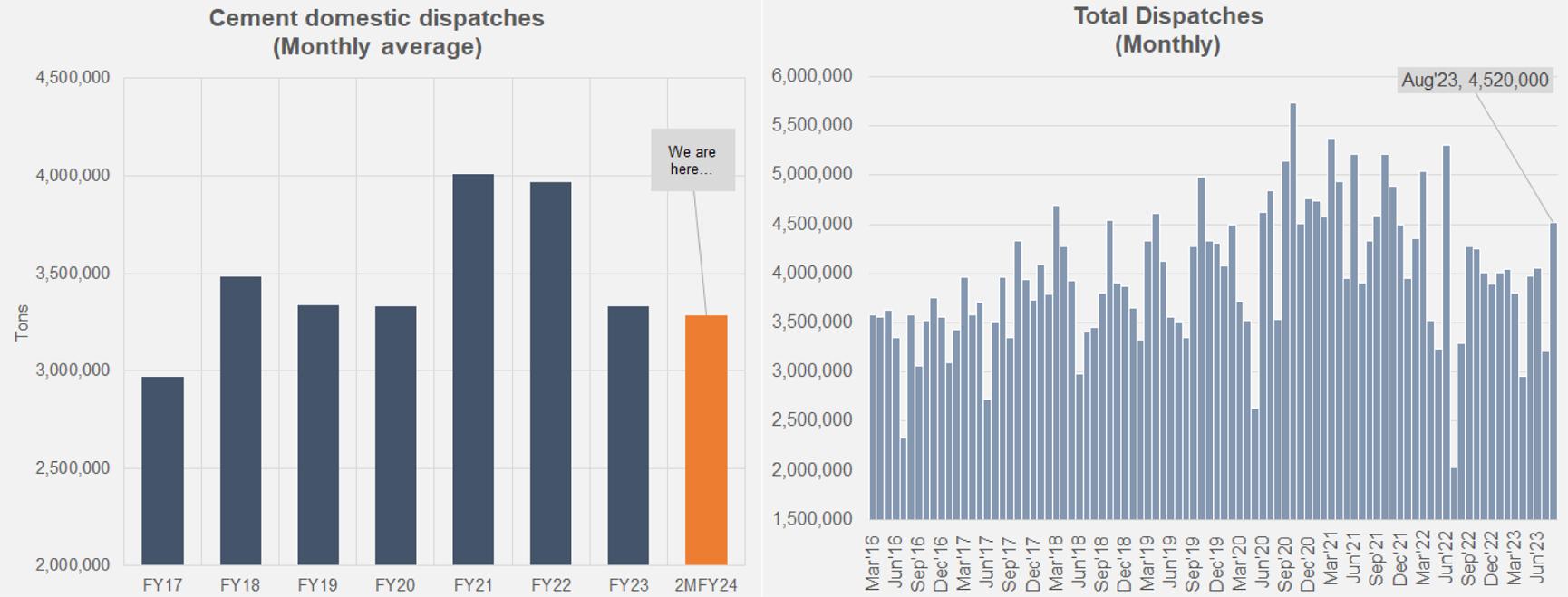

The country may be in the thick of an ongoing macroeconomic crisis, facing challenges on multiple fronts, but is construction on a rebound? Reported figures of cement dispatches show impressive growth in 2M. To be exact, a 45 percent increase in dispatches in the first two months of the fiscal year (FY24) sounds nothing less than a stunning recovery. It is certainly from a low-base of last year’s abymal sales, but the industry sold out about 7.7 million tons of cement to markets, 4.5 million tons in August alone which is higher than dispatches have been in the past 13 months. About 16 percent of these went out to exporting destinations—last year, this share stood at 10 percent. But the growth is not export-led entirely. In Aug-23, domestic dispatches are higher than they have been in at least the past eight months.

Exports have become more robust off of sheer demand recovery, not just in Afghanistan but overseas. Due to cheaper availability of coal and sliding freight rates, exports have become more viable for cement manufacturers. In fact, exports from the southern zone have been more dominant than ever. The domestic market recovery, however, makes less sense.

All demand drivers are in disarray. Prices are at their all-time high, and construction materials overall are substantially more pricey. In cities, buildings and home constructions are on a standstill. Banks are not extending credit for new borrowings in construction financing (both for buildings and civil engineering), gleaning from SBP’s credit data which may not be a major indicator for slowed down construction as so few builders have access to bank credit. Real estate is in a draught with prices dropping as there are fewer buyers in the market. This only leaves development and infrastructure projects where all these cement dispatches are heading. Certainly, ongoing development projects (such as hydro power projects) and other infrastructure investments are well in place and while some timelines have been disrupted due to floods, the projects have not been halted which guarantees continued sales. Meanwhile, new projects have been approved very recently related to railway lines and power projects that will expand demand as they are implemented.

At present, one way to confirm a demand recovery would be to consider sales for steel billets reported by PBS. Unfortunately, the last reported numbers for production in Large Scale Manufacturing (LSM) are for June which shows billet production dropped 16 percent during the outgoing fiscal year (FY23) vs cement’s 13 percent. If steel numbers can corrborate the sudden boost in cement dispatches, one would be less restrained about calling this 45 percent growth a recovery. One potential answer could also be the execution of the track and trace system for cement which may be have led to improved recording and reporting of dispatches under the watchful eye of the tax man.

Though, last thing of note here is the monthly average metric. Compared to that, the monthly average in FY24 so far (July and August) is lower than every year since FY17 (mind you, these monthly averages use dispatches numbers for the whole year). It may not be the fairest comparison—comparing a 2-month average to a 12 month-average but it does indicate that the present dispatches are not quite out of the ordinary, and do not necessarily negate the demand-side factors currently in play.

Comments

Comments are closed.