Bullish momentum at bourse, KSE-100 gains 294 points

- Analysts attribute bullish trend to reports that a staff-level agreement with the IMF will be inked in coming weeks

Bullish momentum was seen at the Pakistan Stock Exchange (PSX) amid improved market sentiments, as the benchmark KSE-100 Index gained 294 points during the trading session on Tuesday.

At 12:04pm, the benchmark index was hovering at 57,656.48 level, an increase of 578.52 points or 1.01%.

However, some profit-taking in later part of the day curbed the gains.

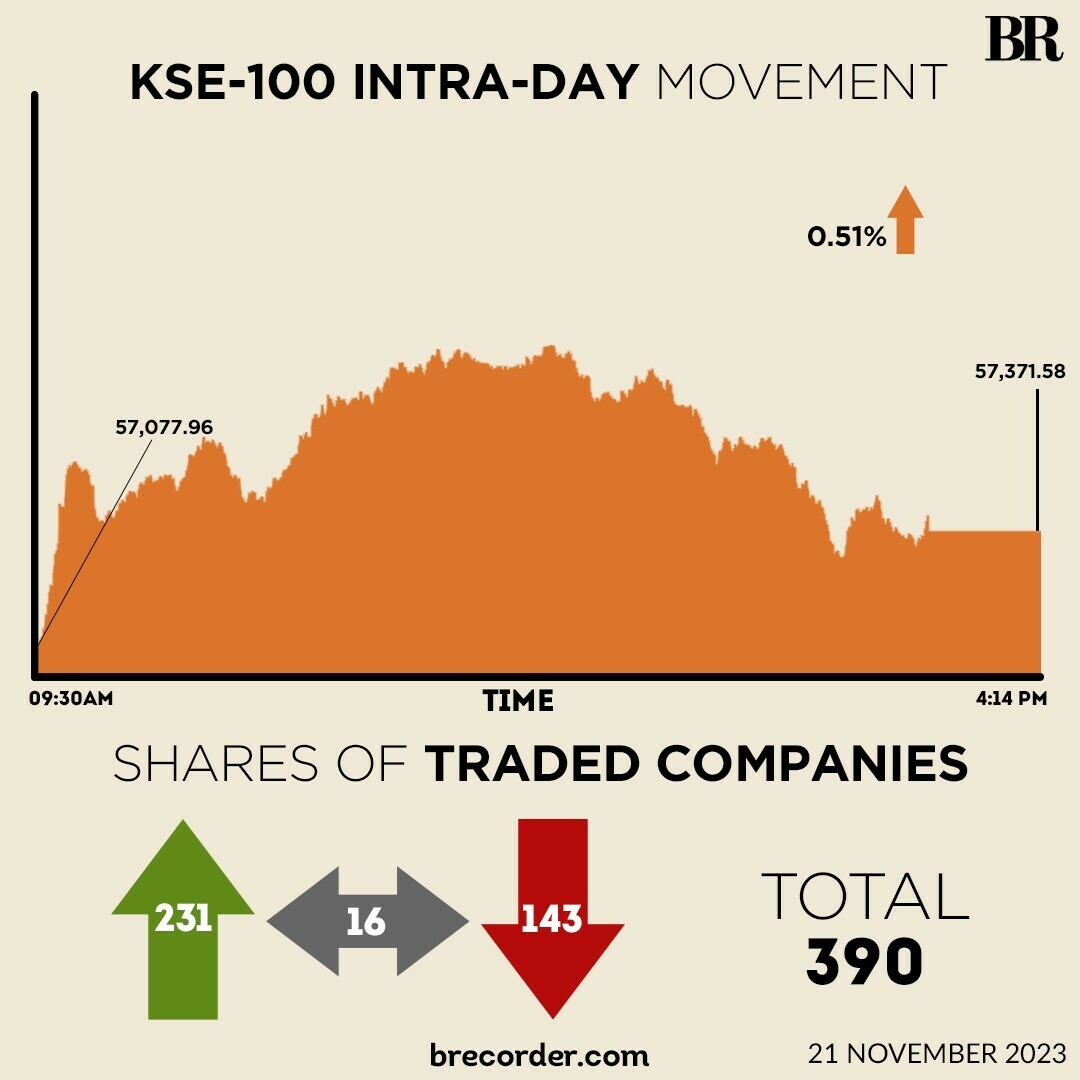

At close, the benchmark index settled at 57,371.59, up by 293.63 points or 0.51%.

“The equity market was positive today reportedly on the back of foreign buying interest. However, slight correction was seen towards the end of the session,” brokerage house Ismail Iqbal Securities said.

Across-the-board buying was witnessed, with index-heavy sectors including automobile assemblers, cement, commercial banks, fertilizer, oil and gas exploration companies and OMCs trading in the green.

On Monday, the PSX had witnessed a range-bound session, as the benchmark KSE-100 Index closed at 57,077.96, up by only 15 points or 0.03%.

Analysts attribute Tuesday’s bullish trend to reports that a staff-level agreement between Pakistan and the International Monetary Fund (IMF) authorities will be inked in the coming weeks.

Moreover, improved economic indicators including a decline in the current account deficit and a break in the rupee’s depreciation run are also contributing to the positive sentiment.

Pakistan’s current account posted a deficit of $74 million in October 2023, according to data released by the State Bank of Pakistan on Monday.

Meanwhile, the Pakistani rupee registered gains against the US dollar for the fourth successive session, as it appreciated 0.06% in the inter-bank market on Tuesday. As per the State Bank of Pakistan, the local currency settled at 285.79, an increase of Re0.18.

On a yearly basis, the CAD was significantly lower, i.e. over 91%, than the $849 million recorded in the same month last year. The decline was attributed to improvement in exports and remittance inflows and a reduction in the import bill.

Volume on the all-share index increased to 1,012.25 million from 718.2 million a session before.

The value of shares rose to Rs19.33 billion from Rs16.6 billion in the previous session.

WorldCall Telecom remained the volume leader with 254.27 million shares, followed by K-Electric Ltd. with 63.3 million shares and Hum Network with 38 million shares.

Shares of 390 companies were traded on Tuesday, of which 231 registered an increase, 143 recorded a fall, while 16 remained unchanged.

Comments

Comments are closed.