Engro Polymer & Chemicals Limited

Engro Polymer & Chemicals Limited (PSX: EPCL) was incorporated in Pakistan in 1997. EPCL is a subsidiary of Engro Corporation which is a subsidiary of Dawood Hercules Corporation Limited. The company is engaged in the manufacturing, marketing, and selling of Poly Vinyl Chloride (PVC), Caustic Soda, Vinyl Chloride Monomer (VCM,) and related products. The company also has a captive power plant and water recycling plant in its integrated chemical complex. The surplus power produced by the company is also supplied to Engro Fertilizers Limited.

Pattern of Shareholding

As of December 31, 2024, EPCL has 908.92 million shares outstanding which are held by 34,310 shareholders. Associated companies, undertakings, and associated companies are the major shareholders of EPCL holding around 77.35 percent shares. Within this category, Engro Corporation Limited takes the lead, followed by Mitsubishi Corporation. Local general public accounts for 15.51 percent of the company’s shares followed by Insurance companies holding 4.9 percent shares. The remaining shares are held by other categories of shareholders.

Financial Performance (2019-2024)

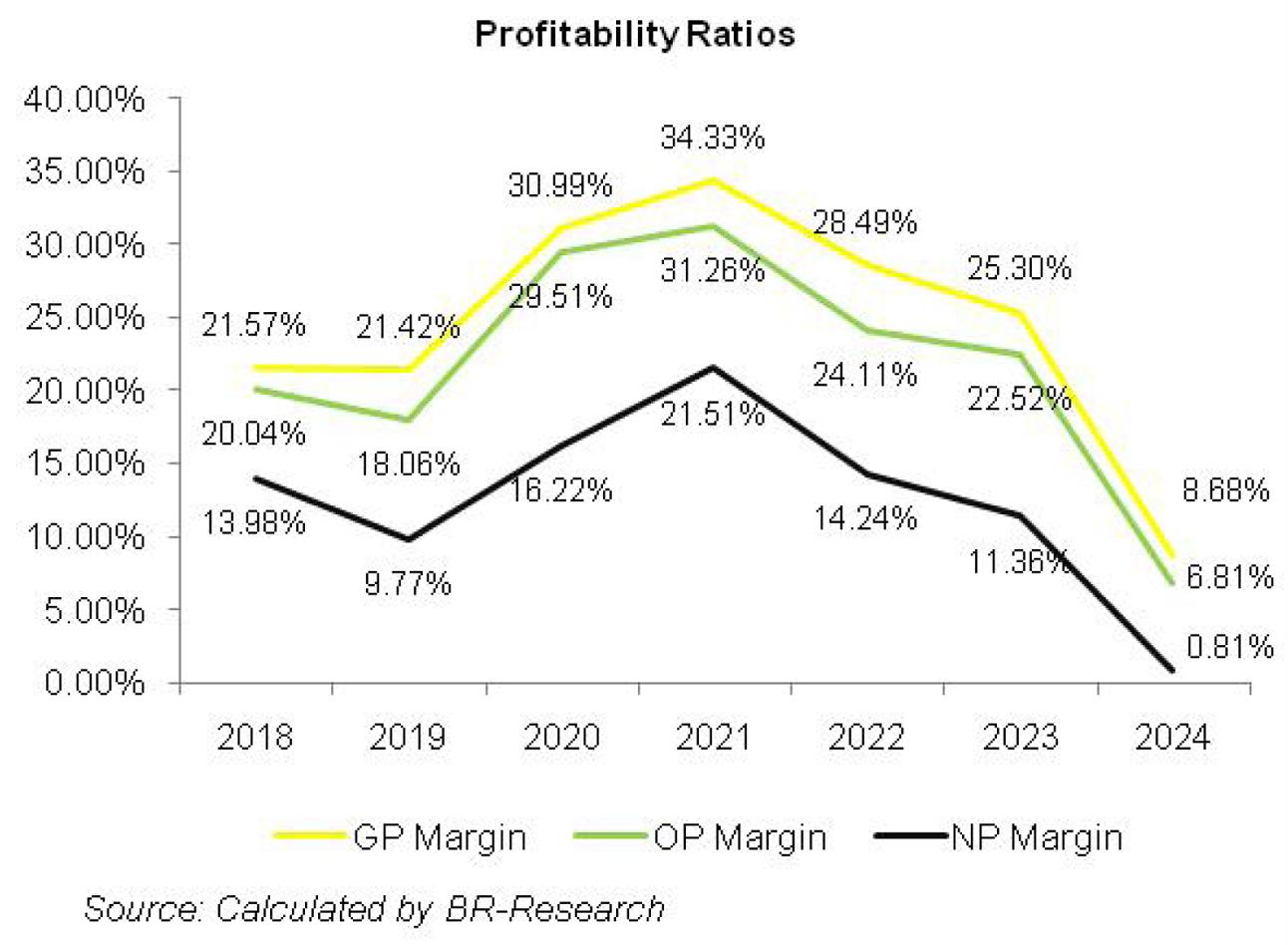

Over the period under consideration, EPCL’s topline slid in 2020, 2023 and 2024. Its bottom line posted a plunge in 2019, 2023, and 2024. The company’s margins which posted a drop in 2019 posted significant growth for the subsequent two years. This was followed by a drastic fall in margins since 2022 (see the graph of profitability ratios). The detailed performance review of the period under consideration is given below.

