Aisha Steel Mills Limited (PSX: ASL) was incorporated in Pakistan in 2005 as a public limited company and started its commercial operations in 2012. The company is engaged in the manufacturing and sale of cold rolled coils and hot dipped galvanized coils. ASL is a company of Arif Habib Group and is one of the largest private sector investments in the local flat-rolled steel industry. Having its production unit strategically located at the Port Qasim, Karachi, the company not only caters to the local demand but also exports to many international destinations. The primary export destinations of ASL include North America, Asia, Africa, Europe and Middle East. ASL’s products serve as an important raw material to automobile, engineering and appliances industry which in turn produce value-added products for the local and export markets.

Pattern of Shareholding

As of June 30, 2023ASL has a total of 930.016 million shares outstanding which are held by 12,647 shareholders. Associated companies, undertakings and related parties which includes Arif Habib Equity (Private) Limited, Arif Habib Corporation Limited, and Fatima Fertilizer Company Limited etc have the majority stake of 47.45 percent in ASL’s outstanding shares followed by local general public holding 20.48 percent of ASL’s shares. Directors, their spouse and minor children account for 20.16 percent of the outstanding shares of ASL. Modarabas and Mutual funds hold 1.98 percent shares while Banking, Non-banking and development financial institutions represent 1.64 percent shareholding. The remaining shares are held by other categories of shareholders.

Historical Performance (2018 – 23)

