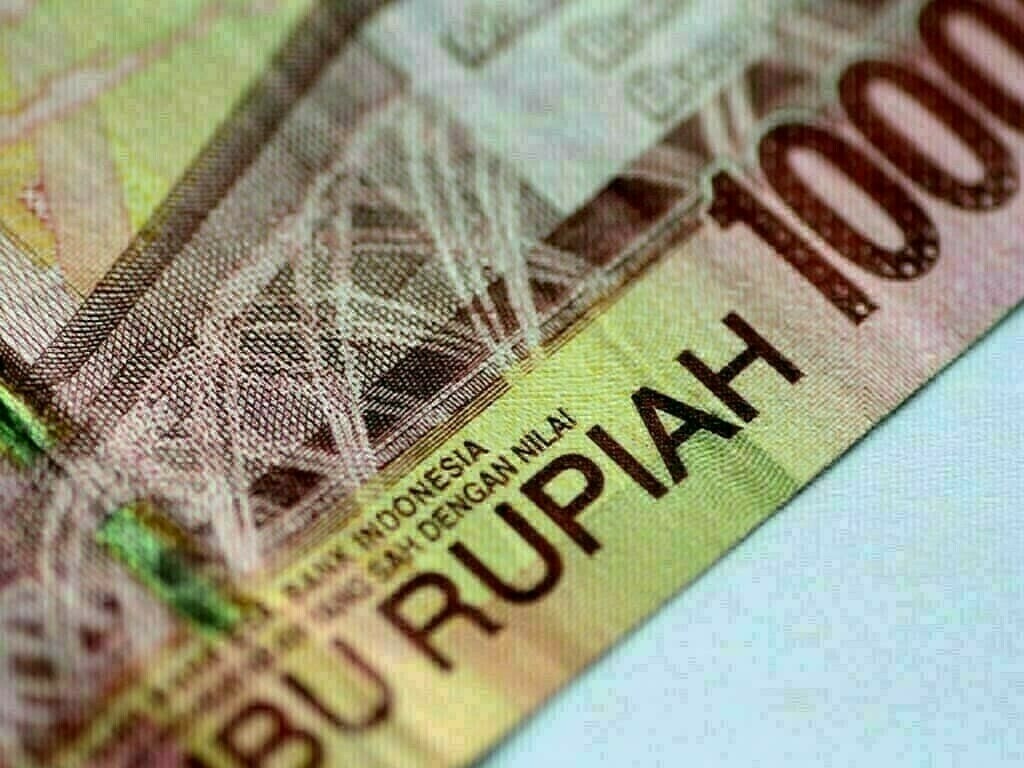

BENGALURU: Indonesia led the gains in Southeast Asian currencies and equities on Monday, after weak US economic data raised expectations of further interest rate cuts.

The Indonesian rupiah climbed 0.3% against the US dollar to its highest since January 24. The Malaysian ringgit

and the Taiwanese dollar followed closely with a 0.2% gain each.

The dollar held ground in Asian hours. But that was after a 1.2% slide last week, including due to a delay in the introduction of US tariffs and as a bigger-than-expected drop in US retail sales raise expectations that the Federal Reserve may cut rates two times this year, instead of just once.

The Philippine peso, however, was a laggard, slipping 0.5%. The peso gained on Thursday after the central bank unexpectedly held rates but has been under pressure since Friday when the governor said the move was to hedge against uncertainties over global trade policies.

In Indonesia, though, the market is widely expecting a quarter-point rate cut on February 19 to bolster growth. The rupiah is on a four-day rally, mainly due to plans to launch a new sovereign wealth fund on February 24 to help the country reach a target of 8% annual economic growth by 2029.

(The) “Dollar decline can also provide the IDR relief, backing a BI (central bank) cut,” Maybank analysts said.

Asian stocks largely traded higher, with markets in Jakarta

and Taipei rising by 2.5% and 1.5%, respectively. Shares in Seoul and Singapore also gained more than 0.5% each.

Equities in Thailand, however, extended losses to drop more than 2% as index heavyweight Delta Electronics sank 26% after posting weak annual earnings.

Comments