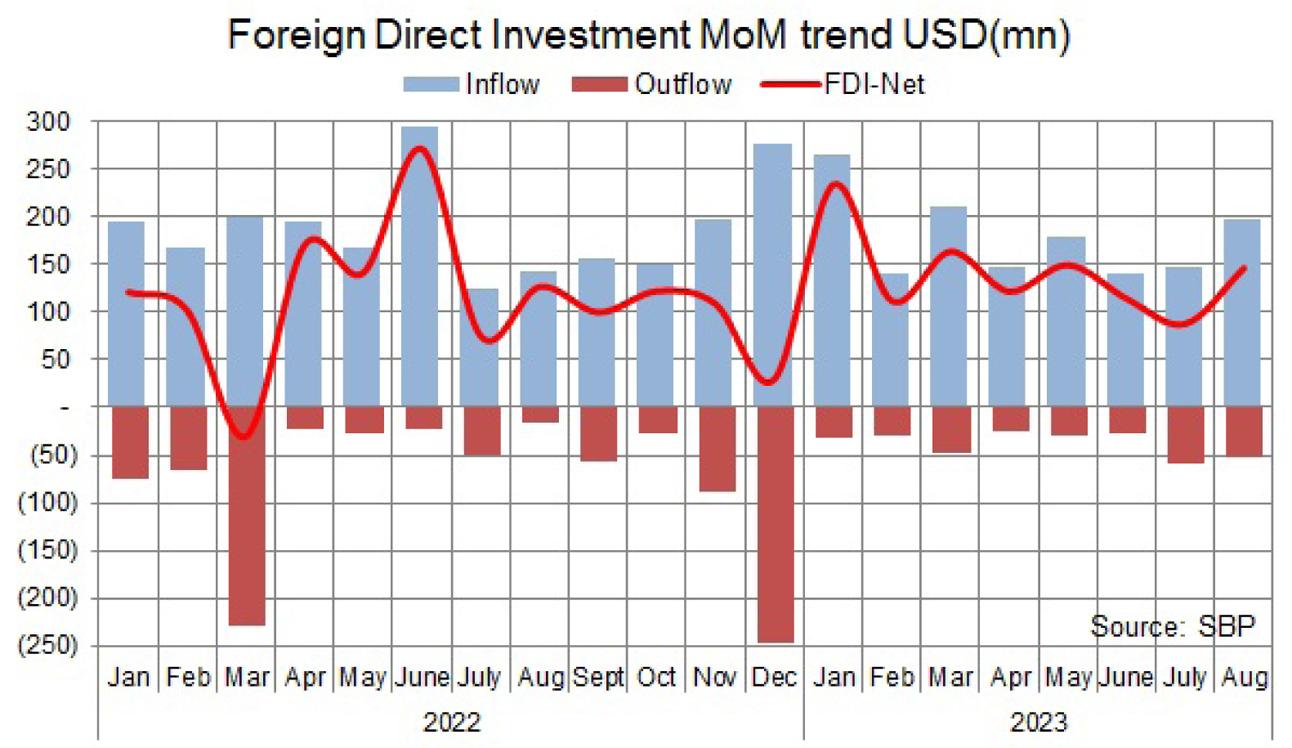

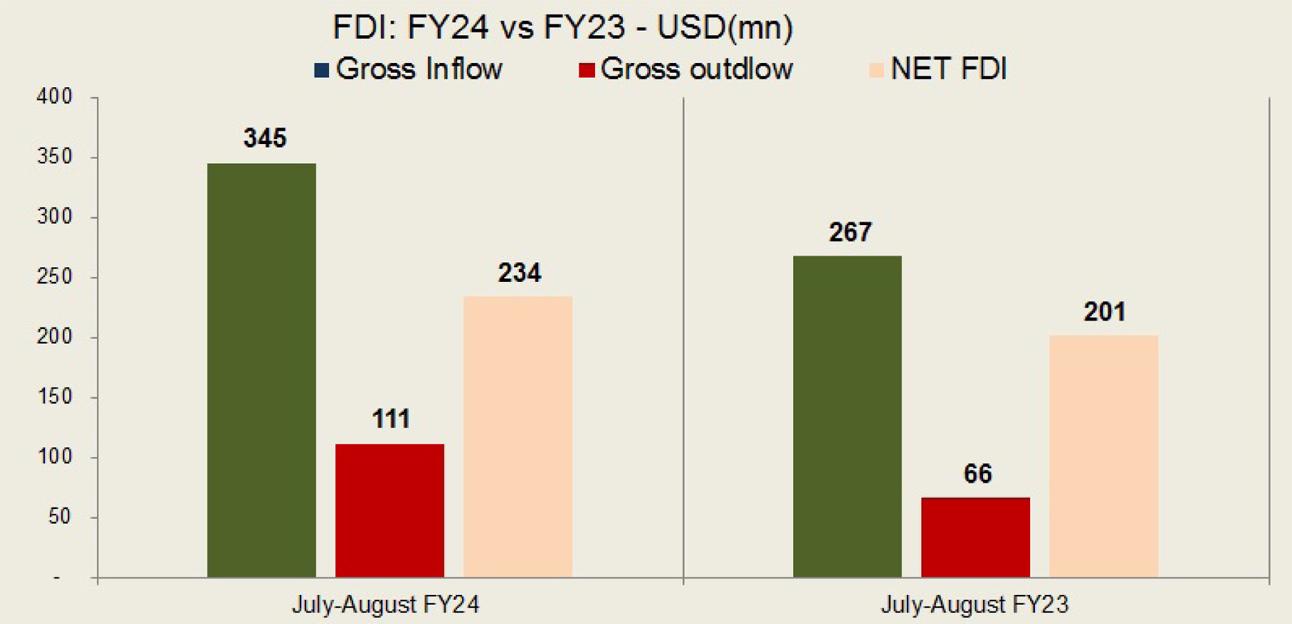

Foreign direct investment in the country has been falling continuously; it diminished by 25 percent year-on-year to only $1.5 billion dollars in FY23. However, some respite has been witnessed in FY24 as the FDI has posted growth in the first two months of the fiscal year. FDI in July 2023 was up by 17.3 percent year-on-year. As per the data released by the central bank, FDI in August 2023 has also witnessed a year-on-year growth of 15 percent. China continued to be the largest foreign investor in the country in July and August 2023, with a total direct investment of $50 million, followed by Hong Kong and Netherlands investing around $33 million and $43 million respectively. Overall, FDI in 2MFY24 was up by 16 percent year-on-year.

Sector wise, FDI continued to be concentrated in the power sector in August 2023, and the sector also saw a jump in net FDI in the sector for 2MFY24 by 24 percent. This was followed by the oil and gas sector that also witnessed a growth in FDI during the period. The other key sector, telecom and communication turned from net positive FDI to net negative FDI, while the financial business sector FDI declined by almost half in 2MFY24 compared to 2MFY23.

The announcement that the country will attract foreign investment of $60-70 billion over the next 3 to 5 years is a bit too ambitious and unrealistic especially when FDI is the weakest link in the balance of payment. For context, Pakistan attracted around $20 billion worth of FDI in the last 10 years. And about the recent growth in FDI, it might be too early to predict a recovery. The crackdown on forex companies has brought some curtailment to the currency’s freefall. But a lot of work is needed to restore investor interest, which right now has deteriorated massively.

Comments

Comments are closed.