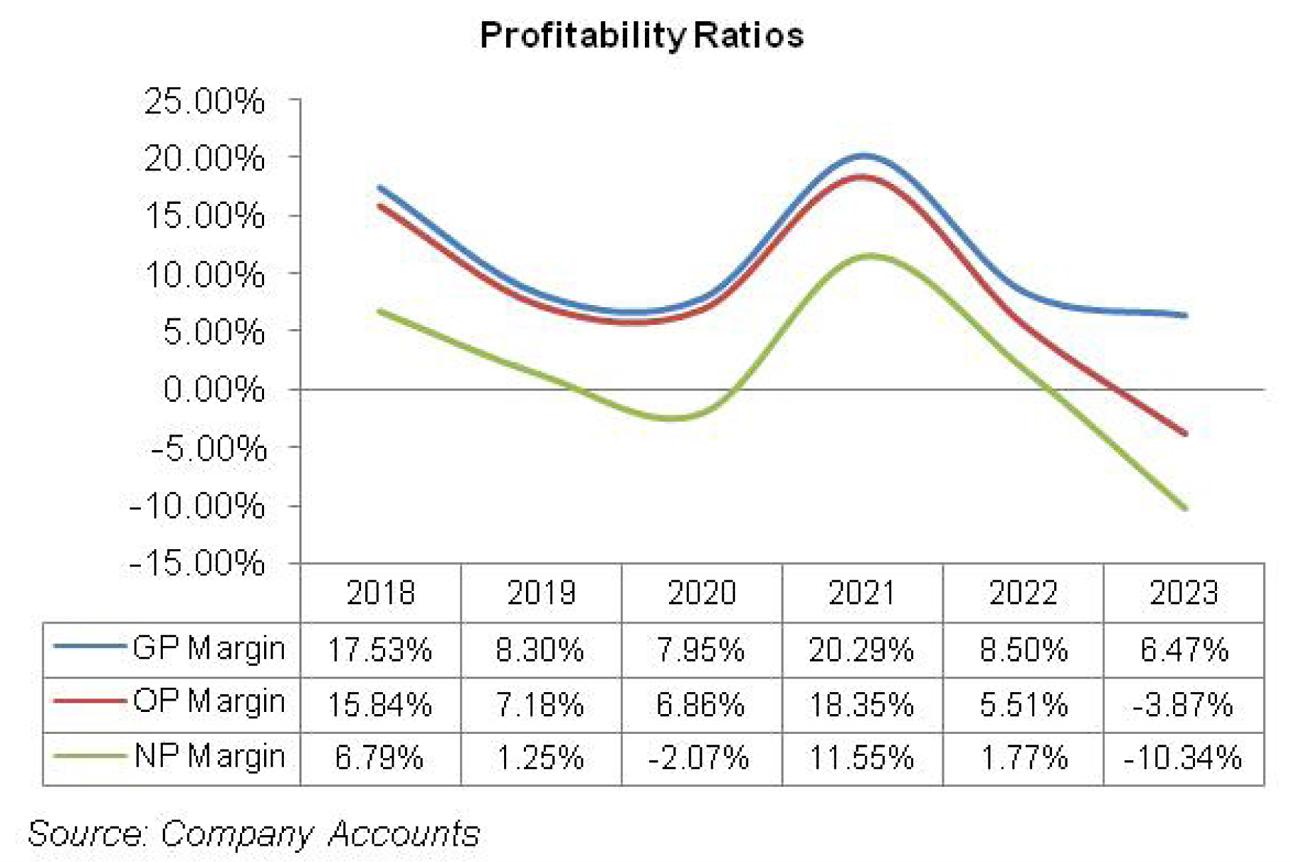

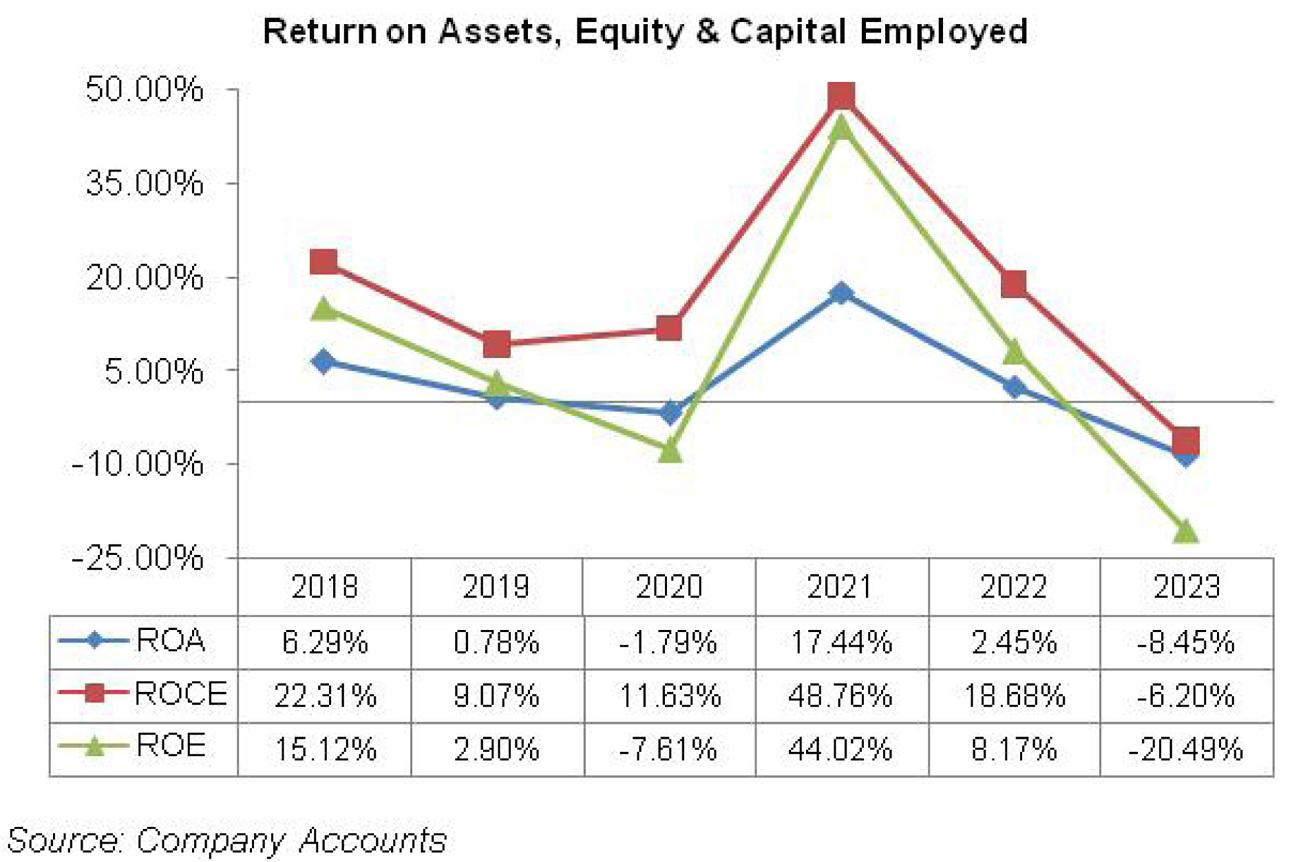

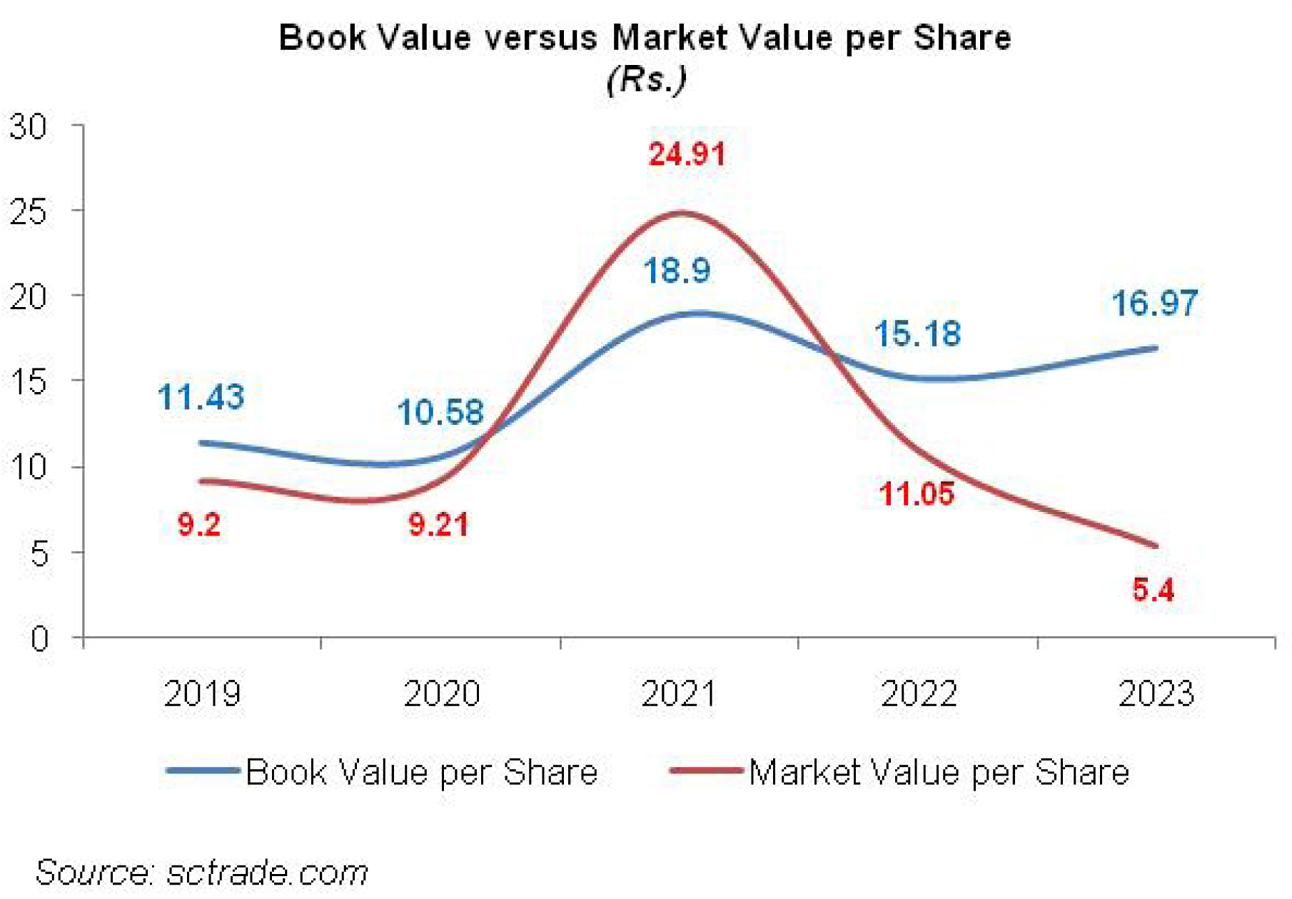

ASL’s topline which has been riding an upward trajectory since 2018 registered a massive plunge in 2023. Conversely, its bottomline and margins followed a declining trend until 2020, showed staggering turnaround in 2021 only to resume its downward trajectory thereafter. The detailed performance review of each of the years under consideration is given below.

In 2019, ASL’s topline registered a marginal 7 percent year-on-year rise. While there was a plunge in both production and sales volume during the year, stable prices of steel products helped ASL achieve higher net sales. In 2019, the company undertook massive expansion taking the total production capacity from 220,000 metric tons to 700,000 metric tons per annum but, on account of muted demand, ASL couldn’t realize optimum capacity utilization and produced 7 percent less than it did in the previous year (see the graph of production and sales volume). Higher steel prices and sharp depreciation of Pak Rupee resulted in 19 percent year-on-year hike in cost of sales in 2019. As a consequence, ASL recorded 49 percent thinner gross profit in 2019 with GP margin drastically falling from 17.5 percent in 2018 to 8.3 percent in 2019. Distribution and administrative expenses mounted by 31 percent and 30 percent respectively in 2019 mainly on account of payroll expense as well as legal & professional charges incurred during the year. ASL didn’t book any profit related provision in 2019, hence no other expense