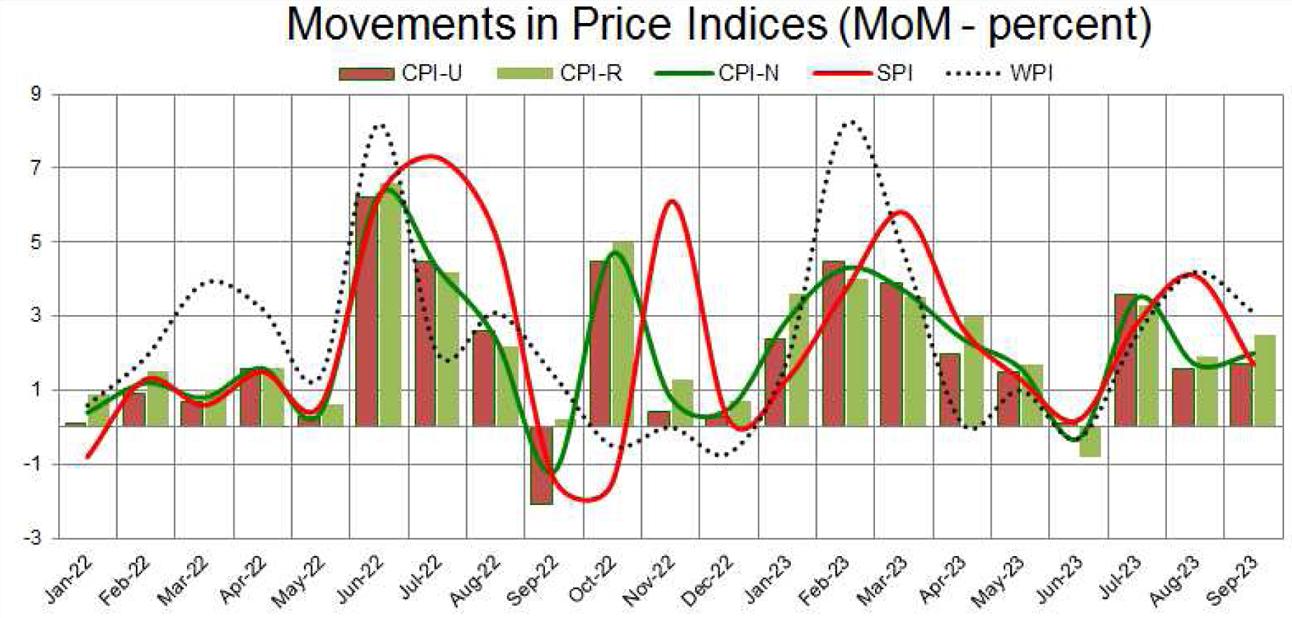

Waiting for inflation to taper is like Samuel Beckett’s Waiting for Godot, a theater in absurdity. It is showing no signs of taming, as the headline number stood at 31.4 percent in September 2023. On a month-on-month basis, the CPI has increased by 2 percent and the average monthly increase is 2.4 percent in the last three months. Inflation in 1QFY24 is at 29 percent versus 25.1 percent in 1QFY23.

This implies that there is a fresh wave of high inflation which is mainly due to the increase in energy prices – electricity and petroleum, and emergence of second round impact (wages and price behavioral changes, after massive inflation last year).

