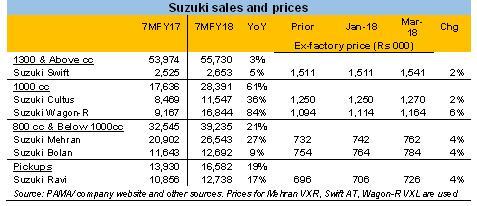

In January, Pakistan Suzuki Motor (PSX: PSMC) wasn’t the only one to increase prices of its cars (up to Rs20,000); Honda and Indus Motors were right there with Suzuki, raising prices by 2-4 percent after the rupee devaluation of 5 percent. The price increase was inevitable. But only two months after that, Suzuki has once again raised prices across the board by up to Rs50,000. The new prices came into effect this month (see table).

The price increase comes after the company stopped taking bookings for its Wagon-R in February and reintroduced the model with some cosmetic changes (e.g. improvement in tyres) that some are saying do not justify the 6 percent price increase. In fact, it has been a long running complaint of consumers that model uplift exercises by existing assemblers often do not enhance the usability, functionality and the overall quality of the cars in question.

The growth in sales, however, is on Suzuki’s side. And it seems in turn that the company has a lot of confidence in its market share and price elasticity of demand.

Curiously, this price hike comes at a time when a handful of new players are bidding to enter the market, expand the playing field and potentially cause some disruption. Not to mention, hoards of used cars are coming into the country (more than 30,000 have come in the first six months of the current fiscal year) after the new policy to curb them failed to materialize. (“Hello, used cars”, published Feb 23, 2018).

https://www.brecorder.com/2018/02/23/400870/hello-used-cars/

The ensuing competition over the next year should not be underestimated, especially from used cars that are mostly in the same segment as Suzuki operates in. New players however, will take a significant time period to set their roots and compete with the three existing car assemblers. And while they may cinch a bit of market share from all three, Suzuki is expected to keep its niche in the proverbial small car category.

Perhaps, seeing its flourishing demand, Suzuki is just capitalizing on it as long as it can, raising prices by a margin that will likely fall within the purchasing power of its consumers. Only sales numbers will tell how this decision sits with consumers and car buyers over the next few months.

Comments

Comments are closed.