was incurred during the year. Finance cost hiked by 73 percent year-on-year in 2019 due to higher discount rate as well as increased borrowings during the year. Another major component of finance cost was exchange loss which escalated in 2019 due to weaker local currency. ASL’s bottomline slid by 80 percent year-on-year in 2019 to clock in at Rs.253.70 million with EPS of Rs.0.26 versus EPS of Rs.1.57 in 2018. NP margin also slipped from 6.8 percent in 2018 to 1.3 percent in 2019.

In 2020, ASL’s topline posted a massive 47 percent year-on-year rise. This was backed by upward revision in prices as well as 26 percent year-on-year rise in the company’s sales volume which stood at 258,453 tons in 2020. Cost of sales hiked by 48 percent year-on-year due to Pak Rupee depreciation despite the fact the steel prices subsided in the international market. Gross profit grew by 41 percent year-on-year in 2020, however, GP margin marched down to 7.9 percent. Distribution and administrative expense hiked by 67 percent and 28 percent respectively in 2020 mainly on account of higher payroll expense followed by higher legal & professional charges, utilities as well as repair & maintenance charges incurred during the year. Operating profit enlarged by 41 percent year-on-year in 2020 but OP margin ticked down to 6.9 percent. Finance cost surged by 82 percent year-on-year in 2020 due to higher exchange loss, increased borrowings and higher discount rate for most part of the year. ASL posted net loss of Rs.616.57 million in 2020 with loss per share of Rs.0.89.

