Buying momentum at PSX, KSE-100 rallies above 115,000

- Experts attribute optimism to developments on IMF front

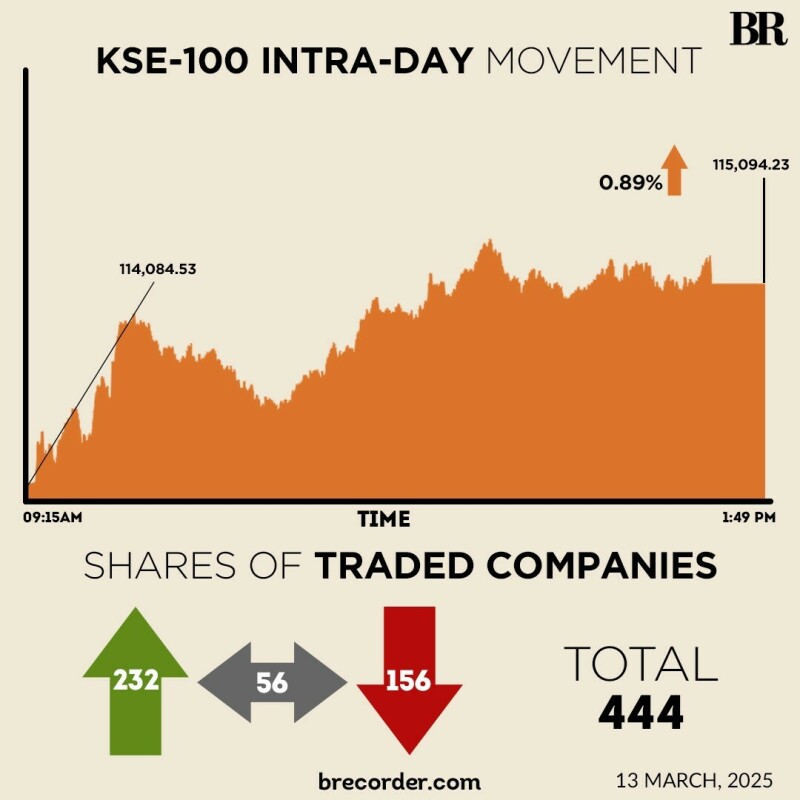

Buying momentum was observed at the Pakistan Stock Exchange (PSX), with the benchmark KSE-100 Index closing above the 115,000 level amid a gain of over 1,000 points on Thursday.

Market remained positive throughout the trading session, pushing the KSE-100 Index to an intra-day high of 115,247.39.

At close, the benchmark index settled at 115,094.23 level, an increase of 1,009.70 points or 0.89%.

Buying was witnessed in key sectors including automobile assemblers, cement, commercial banks, oil and gas exploration companies, OMCs, power generation and refinery. Index-heavy stocks including MARI, OGDC, PPL, HUBCO, ARL, PSO, SSGC, and SNGPL settled in the green.

The buying rally was driven by positive developments on the International Monetary Fund (IMF) front said market experts.

“Interest was seen in PSO and SNGPL following reports that the IMF has agreed to the government’s circular debt settlement plan,” Waqas Ghani, Head of Research at JS Global, told Business Recorder.

Moreover, cement sector stocks rallied amid reports of an Rs50 per bag hike in cement prices, the analyst added.

On Wednesday, PSX’s benchmark KSE-100 closed marginally lower after the index failed to sustain its gains during intra-day trading and settled at 114,084.54.

In a major banking development, global rating agency Moody’s improved Pakistan’s banking outlook from stable to positive on Wednesday.

Internationally, tech stocks led advances in Asia on Thursday, taking their cue from Wall Street’s gains after tepid inflation data allayed concerns over the state of the US economy.

US Treasury yields remained elevated after pulling further away from recent lows the day before, on escalating tit-for-tat tariff battles between the United States and trading partners.

The euro was steady after slipping back from a five-month high on Wednesday when President Donald Trump warned of a response to the European Union’s threatened counter-tariffs on US goods.

However, the shared currency continued to garner support from signs of progress towards peace between Russia and Ukraine.

Japan’s Nikkei gained 0.9%, buoyed by advances in chip-sector heavyweights such as Advantest and Tokyo Electron.

Taiwan’s tech-heavy equities index added 0.6%, and South Korea’s KOSPI climbed 0.7% Mainland Chinese blue chips edged up 0.1%, although Hong Kong’s Hang Seng retreated from small early gains to be down 0.3%.

The US S&P 500 advanced 0.5% on Wednesday, and the Nasdaq jumped 1.2%, with beaten-down megacap tech shares rebounding sharply. Futures in both indexes pointed 0.1% higher on Thursday.

Volume on the all-share index increased to 382.79 million from 299.63 million recorded in the previous close.

Whereas, the value of shares improved to Rs25.4 billion from Rs20.3 billion in the previous session.

B.O.Punjab was the volume leader with 48.8 million shares, followed by Barkat Frisian Agro with 24.68 million shares, and Fauji Cement with 19.66 million shares.

Shares of 444 companies were traded on Thursday, of which 232 registered an increase, 156 recorded a fall, while 56 remained unchanged.

Comments