Petrol and diesel both soared to new highs last Saturday. It appears that years of messaging is finally starting to show results as a staggering increase for the fortnight did not lead to hours of media reporting from the petrol stations, or newspapers dropping the “petrol bomb” headlines – exceptions aside. Even the masses appear to have a resigned look – but that may well be because of the plight that has broken them – more than an appreciation of how things work.

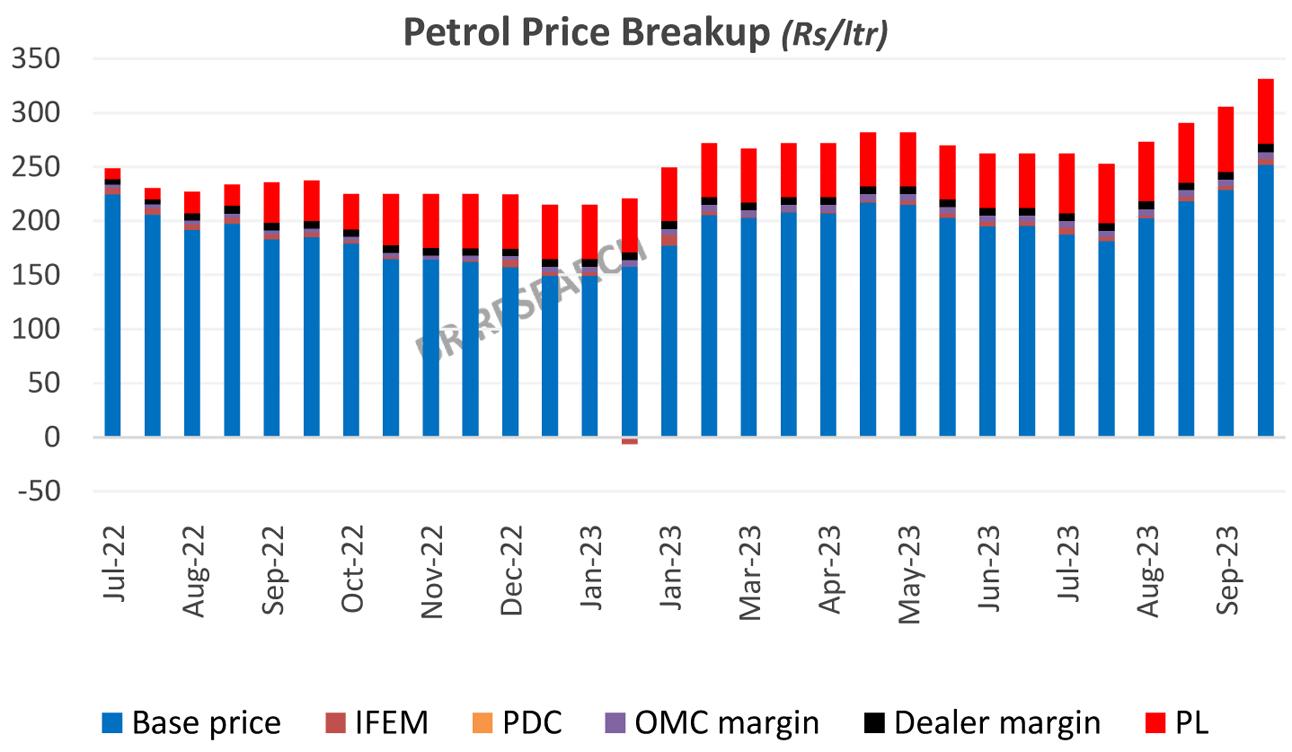

Be that as it may, the recent round of retail price increase in petroleum products is undoubtedly going to lead to a fresh round of inflation. A staggering Rs76/ltr has been added to high-speed diesel retail price in the last four fortnights. Motor gasoline (petrol) is not that far behind, with price going up by Rs73/ltr since the start of August 2023.

There is emerging consensus that taxes on petroleum prodcuts should be kept high to account for the externalities. Pakistan’s perpetual foreign excange crisis also neccessitates complete pass through of international prices, without having to forgo taxes – in order to keep the POL imports in check. At current rates, with the PL on petrol at 20 cents/liter, it is still 10 cents/liter shy of what the IMF deems fit for Pakistan in ideal circumstances. Even if one accounts for taxes at import stage, the continued absensce of GST on both petrol and HSD – still offers a room of Rs55/ltr on petrol, and Rs52/ltr on HSD. The IMF has not insisted on levying GST, and appears content with maximizing PL for now, therefore, the chances of that happening are slim.