In 2019, EPCL’s topline posted a year-on-year uptick of 7.27 percent to clock in at Rs37,836.63 million. The paltry topline growth was due to a slowdown in the PVC market owing to deteriorated construction activities in the country and the dumping of PVC from other sources. The Chlor Alkali market also declined during the year owing to CNIC requirements, imposition of sales tax on local sales, and also because of gas curtailment… During the year, the sales volume of PVC and caustic soda dipped by 6 percent and 4 percent respectively to clock in at 191 KT and 83 KT. In 2019, the caustic flake facility also came online and registered a sales volume of 1KT, particularly in the export market. The cost of sales grew by 7.47 percent in 2019 due to inflation, Pak Rupee depreciation, and higher gas prices. However, the company’s ability to venture into a high-margin export market and implementation of cost control measures resulted in a 6.54 percent improvement in gross profit in 2019 with GP margin clocking in at 21.42 percent versus GP margin of 21.57 percent recorded in the previous year. Distribution expense inched up by 1.78 percent in 2019 due to higher salaries of the sales force coupled with increased traveling, conveyance, and training charges incurred during the year. Administrative expenses inched down by 1 percent in 2019 due to lower payroll expenses despite workforce expansion from 455 employees in 2018 to 508 employees in 2019. Other expenses mounted by 49.94 percent in 2019 due to higher exchange losses. Other income dipped by 25.54 percent in 2019 mainly because of the high-base effect as the company recorded insurance income recognized in the previous year on account of business interruption. EPCL recorded a 3.34 percent decline in its operating profit in 2019 with OP margin clocking in at 18 percent versus OP margin of 20 percent recorded in the previous year. Finance costs surged by 196.22 percent in 2019 on the back of a high discount rate and an increase in the utilization of borrowing lines. Net profit tumbled by 25 percent to clock in at Rs.3696.06 million in 2019 with EPS of Rs.4.07 versus EPS of Rs.6.21 recorded in the previous year. NP margin also dwindled from 13.98 percent in 2018 to 9.77 percent in 2019.

2020 was the year when the company recorded impressive margins, never witnessed before. Moreover, despite a 6.62 percent dip in net sales, the bottom line grew by over 55 percent year-on-year. Suppressed topline was a result of muted offtake of both PVC and Caustic which dipped year-on-year by 15 percent and 27 percent respectively to clock in at 163 KT and 61 KT. The impact of low offtake was partially offset by higher PVC prices and cost-control measures implemented during the year. EPCL posted an impressive GP margin of 31 percent in 2020 with gross profit multiplying by 35 percent. Distribution expense declined by 24.83 percent in 2020 due to considerably lower sales promotion expenses, lesser salaries, and curtailed travelling & conveyance charges incurred during the year. Administrative expenses dropped by 3.52 percent in 2020 due to a considerable decline in communication, travelling, conveyance, and training charges incurred during the year on account of COVID-19. This was partially offset by higher payroll expenses incurred during the year as the number of employees increased to 563 in 2020. Other expenses slumped by 30.77 percent in 2020 due to a massive decline in exchange loss. Other expense was completely offset by 26.80 percent higher other income recorded in 2020. This was due to higher income from financial assets at FVTPL and amortized costs. EPCL’s operating profit improved by 52.56 percent in 2020 with OP margin attaining a new high level of 29.51 percent. Finance costs escalated by 22.15 percent in 2020 due to an increase in long-term loans on account of the utilization of ILTFF to finance its PVC expansion project. EPCL recorded 55 percent growth in its bottom line which stood at Rs.5730.24 million in 2020. This translated into EPS of Rs.6.28 and NP margin of 16.22 percent.

2021 proved to be the most fortunate year for EPCL. An increase in PVC and Caustic volumes coupled with higher PVC prices on account of global supply constraints resulted in 98 percent year-on-year growth in EPCL’s topline which clocked in at Rs.70,021.68 million. PVC volume increased by 28 percent to clock in at 208 KT in 2021. Similarly, caustic soda and caustic flakes also recorded year-on-year growth of 12 percent and 250 percent respectively to clock in at 68 KT and 7 KT. EPCL recorded a 119.52 percent improvement in its gross profit with GP margin attaining its highest level of 34.33 percent in 2021. Higher sales volume resulted in a 37.92 percent escalation in EPCL’s distribution expense mainly because of increased dealer commission, higher salaries of the sales force, and elevated travelling, conveyance, and training charges incurred during the year. EPCL hired more employees due to the completion of its expansionary projects during the year. The workforce stood at 598 employees in 2021. This resulted in higher payroll expenses which pushed up the administrative expense by 24.95 percent in 2021. Other expenses mounted by 177.21 percent in 2021 due to higher exchange loss and increased provisioning done for WWF and WPPF. Other income ticked up by 12.48 percent in 2021 due to higher income from investment at fair value. EPCL recorded 109.98 percent higher operating profit in 2021 with OP margin jumping up to 31.26 percent. A low discount rate coupled with repayment of loans during the year enabled EPCL to lessen its financial cost by 13.13 percent in 2021. The bottom line of the company grew by 162.83 percent year-on-year in 2021 to clock in at Rs. 15.060.51 million. This translated into EPS of Rs.16.32 and NP margin of 21.51 percent.