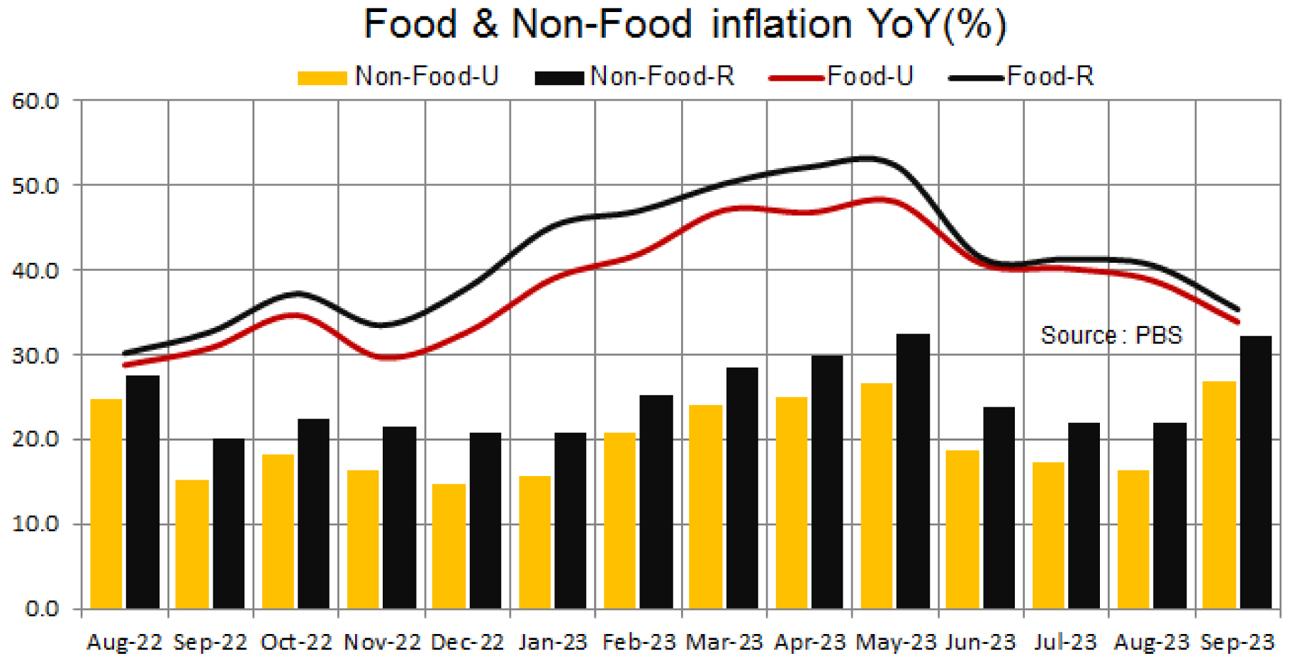

Interestingly, the second-round impact is more pronounced in the rural setting as compared to the urban. The rural core inflation stood at 27.3 percent (12M moving average at 22.9%) versus 18.6 percent (12M moving average at 17.4%) in the urban segment. Since this spell of inflation (for the last 1-2 years) is due to the shock in commodity prices, the impact is higher in rural areas. On the other hand, asset prices (indicated by subdued house rent and real estate prices) inflation is tamed. Hence, the impact is lower in urban areas.

The wages are perhaps increasing more in the rural areas, which is partially due to better crop prices of sugar, wheat, and other commodities. Then overall inflation (since May 2019) is significantly higher in rural areas – the price index is up 2.1 times in rural settings versus 1.9 times for urban dwellers in the same period, as food inflation weight is higher in rural areas. The pinch is felt more in the rural areas where the focus of media is limited.

In September, on MoM basis, food prices are up by 1.6 percent and the higher impact is due to seasonal rise in the perishable food items – up by 7.5 percent in a month, with increase in prices of onions are on the top. In non-perishable items, sugar took the trophy with 10.3 percent monthly increase in urban and 12.5 percent in rural areas.

The biggest monthly increase is in the transport index – up by 9.1 percent and again rural is higher with 11.3 percent increase while the urban transportation index is up by 7.8 percent. This is primarily due to hefty increase in fuel prices – thanks to both currency depreciation and sudden rise in the global oil prices. With currency appreciation last month, transportation is likely to be negative in October.

Then the second-round impact is visible by the increase in many other sub-indices. Health is up by 4.5 percent over the previous month and 25.3 percent over the same period last year. Then clothing and footwear monthly increase stood at 2.1 percent and yearly at 20.5 percent. The increase in other indices is already visible – such as yearly increase in recreational & culture, miscellaneous restaurants and hotels are at 58 percent, 36 percent and 34 percent, respectively.

Anyhow, overall inflation seems to be at its peaking point in FY24. There are upside risks, as rising global oil prices and any sudden drop in the currency could create new inflationary pressures. However, if the currency does not have any mad movement, the inflation is likely to taper off in the second half of the fiscal year – though SBP’s medium term target of 5-7 percent is likely to remain elusive.

Comments

Comments are closed.