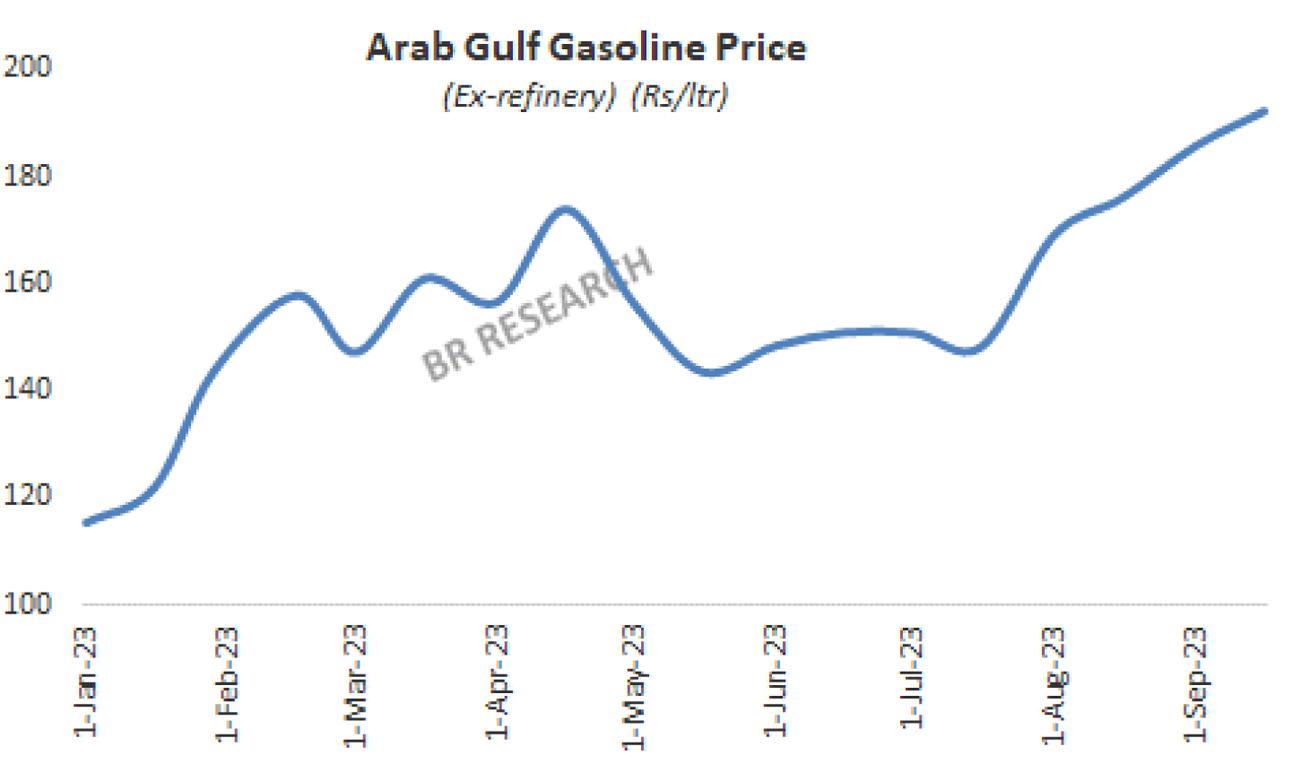

Dollar is what has driven POL prodcuts’ prices the most – as international oil prices are not even at a 12-month high – and far off from the record high seen in yesteryears. Price setting of petroleum prices is often termed as the uncontrollable – which is only partly true. A better functioning country would have its currency in a much better shape than Pakistan. The government in Paksitan has countless controls on price setting of a huge set of consumer products, applies (often counterproductive) controls on commodity movement to and from Pakistan, fails miserably in controlling illegal trade – all of which invariably leads to a weaker currency more often than not.

This is by no means a suggestion to hold on to the currency parity ala Dar, but letting go of controls elsewhere can sure be done. Whenever the currency is left at the mercy of traders, artificial shortages will be created one way or the other. The resultant retail price increase in petroleum prices almost always leads to increase in non-perishable food prices – with very few incidences of price reversals when petroleum prices go down.

Comments

Comments are closed.