FY21 appears to be the most fortunate year for ASL as not only did its sales volume grew by around 47 percent year-on-year to clock in at 379,622 tons, its topline multiplied by 85 percent year-on-year. This was on account of reforms implemented by the government of Pakistan to deal with economic imbalance. These included Rs.1, 24 trillion packages in the construction industry. This was the year when the local as well as global economy was recovering from the shocks of COVID-19 and massive trade and industrial activity took place in almost all the segments of the economy. This resulted in increase in the demand of commodities with steel being no exception. The global prices of steel peaked in 2021, however, Pak Rupee somewhat stabilized. ASL was also able to pass on the impact of cost hike to its consumers. As a consequence, gross profit mounted by 373 percent in 2021 with GP margin jumping up to 20.3 percent. In 2021, ASL not only performed brilliantly in the local market but its export sales also posted a massive rebound especially in North American and Asian. As a result of export sales, selling and distribution cost also picked up by 471 percent, particularly in the category of export clearance charges. This could’ve diluted the operating profit, but a considerable growth in other income on account of exchange gain saved the day and ASL attained OP margin of 18.3 percent in 2021– the highest since 2017.Finance cost also slumped by 55 percent in 2021 due to monetary easing, All these factors led to a stronger bottomline of Rs.6368 million in 2021 with EPS of Rs.8.21 and NP margin of 11.6 percent.

