HASCOL’s losses uncontrollable

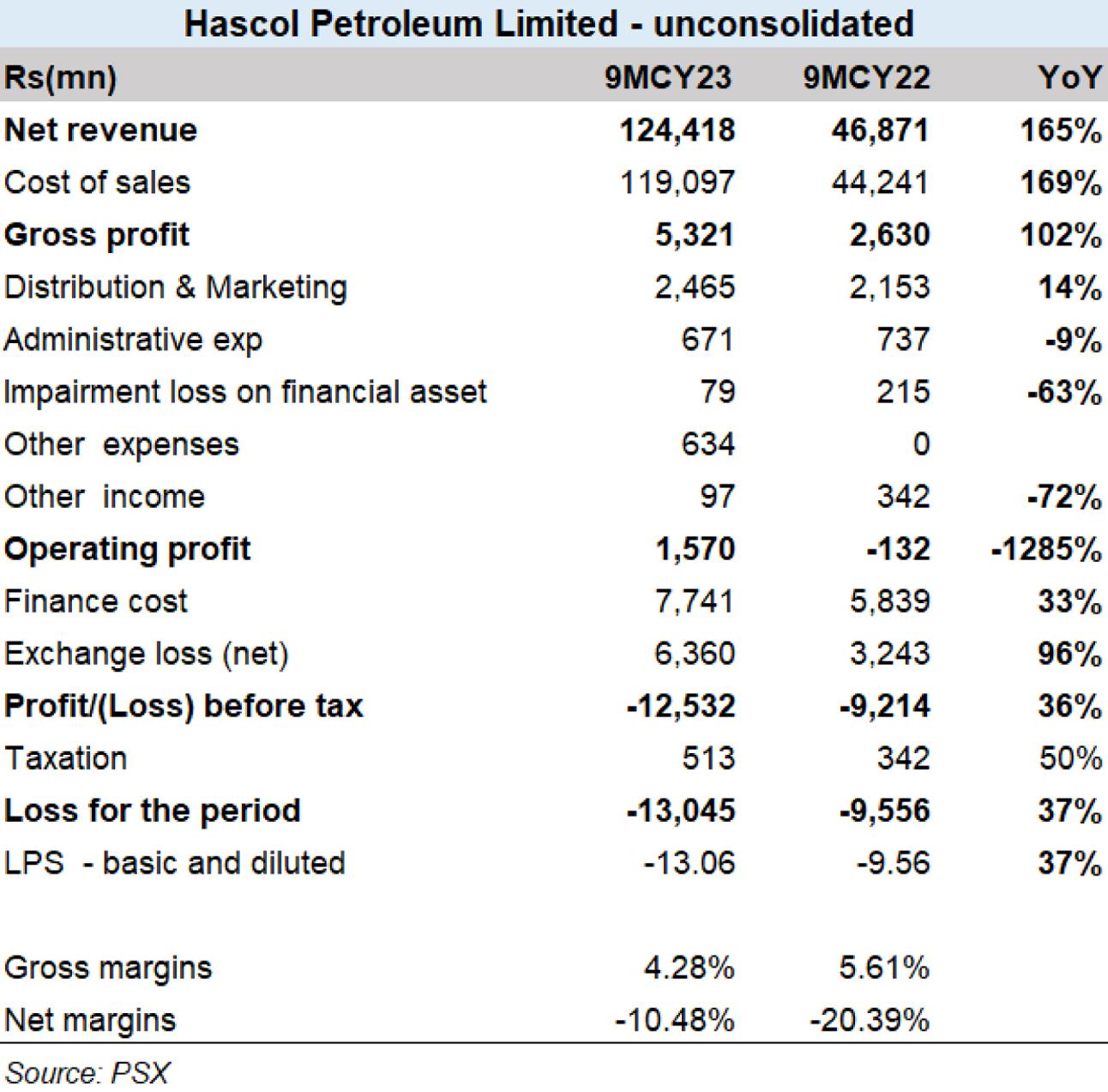

While Hascol Petroleum Limited (PSX: HASCOL) witnessed some decline in losses in 2021, the following years have continued with rising losses for the company. The oil marketing company’s profitability has been in shambles with 2022 loss after tax growing by 90 percent year-on-year to Rs14 billion. HASCOL’s 9MCY23 loss after tax stood at Rs13 billion, and it looks like CY23 (2023) is going to be another year of negative earnings – although the loss might be less than the all-time high loss for HASCOL in 2020 (Rs23 billion).

The oil marketing sector has been having an extremely challenging time amid steep devaluation of the currency and diminishing reserves, curtailment of imports, and skyrocketing inflation. During 9MCY23, HASCOL’s net sales were however, up whoppingly by 165 percent year-on-year, due to increase in sales volume and sales price. The company was able to show massive gross profit growth during the nine-month period despite higher cost of sales.

HASCOL’s operating expense remained subdued, but the operating profits were eaten by higher finance cost and staggering exchange losses. Due to currency devaluation during the year along with limited LC lines, HASCOL incurred exchange losses of Rs6.36 billion, up by 96 percent year-on-year. And along with 33 percent increase in finance cost amid higher interest rate environment, the OMC’s earnings slipped into the negative zone.

As per the company’s 1QCY23 director’s report, the company’s corporate revival plan, which is primarily about the restructuring of its bank debt is on track and is designed to lead to the injection of required fresh equity by existing and potential investors. Back in June this year, Taj Gasoline Limited, a private oil marketing company operating 61 retail sites in Sindh, had submitted a public announcement of intention to buy at least 41 percent shareholding of Hascol Petroleum Limited and HASCOL had okayed due diligence.

Comments

Comments are closed.