As against 2021 where the company enjoyed a robust topline and bottom line, 2022 was a rather depressing year for EPCL. During 2022, the company was able to achieve a topline growth of 17.19 percent year-on-year. This was despite low PVC prices due to global economic uncertainty coupled with high volatility in international energy prices. Topline growth was the result of Pak Rupee depreciation which magnified the value of its export sales. Moreover, PVC sales volume also increased by 11 percent to clock in at 231 KT in 2022. High cost of sales owing to the depreciation of the Pak Rupee and high fuel and energy (RLNG) charges resulted in a 2.73 percent year-on-year drop in the gross profit with GP margin falling down to 28.49 percent. Distribution expense escalated by 44.62 percent in 2022 mainly due to higher dealer commission and sales promotion expenses incurred during the year. Administrative expenses mounted by 47 percent in 2022 due to inflationary pressure and also because of the induction of new employees which took the tally to 601 employees in 2022. Other expenses multiplied by 46.12 percent in 2022 due to massive exchange loss incurred during the year on account of Pak Rupee depreciation. Other income grew by 11.62 percent in 2022 due to higher income on bank deposits and income from financial assets at amortized cost. Operating profit slid by 9.61 percent in 2022 with OP margin shrinking to 24.11 percent. Finance cost enlarged by 62.43 percent in 2022 predominantly because of the higher discount rate. Net profit slid by 22.39 percent to clock in at Rs.11,689.12 million in 2022 with EPS of Rs.12.39 and NP margin of 14.24 percent.

In 2023, EPCL’s topline dipped by 1 percent to clock in at Rs.81,224.45 million. This was due to lower prices and sales volume of both PVC and caustic soda on account of turbulence in the local and global macroeconomic backdrop. Despite the thinner topline, the cost of sales registered a 3.4 percent spike in 2023 on the back of the Pak Rupee depreciation and elevated gas prices. This translated into a 12.11 percent dip in EPCL’s gross profit in 2023 with GP margin dipping to 25.30 percent. Distribution expense ticked up by 7.19 percent in 2023 as higher salaries and dealer commission were offset by lower sales promotion expenses as well as lesser traveling & conveyance charges incurred during the year. Administrative expenses mounted by 60.85 percent in 2023 due to higher payroll expenses as well as increased cost of purchased services. Lower profit-related provisioning and exchange loss culminated in a 50.78 percent drop in other expenses in 2023 which was almost offset by 15.21 percent higher other income recorded during the year. Higher other income was the result of insurance claims, higher scrap sales, higher profit on bank deposits, and income on loans granted to subsidiary companies. Operating profit slid by 9 percent in 2023 with OP margin descending to 22.52 percent. Finance cost magnified by 35.75 percent in 2023 due to higher discount rates and increased utilization of working capital lines. Net profit tapered off by 23.18 percent to clock in at Rs.9230.66 million in 2023. This translated into EPS of Rs.9.45 and NP margin of 11.36 percent.

In 2024, EPCL’s topline slid by 6.83 percent year-on-year. There was a slight improvement in PVC demand due to a gradual revival in economic activity; however, there was a decline in international PVC prices which put downward pressure on the top line. Overall, PVC volumes remained low compared to the previous year. Caustic soda volumes slightly improved in 2024. Despite topline compression, the cost of sales mounted by 13.90 percent in 2024 on the back of higher gas and raw material prices. This resulted in a 68 percent contraction in gross profit with GP margin falling down to its lowest level of 8.68 percent in 2024. Distribution expense inched up by 5.46 percent in 2024 due to higher dealer commission, increased cost of purchased services, and elevated training, traveling, and conveyance charges incurred during the year. Administrative expenses soared by 27 percent in 2024 due to an exorbitant rise in the cost of purchased services. This was partially offset by lower payroll expenses as the company streamlined its workforce from 584 employees in 2023 to 540 employees in 2024. Other expenses slumped by 87.95 percent in 2024 as no exchange loss was incurred during the year owing to the stability in the value of local currency. Other income also dwindled by 11.43 percent in 2024 due to a considerable decline in income from investments due to lower cash availability and a drop in discount rate. EPCL registered a 71.82 percent year-on-year fall in its operating profit in 2024 with OP margin descending to 6.81 percent. Finance costs escalated by 79.23 percent due to increased short-term and long-term borrowings which was partially offset by a lower discount rate. EPCL’s net profit eroded by 93.39 percent to clock in at Rs.610.34 million in 2024 with EPS of Rs.0.45 and NP margin of 0.81 percent.

Future Outlook

Going forward, the company’s margins are expected to shrink due to stable PVC prices, range-bound ethylene prices, and high energy costs. Demand is expected to improve owing to stable macroeconomic conditions.

Comments