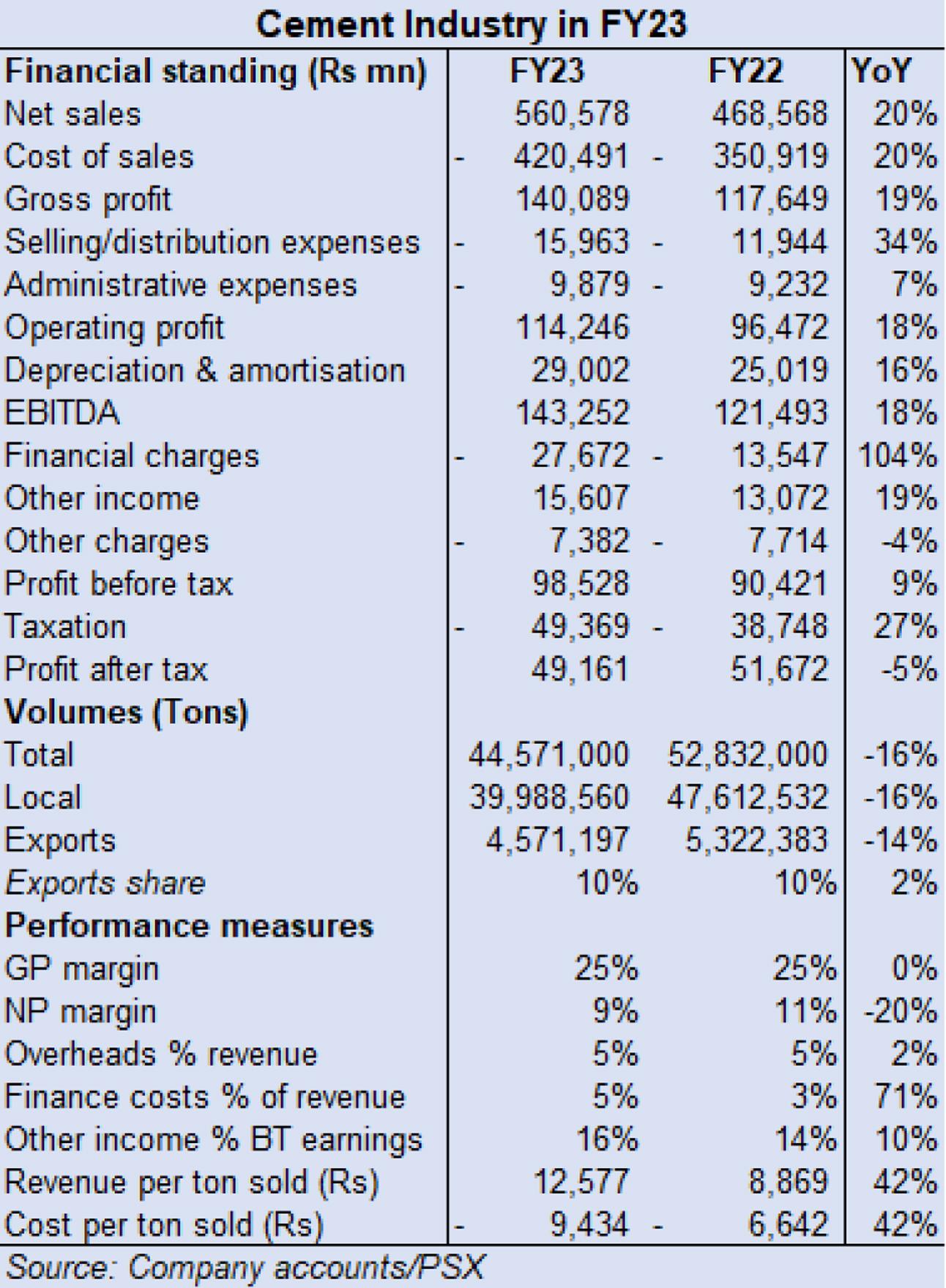

In a seemingly dull year- demand-wise- marked by a 16 percent drop in cement offtake, the cement industry’s combined earnings delivered a fairly stable financial performance, up 9 percent in before-tax profits, with post-tax earnings down 5 percent year on year only because of the hefty tax incidence FY23: 49%, FY22: 42%). This is from the results of 12 out of 16 listed cement companies. Margins stood strong at 25 percent during the year.

The decline in dispatches was mainly driven by the domestic market where construction demand was lacking in lustre as cost overruns and weak buying power delayed projects and purchasing decisions. Demand seems to have originated primarily from large scale projects related to infrastructure and energy where funding was in place and completion inflexible.

Mindful of their own costs rising- though most cement companies shifted to cheaper and readily available coal procured from Afghan and local sources thus also shielding themselves from the effects of PKR depreciation- cement industry raised prices in unison. We estimated the combined revenue per ton sold of the 12 companies, and found it rose 42 percent. Costs of goods sold per ton sold also grew 42 percent, thus leading to margin maintenance. It seems, the industry only raised prices enough to combat it’s own rising costs of production and price hikes were almost entirely cost-led.

But here we are also faced with the declining capacity utilization. Typically, falling capacity utilization implies companies must be scrambling to get to the customers before their “competitors” can. Too much capacity and too little demand means price competition. This means, prices would drop, rather than increase if capacity utilization plummets. That didn’t happen. In fact, cement prices kept increasing, in line with the general inflation. For one, it was clear that other goods going into construction were not becoming cheaper either, so dropping prices would not necessarily increase volumes. But there is something to be said about the intensity of knowledge about how your own competitors will react to changing economic conditions. Prices are easier to set and change when such knowledge is near to perfect.

For industry players to have pricing power, they will all have to stay in their own lane without trying to grab a greater market share. Cement is mostly a homogeneous commodity and there isn’t major differentiation in quality. Which means, buyers decisions depend on transport costs and as a result, geographic proximity to plants. Substantial difference in prices across cement brands could easily lead to substitution. This necessitates companies toeing the line on price consensus and/or following their market peers’ every move and only reacting to them.

Another possibility is that each cement player in complete isolation has a very strong estimation of real demand in the market and decides its order book is firm enough to simply pass on its rising costs to the customers knowing the customer would continue to buy what he absolutely needs. In either case, much like the rest of Corporate Pakistan, the cement industry perseveres even as the larger economy stays in the doldrum, and good for them!

Comments

Comments are closed.