After bidding farewell to a blissful 2021, came a year full of challenges and shocks. Steel prices touched record high on the back of commodity super cycle in the international market. This coupled with weaker local currency proved to be a double whammy for ASL. Local economic activity remained suppressed due to political upheaval, high inflation and enormous fiscal imbalances. This resulted in 19 percent year-on-year fall in ASL’s sales volume to clock in at 306,213 tons. ASL’s topline grew by 18 percent year-on-year in 2022 primarily on account of upward revision in the prices of its products. Although international steel prices corrected in 2022, sharp depreciation in the value of Pak Rupee gave no respite to the cost of sales and GP margin plummeted to 8.50 percent, from its historic high of 20.95 percent in 2021. Gross profit also turned out to be 51 percent thinner than the last year level. Export sales showed an improvement particularly in the North American market; consequently, export clearance charges grew. This pushed selling and distribution charges up by 76 percent year-on-year in FY22. Administrative expense also surged by 11 percent year-on-year in 2022. Other income massively dropped as the exchange gain realized in 2021 on the back of stable currency vanished in 2022. Operating profit slipped by 65 percent year-on-year in 2022 with OP margin drastically falling to 5’5 percent. Then finance cost grew by 51 percent in 2022 owing to multiple hikes in the discount rate as well as increased working capital related borrowings. As a result, bottom line shrank by 82 percent year-on-year to clock in at Rs.1146.11 million in 2022 with EPS of Rs.1.27 and NP margin of 1.8 percent.

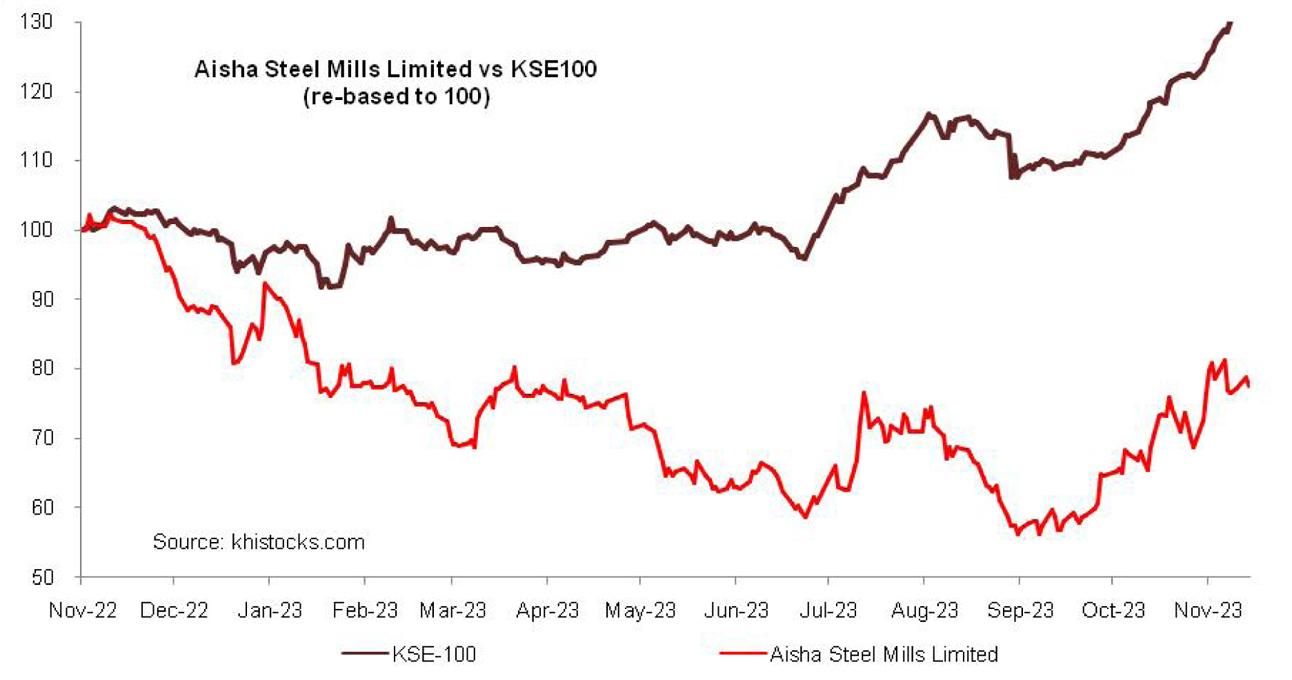

In 2023, ASL’s topline couldn’t keep pace with the economic and political headwinds circling the economy and dwindled by 52 percent year-on-year. Sales volume registered 60 percent year-on-year contraction to clock in at 122,334 tons in 2023. This was on account of slower demand due to sluggish business activity on account of import restrictions, demand suppression as well as devastating floods which destroyed the infrastructure and agricultural sector to a huge extent. Cost of sales slid by 51 percent year-on-year in 2023. Although steel prices tapered off in 2023 due to slowdown of major economies, ASL was not able to retain its GP margin owing to sharp depreciation of Pak Rupee. Gross profit nosedived by 63 percent year-on-year in 2023 with GP margin touching its 6-year lowest level on 6.5 percent. Distribution expense eroded by 66 percent year-on-year in 2023 due to decreased export sales. Administrative expense inched up by 5 percent year-on-year in 2023 due to high inflation. Massive exchange loss resulted in 132 percent spike in other expense in 2023. ASL registered operating loss of Rs.1203.79 million in 2023. Finance cost didn’t give any breather and surged by 58 percent year-on-year in 2023. This coupled with increase in local taxes further worsened ASL’s net loss which stood at Rs.3215.65 million in 2023 with loss per share of Rs.3.56.

Recent Performance (1QFY24)

ASL kicked off FY24 on a robust note with 62 percent year-on-year rise in its topline. This was the result of 36 percent greater volume sold during the quarter, clocking in at 38789 tons. Export sales also improved in 1QFY24 to stand at 2463 tons, up 6.2 times. Cost of sales grew by 50 percent year-on-year in 1QFY24 as steel prices remained stable during the period due to sluggish demand in China, America and Europe. Moreover, Pak Rupee also witnessed some appreciation in 1QFY24. This resulted in 577 percent bigger gross profit recorded by the company in 1QFY24 with GP margin moving up from 2.3 percent in 1QFY23 to 9.8 percent in 1QFY24. Higher export sales translated into 176 percent spike in distribution expense during the quarter. Administrative expense grew by a marginal 8 percent in 1QFY24 maybe on account of inflation. Exchange gain wiped off provisioning expense incurred during the year and resulted in a significant rise in other income in 1QFY24. ASL posted operating profit of Rs.1021.25 million in 1QFY24 versus operating loss of Rs.1206.50 million posted during the similar period last year. Higher discount rate pushed finance cost up by 20 percent year-on-year in 1QFY24. This diluted ASL’s bottomline. However, it was able to register net profit of Rs.35.24 million in 1QFY24 versus net loss of Rs.1411.34 million in 1QFY23. EPS stood at Rs.0.01 in 1QFY24 while NP margin clocked in at 0.3 percent.

Future Outlook

Although import restrictions have been eased, dwindling foreign exchange reserves don’t warranty any improvement in the CKD imports. Even if the supply side constraints show some respite, demand side factors will continue to impede the automobile sales as purchasing power of consumers have considerably dropped owing to high inflation and economic slowdown characterized by downsizing and layoffs. Hence demand in cold rolled coil category is anticipated to remain muted in the coming times. The margins may however rise owing to relatively stable currency and steel prices.

Comments

Comments are closed.